Stock market close, Friday, July 18: The DJIA bounced back on Friday, up more than 100 points following Thursday's worst performance since early April. Geopolitical tensions remain high following the attack on a Malaysian jet airliner over Ukrainian skies yesterday morning, and Israel's tactical launch inside Gaza.

Here's the scorecard from today's trading session:

DOW: 17,098.51 (+0.72%)

NASDAQ: 4,432.15 (+1.57%)

S&P 500: 1,978.18 (+1.02%)

And here are the top stories from the stock market today:

- Volatility Slumps: The CBOE Volatility Index (VIX) fell 15% on Friday, one day after it surged 32%, its largest gain since April 2013. Despite the recent uptick, this index (commonly known as the Fear Index) is below its historical average of nearly 20. Get more on the VIX and how this powerful index works here.

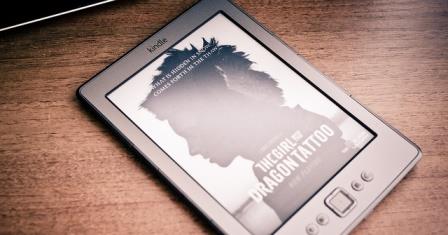

- Read Up, America: Shares of Amazon.com Inc. (Nasdaq: AMZN) were up more than 1.4% on news that the company will launch Kindle Unlimited, an unrestricted subscription reading and audiobook service for Kindle and other mobile devices. According to reports, the service could generate more than $1 billion in new revenue for Amazon, a level that excites investors.

- Software Stumbles: Shares of RealPage Inc. (NYSE: RP) plummeted more than 22% on news that the software company slashed its second-quarter guidance. It cut its second- quarter revenue outlook to $93.8 million to $94.8 million, down from $106 million to $108 million. RP said its financial struggles are due to rental property owners reducing their marketing spending over concerns of falling vacancy and turnover rates.

- Spin-Off Excitement: Global giant General Electric Co. (NYSE: GE) announced that quarterly net income jumped 13%, but that failed to stop shares from sliding more than 1%. The company reported improving revenue in oil and gas equipment and jet engines. GE also announced that it plans to spin off its credit card business in an IPO by the end of July. Here's why we love GE stock and today's earnings...

- Volatility Spikes: Google stock (Nasdaq: GOOGL) was up more than 3% today, crossing $600 per share on Thursday's news that the company beat second-quarter earnings expectations and that its chief business officer is exiting the firm. The company announced that quarterly revenue increased 22%, but didn't include results from its Motorola Mobility unit, which will soon be sold to Lenovo Group Ltd. (OTCMKTS: LNVGY). The company's chief business officer Nikesh Arora will be moving to SoftBank Corp., where he will become the company's vice chairman.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

- Don't Hesitate on This Industry Boom That's Already Here: If you follow the headlines, you'd think the last place to invest your hard-earned money is in healthcare. But here's the thing. As technology investors, our job is to look beyond the politics of the moment and take a look at what others may be missing. Turns out, if you picked the right healthcare investment over the last two years, you would have beaten the S&P 500's returns by more than 50%. Here's why...

- Act on This Massive Profit "Spark" Ahead of the Big Boys: It's easy to see why investors pile into a company's stock on the heels of highly successful products, technologies, or services. For small caps, finding the right leader can prove a more critical "spark" to major profits. This is why you should follow Money Morning Small-Cap Investing Specialist Sig Riggs' advice and use these three steps to make big gains...

- The U.S. Export Ban Is a Windfall for These Companies: After more than four decades, it looks like America is getting back into the oil export business again. For the first time since the 1970s, Washington has opened the door to sending more U.S. crude abroad. And these companies are poised to profit BIG from the announcement...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.