The price of silver is up for the sixth week in a row, refusing to languish in the summer doldrums, which have historically kept the white metal from sustaining rallies into July and August.

At Thursday's close, the spot price for an ounce of silver traded at $21.47, up 1.3% on the week, and up 14.5% since early June when it bottomed out and started its rally. Silver hasn't traded this high since March, when it began a nearly three-month-long bearish cycle.

Additionally, the iShares Silver Trust (NYSE: SLV), an ETF that gauges the performance of silver, is up 2% on the week, and the ProShares Ultra Silver ETF (NYSE Arca: UVXY) is up 4.1%.

This week, silver got a boost with the release of minutes from the June meeting of the U.S. Federal Reserve's Federal Open Market Committee (FOMC). The minutes reaffirmed the Fed's muted tenor on the timing of interest rate hikes.

When interest rates are higher, it works to push down inflation, which makes silver less attractive as an investment. Investing in silver is a strategy generally used to hedge against rising prices and a weaker dollar. Without any explicit signal as to when interest rates will rise, coupled with the expectation that they will stay low for a considerable period, investors are sticking with precious metals in an economic environment that grows more conducive to inflation by the day.

Silver is usually highly correlated with gold and prices move in similar directions. When investors flood into gold on fears of inflation, silver - which trades at a substantially lower volume - gets a residual lift by liked-minded investors.

Money MorningResource Specialist Peter Krauth said he can see inflation rising to 3% by the end of the year, which will only work in silver's favor.

"Could inflation get out of hand? There's a strong possibility," Krauth said. He added that while it's still too early to tell, the current spikes in silver could be "signals that inflation is becoming entrenched."

Silver Unfazed by Historically Weak Trading Months

But silver's prices are not solely determined by investors, as the white metal is both an investment vehicle and an industrial input. It is a great heat conductor and quite resistant to corrosion. It is a component of jewelry production, and can be found in electrical circuits and wiring, electronic screens, and photographic film.

That means prices are contingent upon both investor demand and industrial demand. This can be a double-edged sword.

"It's a financial asset, like gold, and it's an industrial metal," Jeffrey Christian, a managing partner at CPM Group, told Money Morning. "Sometimes both of those things benefit it, and sometimes both of those things are negative."

Because of this, silver generally suffers not only from weak summer trading, but also the cyclical nature of its fabrication, taking hits on two fronts.

"Investment demand and fabrication demand have strong seasonality and you tend to see the weakest period of demand for silver in July and August both from investors and industrial users," Christian said.

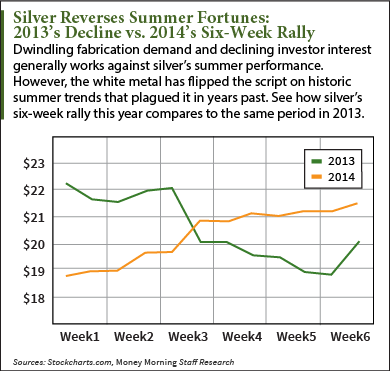

Last year, during the six-week period from June to mid-July, silver made a slight recovery following three straight weeks of losses before closing down 10.4%. It was trading at $19.87 this time last year.

But this seasonal phenomenon has yet to pull down the price of silver this year. Silver is trading up despite low expectations and a steady decline in trading volume from earlier on in its June rally.

The current rally started as investors liquidated a high volume of short positions and began going long. This was about the time silver was dipping into year-to-date lows just south of $19, Christian said.

What sustained that gain was an FOMC meeting, where Yellen seemed to indicate that the pace of interest rate hikes was not going to accelerate any time soon. Silver rose 4.3% on the day of Yellen's comments.

Since then the momentum may have slowed down, but silver is still posting weekly gains. Prior to the release of the FOMC minutes on Wednesday, prices were trading down 0.8% on the week. But over the next day, silver more than recovered and posted highs it hasn't seen since March.

If you're not sold on physical silver, you can always follow multi-billionaire investor George Soros into silver stocks. Some silver mining companies stand to gain more when prices rally, and Soros has boosted his portfolio holdings with these seven gold and silver companies...