Gold prices have rallied 7% so far in 2014. It follows that investors in gold stocks - which are closely linked with gold itself - stand to profit.

Gold prices have rallied 7% so far in 2014. It follows that investors in gold stocks - which are closely linked with gold itself - stand to profit.

But the first half of 2014's gains aside, pressures shaping the yellow metal right now demand an allocation of gold stocks in a healthy investment portfolio.

In fact, Money Morning Chief Investment Strategist Keith Fitz-Gerald said in May that the case for owning gold has never been stronger.

"Many investors are asking themselves if now is the time to buy gold. I think that's the wrong question," Fitz-Gerald said. "What they should be asking themselves is if they can afford not to buy gold."

Here's why...

No. 1: Gold Mining Stocks Are Poised for a Surge

It's starting to look like a new bull is being born in commodities.

That's because we're starting to see real movement in most resources. For example, early in the year, there was a huge move in agricultural commodities. The PowerShares DB Agriculture ETF (NYSE: DBA) made a huge move, most of it in the month of February, from $24 to $29. It's up more than 8% year to date.

And that's good news for gold mining stocks.

"Higher commodities prices will prove to be a bounty for the miners and other resource producers," Money Morning Resource Specialist Peter Krauth told readers on July 7.

You see, as commodities prices were falling over the last three years or so, many gold mining companies took to costs with a machete and slashed wherever possible, to weather the storm for an extended rout in prices.

"Gold mining companies downsized staff, axed projects, and even rationalized selling non-core assets," Krauth said. "So now they are much leaner, and will be much more profitable as commodities prices rise again."

Increased activity in mining mergers and acquisitions underpins gold mining stock momentum. Recently, Goldcorp Inc. (NYSE: GG) got into a bidding war with Agnico Eagle Mines Ltd. (NYSE: AEM) and Yamana Gold Inc. (NYSE: AUY) in an attempt to take over Osisko Mining. Smaller deals have also emerged, with B2Gold Corp. (NYSE:BTG) committing to a friendly takeover, and Mandalay Resources Corp. (TSE: MND) acquiring Elgin Mining Inc.

"This is significant because it reflects a feeling of confidence and strength on the part of the mining industry," Krauth said. "And if I'm right about the prices of many - or even most - commodities having bottomed, then the likelihood that the cycle has troughed and is now starting to turn up has improved dramatically."

No. 2: Gold Stocks Are a Hedge Against Impending Inflation

Inflation has been heating up in the last several months. In May, consumer prices rose at more than a 4% annual pace. Prices for beef, pork, and other foods are soaring. Core inflation - prices less food and energy - after remaining fairly tame for several years, is also accelerating.

Americans could be facing inflation greater than 3% or even 4% for the rest of 2014 and 2015.

And abroad, the European Central Bank (ECB) announced a new policy on June 5 to promote lending and, ultimately, inflation in the Eurozone.

Inflation sends gold prices - and gold stocks - higher.

That's because precious metals tend to move in tandem with inflation. As the value of a currency decreases - which is an effect of inflation - the price of precious metals increases. A declining value of a currency means that it takes more of that currency to purchase an ounce of the metal.

Since there is fear of inflation in the United States, and there is a specific attempt to produce inflation in Europe, right now there is upward pressure on the price of gold.

"The medium and longer term for gold is very bullish," Krauth said after the ECB announced its move. "In fact, sentiment is rough in the precious metals space right now. But that only makes their future that much more compelling. Banks are accelerating their easing ever more."

Krauth isn't alone in this sentiment.

"Going ahead, economic data will guide gold prices," Jeff Sica, who helps manage $1 billion at Sica Wealth Management, told Bloomberg. The metal could see additional gains if the U.S. economy slips or geopolitical turmoil accelerates, Sica said.

Sharing that sentiment is Howie Lee, an investment analyst at Phillip Futures.

"This quarter [Q3], we expect gold to remain elevated or even possibly climb due to multiple uncertainties," Lee told Reuters. He added that uncertainties over the uneven U.S. economic recovery and geopolitical tensions will provide a cushion for gold.

No. 3: Asian Demand Is About to Go Through the Roof

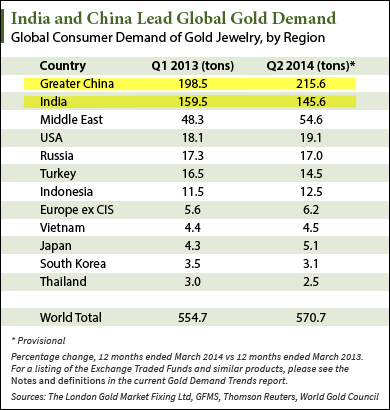

Consumers in India and China - who jointly represent three out of every five people alive today - generally believe that gold is going to increase in price over time. Yet few actually own it, according to the World Gold Council (WGC) and U.S. Global Investors.

"As the economic development in these two countries continues at a rapid pace, overall demand will increase, even if it falls off in developed countries like the United States and in the European Union," Fitz-Gerald said. "Already the statistics are proving this point. Consumer demand in China rose 32% in 2013 to a record 1,066 tonnes, while in India, demand rose 13% to 975 tonnes."

What's more, a recent political shift in India is about to send gold prices and gold stocks soaring.

You see, India houses the world's second-highest demand for gold. Together with China, it accounts for more than half of global consumer demand for gold, which is calculated by demand for jewelry, bars, and coins.

Click to Enlarge |

Click to Enlarge |

But in 2013, India found itself embroiled in a currency crisis. The policies the Indian government enacted to stem the crisis placed a significant damper on Indian gold imports. In fact, Indian gold imports fell considerably in the latter half of 2013, dropping to 30% of former levels. According to Kitco, around 1,200 tonnes of gold was expected to be imported into the country for the year, but only 825 tonnes in total were imported.

New leaders were voted into office by general election in April, and part of their platforms was to ease these importing policies - something that Krauth sees as having a big impact on gold.

"Clearly this is likely to be a major shot in the arm for the gold price, and it could happen within the next few months," Krauth said.

Barron's reported on June 6 that although gold will likely remain depressed for the next three weeks, demand out of India and China should bolster gold prices in the second half of 2014.

"We expect the weak physical demand seen in Asia of late to pick up again in the second half of the year, which should result in a rising gold price, especially since the headwind from [exchange-traded fund] investors is likely to further abate," analysts Barbara Lambrecht and Michaela Kuhl said to Barron's. "We are confident that gold demand in India will pick up noticeably as compared with the first half year and last year once the import restrictions have been eased. China is also likely to demand more gold again in the coming months."

No. 4: Gold Stocks Benefit from Rampant Geopolitical Tension

Geopolitical tension is pushing gold prices and gold stocks higher. The safe-haven investment tends to enjoy gains when fear is in the air.

The Middle East has been a hotbed this year. In this week alone, the militant group Islamic State of Iraq and Syria (ISIS) continued its attacks in Iraq, the country warned the UN that Sunni militants seized nuclear materials in Mosul, and Israel launched a military offensive in the Gaza strip - the escalation in violence between Israel and Gaza militants has become the worst since November 2012.

Additionally, tensions between Russia and Ukraine are still simmering. Yesterday, JPMorgan reduced its equity market staff in Russia as the country's economy has suffered heavily due to the conflict. Russian investment banking fee income has fallen by about a third in 2013, and IPOs were put on hold when the crisis sent Moscow's markets tumbling, according to FOX Business.

"Some investors are buying gold as the Middle East region is very tense," R.J. O'Brien & Associates senior commodity broker Phil Streible said in a telephone interview with Bloomberg. "We have been seeing an increase in the safe-haven premium since the violence in Ukraine started."

Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.

Related Articles:

- Bloomberg: Gold Advances as Mideast Tensions Boost Haven Demands

- FOX Business: JPM Reduces Russia Staff as Ukraine Crisis Hits

- Reuters: Gold Hits 3-Month High on Softer Dollar, Iraq Violence

- Bloomberg: Gold Gain Obscures Fund Outflows as Investors Buy Equities

- Barron's: Gold Headed to $1,400 on Asia Demand?