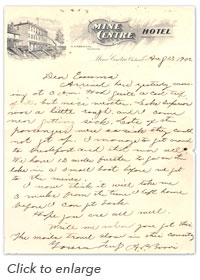

It was August 13, 1902, and upstate New York's A.B. Bouvier found himself far from civilization - in Ontario, Canada's Mine Centre district. He was there to check out some mining property. And as he recounted in two letters to a friend of his - a woman named Emma - the trip hadn't been an easy one.

The two letters are part of a small group of historic documents that I've amassed through the years. The two scrawl-covered pages tell quite a story. And the collector I got the notes from filled in some of the other details.

The first letter tells of a trip across Lake Superior - one that left everyone on the boat (except Bouvier) feeling seasick.

"Lots of the passengers were so sick they could not get up," Bouvier wrote. "I managed to get to breakfast and that was all."

The rolling and pitching Great Lakes boat trip turned out to be the easiest part of his journey north of the border. It illustrates the hard work involved with locating an opportunity.

The lake steamer got Bouvier to the Mine Centre Hotel. But it didn't get him to his objective: the Log Cabin Gold & Copper Co. As the second of his two letters describes, this second leg of his journey was equal parts adventure and sheer terror.

Dear Emma:

We arrived at the mine 12 miles from Mine Centre [tonight]. We came in a small boat those 12 miles which would only carry 3. It was not over two feet wide and [we] had to get in the bottom to keep it from tipping over. This country is all timberland for miles and plenty of small lakes and rivers. No roads. And the only way out is up and down the streams in a boat in the summer and on the ice in the winter. Have a good place to stay at the mine and quite good board (food) but do not want it forever. I do not think I can be home much before Aug. 28 or 30.

Yours truly;

A.B. Bouvier

History - at least not the history that I have - doesn't tell us whether Bouvier invested in the mining project... or, if he did, how that mining project worked out.

But in an era when mining swindles were one of the more popular strategies for separating folks from their hard-earned greenbacks, the two letters do seem to show that Bouvier was a sharp guy... what we'd probably refer to as an "informed investor" in the financial parlance of today.

The Art of Due Diligence

I'm not exaggerating about the proliferation of mining scams, and the risks associated with investing in miners in general - especially so-called "junior miners." Growing up I often heard my grandparents - my Dad's folks - make whispered references to a Canadian gold miner they'd invested in... references that were usually accompanied by some wishful-thinking-type comments to the effect that the shares "could still be valuable... someday."

When my Dad and I cleared out their house to get it ready for sale in 2007, we found the share certificates. And we did our own "due diligence."

Sure enough... they were worthless. As my Dad, William Patalon Jr., recalled yesterday, when the mine was dug there wasn't enough gold to warrant further operation.

My grandfather, William Sr., was a tough-as-nails railroad man, a machinist with the Lehigh Valley Railroad. And both he and my grandmother, "Grandma Anna," were true products of the Great Depression... meaning they were usually conservative and cautious when it came to finance. Right to the ends of their lives, they both avoided debt like it was Satan incarnate and would always pay cash for a new car or other purchase.

So it had to be one heck of a "salesman" who induced them to wriggle out of this cautious financial mindset to plunk part of their savings down on a mine they'd never seen and really knew nothing about.

That family story is part of the reason I was so taken with Bouvier's story. Unlike my grandparents, you see, Bouvier went to see for himself.

But the two historic letters struck a second chord with me: That whole "go and see for ourselves" mindset reminded me of similar stories that two of our own guys here at Money Map Press have related to me.

I'm talking about Energy Advantage Editor Dr. Kent Moors, our resident oil-and-gas expert, and Real Asset Returns Editor Peter Krauth, who focuses on natural resources ranging from natural gas to silver and gold.

Kent is one of the top energy experts in the world, in fact, and is always on the go - visiting government ministries, big and small companies, and even physical drilling sites... all for the purpose of "seeing for himself."

That resolve to conduct such careful due diligence has really paid off for Money Map Press subscribers - he has a stunning record as a stock-picker.

Indeed, several of his recommendations to Private Briefing subscribers have doubled or better.

And his understanding of new regulations giving Main Street investors easier access to "real" oil field investments recently paid off - and paid off big. A special project of just that type in the Eagle Ford/Austin Chalk area of Texas - which he'd personally scouted - struck oil with the first well the team drilled.

"You know, Bill, as the story you shared about your grandparents underscores, investors all too often don't understand the natural-resource-type investments they're making," Kent told me during a visit to my office here in Baltimore this week.

"That's particularly true with energy-drilling projects. Too often, investors are given insufficient information, are forced to finance projects with vague objectives, and are liable for additional funding if things go wrong. What's more, they are usually the last ones to get paid. But none of that is true with the projects that I select. I insist that our projects be the most transparent ever offered and provide for an early payback. And a big reason for that is that, well, I physically visit the locations... many times... and am as familiar with the project as anyone on the drilling/exploration team. It's a proven formula - it's one that works time and again - which is why I follow it without deviation."

(Kent and I had a long talk during his visit here, and he shared some stunning observations and gave me several promising recommendations. I'll be sharing all of this with you very soon - and will soon also have information on his next "Main Street investor" drilling project.)

The advantage of "seeing for yourself" holds just as true for gold. And as yesterday's gold-price surge underscores, this is a perfect time to talk about the "yellow metal" - and the companies that mine it.

We Have "Liftoff"

Gold for August delivery jumped recently $41.40 an ounce, or 3.3%, to settle at $1,314.10 on the Comex division of the New York Mercantile Exchange (NYMEX). That's the highest level since April 14, says FactSet Research.

The reason: Gold investors are starting to appreciate that "retail price inflation will become an issue in the U.S. economy," Brien Lundin, editor of the Gold Newsletter, told MarketWatch.

That may be a surprise to the masses, but it's not a surprise here: We've been telling you for months that inflation was taking hold in the food, real estate rental, and medical sectors - and have shown you specific ways to protect yourself and profit.

But U.S. promises to elevate its involvement in Iraq and some overly "dovish" comments by the U.S. Federal Reserve this week seem to have acted as a call to arms on the inflation-investment front.

U.S. President Barack Obama said recently that he was ordering 300 military advisors to Iraq because of escalating violence. Fed chair Janet Yellen has refused to be specific on when the central bank would boost interest rates above their current level near zero.

Yellen has gone out of her way to underscore that no "mechanical formula" exists to specify when rates should rise. And she dismissed speculation that the central bank might boost rates because inflation seemed to be accelerating. Her reasoning: Inflationary data is "noisy," meaning it's worthless to act upon.

Because continued low rates in the face of a strengthening economy would accelerate inflation, Yellen's confirmation that rates would remain low is bullish for gold prices.

And it's an environment that's really bullish for gold miners.

In fact, mining stocks - which have been pounded since peaking in mid-March - have been on fire this month.

The Market Vectors Junior Gold Miners ETF (NYSE: GDXJ), the second-largest exchange-traded fund that invests in gold miners, is already up 17% this month. And the Market Vectors Gold Miners ETF (NYSE: GDX), the largest gold miners ETF by assets, is up 16%.

But there are several specific miners that we like - including one whose properties Peter has "seen for himself."

A Major and a Minor Miner

Our favorite big-cap miner is Goldcorp Inc. (USA) (NYSE: GG), a stock that we've repeatedly - and thoroughly - researched. In fact, it's the focus of the Private Briefing special research report "The Savviest Gold Miner on Earth."

The Vancouver-based Goldcorp is one of the industry's best-run miners. It also has perhaps the strongest finances. Last year, Cowen & Co. stress-tested several of the biggest mining companies and cited Goldcorp as one of the two strongest major miners on Earth. In fact, the Cowen stress test concluded that Goldcorp would remain profitable - even in the face of a $200-an-ounce plunge in gold prices.

Goldcorp and the other gold miner "appear to be able to withstand a severe gold-price decline and still achieve positive earnings," the Cowen analysts concluded.

Analysts currently have a $31 consensus target price on Goldcorp. But the "high-water mark" estimate is $39 - 42% above current levels.

And one of our favorite "juniors" - meaning, by definition, it's a speculative company - is the Winnemucca, Nev.-based Paramount Gold and Silver Corp. (NYSEMKT: PZG). It's an exploration-stage miner with projects in northern Nevada and Chihuahua, Mexico.

Paramount's shares were up 9.9% yesterday - part of the broad updraft in mining shares.

Despite the risks, we like Paramount - and for one simple reason: We know the company. You see, back in August 2012 Peter went and "saw for himself" when he visited the company's "Sleeper Gold Project" in Nevada.

The visit made a lasting - and positive - impression.

"It was quite a trip, Bill," Peter told me. "Nevada is the sixth-largest gold-producing region in the world, with 12% of annual worldwide gold production, and some 80% of all U.S. gold production. I went to Winnemucca, a not-so-sleepy town of about 7,000, where Paramount Gold and Silver has a field office."

The Sleeper Project - a former AMAX Gold open-pit mine property acquired by Paramount back in 2010 - is located roughly 25 miles from Winnemucca, Nev., off a main highway. AMAX had operated Sleeper as a high-grade project for 13 years, ending in 1996.

According to Peter, Paramount viewed the property as one that could be reopened and produce cash flow - while also allowing the company to explore the surrounding area in the belief there might be comparable resources still to be discovered.

Since acquiring Sleeper, PZG has added two large land packages, "Dunes" and "Mimi." Today, Sleeper consists of 2,750 claims covering 47,500 acres reaching south to the Newmont Mining Corp. (NYSE: NEM) "Sandman" project. Sleeper is now a 20-square-mile project in one of the most prolific mining districts on the planet.

"Project manager and consulting geologist Nancy Wolverson gave me a complete tour of the property, which has great access to roads, power lines, and water," Peter recounted. "Sleeper is really exciting in that it once was a high-grade producer with production records that show that not even half of the gold mined there has been recovered."

Some of the old dumps that had been tested were shown to hold about 54 million tons of above-ground ore. The company budgeted $6.3 million on exploration at Sleeper and was pushing forward with a 7,000-meter drill program with two rigs by the end of 2012.

According to a company "Preliminary Economic Assessment" (PEA), the Sleeper project had a "net present value" (NPV) of $695 million - nearly double the company's $358 million market cap back then.

A PEA is a detailed mining project plan that describes mining and processing methods, rates of production, capital and operating costs, cash flows at specified metal prices, rates of return, mine life, and net present values (NPVs) at different discount rates.

In short, it's a way to value the project - and, by extension, the company that operates it.

Paramount has other projects too. After viewing the property and talking with the company, studying the PEA and considering the miner's other projects, Peter conservatively estimated Paramount's value at $1 billion. That estimate, of course, was based upon the prevailing gold price of $1,670 an ounce at the time.

The massive subsequent sell-off in the gold market really slowed things down for junior miners.

But Peter's visit to the mining site gave him an insight on the company that few other experts possessed.

And that made it much easier to assess recent announcements Paramount made about its other property - its San Miguel project in northern Mexico.

According to Paramount, independent consultants are nearing completion of a new resource estimate for its 100%-owned San Miguel project. And that would soon be followed by a revised PEA for San Miguel.

"We are eager to see the results of the updated resource and mine plans for San Miguel," said Paramount CEO Christopher Crupi. "We anticipate they will demonstrate the potential for a strong, economically rewarding project at current metal prices."

Analysts currently have a one-year target price of $1.88 a share on Paramount. That's 69% above yesterday's closing price of $1.11. Back on April 9, HC Wainwright initiated coverage on Paramount with a "Buy" rating and a $2.30 price target.

The company's shares have a 52-week range of 78 cents to $1.72. As of Wednesday, the stock's 50-day moving average was $1.04 and its 200-day moving average $1.13. Approximately 11.1% of the shares of the company are short-sold.

Paramount's last earnings report was issued May 20. The company reported a net loss of 3 cents a share - 2 cents more than the Wall Street consensus. Analysts expect the company to lose 7 cents a share during the current fiscal year.

But because Peter "went and saw" for himself, Paramount is more than just a collection of numbers. It's a company he understands intimately, and can mentally take apart, analyze, and reassemble.

And he likes what he sees.

"In late May, Bill, Paramount announced excellent recoveries from leaching tests on ore from its San Miguel (Mexico) project," Peter told me yesterday evening. "Although the silver recoveries are relatively low, it's not a surprise, and certainly not a deal breaker. In fact, the company expects to recover up to 94% of the gold, and concluded that using 'heap leaching' to recover the metals is feasible. This is a pretty big deal, since this technology is rather low cost and, therefore, allows for better profit margins. As well, it could allow a lot more material to be considered 'economic,' potentially boosting the project's value in a significant way."

Looking forward, "PZG expects to announce a new NI 43-101 compliant resource estimate for its San Miguel project, then follow up with a revised Preliminary Economic Assessment (PEA)," Peter continued. "I expect we'll see a lot of resources move up in quality from inferred and indicated, thanks to the latest drilling results."

The bottom line is a bullish one - because he's seen so much of the company's operations firsthand.

"Thanks to my earlier analyses - and my highly beneficial personal visit - I have to say that I'm really excited to track this company," Peter concluded. "Paramount just keeps improving its projects and does superb work confirming the serious potential of its projects. In junior mining, that's a formula for success."

And we're certain that A.B. Bouvier would have approved.

About the Author

Before he moved into the investment-research business in 2005, William (Bill) Patalon III spent 22 years as an award-winning financial reporter, columnist, and editor. Today he is the Executive Editor and Senior Research Analyst for Money Morning at Money Map Press.