Stock market today, July 17, 2014: The Dow Jones Industrial Average finished up yesterday (Wednesday) for its 15th record-breaking close in 2014. U.S. Federal Reserve Chairwoman Janet Yellen testified before Congress, reiterating that the economy remains vulnerable to a struggling job market and stagnating wages - two reasons why the central bank will continue its loose monetary policy in 2014.

Here are the top headlines in the stock market today you should know to make your Thursday profitable:

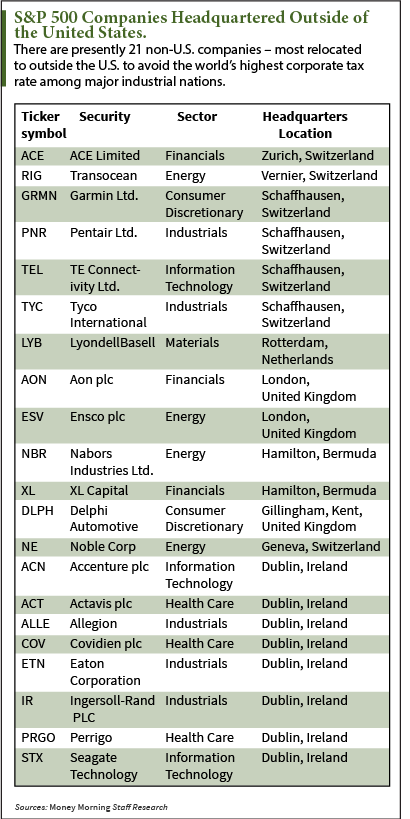

Soak the Rich: The Obama administration has ramped up a new push to stop U.S. companies from engaging in cross border mergers to reduce their corporate tax burden. These tax-driven mergers, known as inversions, have aggressively increased since 2012, with at least 44 companies engaging in this practice. U.S. Secretary Jack Lew called for a "new sense of economic patriotism" and demanded that Congress should pass tax laws that would be retroactive to May, before the latest round of deals. The U.S. corporate tax rate is the highest in the world.

Soak the Rich: The Obama administration has ramped up a new push to stop U.S. companies from engaging in cross border mergers to reduce their corporate tax burden. These tax-driven mergers, known as inversions, have aggressively increased since 2012, with at least 44 companies engaging in this practice. U.S. Secretary Jack Lew called for a "new sense of economic patriotism" and demanded that Congress should pass tax laws that would be retroactive to May, before the latest round of deals. The U.S. corporate tax rate is the highest in the world.

- Merger Mania: In an effort that would directly take aim at The Walt Disney Co.'s (NYSE: DIS) ESPN, Rupert Murdoch and Twenty-First Century Fox Inc. (Nasdaq: FOX) are attempting to boost its media holdings through an acquisition of Time Warner Inc. (NYSE: TWX). Recently, Murdoch's empire made a bid of $75 billion for Time Warner, which would include its holdings of HBO and TNT. Shares of Time Warner were up more than 17% yesterday.

- Today's Economic Calendar: Today's schedule features a speech by St. Louis Federal Reserve President Richard Fisher, weekly jobless claims, housing starts, and an update in the U.S. money supply.

- Nickel and Dime: Global airline companies generated revenues of $31.5 billion in 2013 from add-on and non-ticket fees, according to a recent survey. Discount airline Spirit Airlines Inc. (Nasdaq: SAVE) relied on fees for 38% of its revenues, the highest percentage of any company. Meanwhile, three U.S. carriers, United Continental Holdings Inc. (NYSE: UAL), Delta Air Lines Inc. (NYSE: DAL) and American Airlines Group Inc. (Nasdaq: AAL), topped the list.

- Sell, Sell, Sell: According to multiple reports, General Electric Co. (NYSE: GE) is aggressively seeking a buyer for its century-old appliance business. The business division produces just 2% of company revenues, and its sale would effectively cut ties between GE and average American consumers. The company had attempted to sell this business line back in 2008, but the financial crisis prevented it from locating a buyer.

- Sanction Central: U.S. President Barack Obama announced yesterday that the U.S. Treasury Department has expanded economic sanctions against Russia as tensions in Ukraine continue. The targeted sanctions center on Russian companies including oil giant Rosneft Oil Co. (OTCMKTS: RNFTF) and Gazprombank. The sanctions will stop these companies from obtaining new financing from U.S. markets. Obama cited an increased flow of weapons and Russia's unwillingness to address recent violence for the widening of sanctions.

- Earnings Reports: Stay tuned for earnings reports from Alliance Data Systems Corp. (NYSE: ADS), AutoNation Inc. (NYSE: AN), Baker Hughes Inc. (NYSE: BHI), Fifth Third Bancorp (Nasdaq: FITB), Google Inc. (Nasdaq: GOOG, GOOGL), International Business Machines Corp. (NYSE: IBM), Philip Morris International Inc. (NYSE: PM), Schlumberger NV (NYSE: SLB), Mattel Inc. (NYSE: MAT), and Morgan Stanley (NYSE: MS).

Full U.S. Economic Calendar July 17, 2014 (NYSE: all times EDT)

- Housing Starts at 8:30 a.m.

- Jobless Claims at 8:30 a.m.

- Philadelphia Fed Survey at 10:00 a.m.

- EIA Natural Gas Report at 10:30 a.m.

- 3-Month Bill Announcement at 11 a.m.

- 6-Month Bill Announcement at 11 a.m.

- 52-Week Bill Announcement at 11 a.m.

- 10-Yr TIPS Announcement at 11 a.m.

- St. Louis Federal Reserve Bank President James Bullard speaks at 1:35 p.m.

- Fed Balance Sheet at 4:30 PM ET

- Money Supply at 4:30 p.m.

If you follow the headlines, you'd think the last place to invest your hard-earned money is in this sector. But it turns out, if you picked the right investment there over the last two years, you would have beaten the S&P 500's returns by more than 50%. Here's why...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.