After several weeks of relative stability, the Bitcoin price on Thursday (yesterday) suddenly dropped about 3.7%, leaving many Bitcoin enthusiasts wondering what was going on.

With no major Bitcoin news to drive prices, it looks like Thursday's move may have been the result of a decline in liquidity in the market, which would give a large trade or series of trades an outsized influence on the Bitcoin price.

With no major Bitcoin news to drive prices, it looks like Thursday's move may have been the result of a decline in liquidity in the market, which would give a large trade or series of trades an outsized influence on the Bitcoin price.

Ironically, the lack of liquidity is the result of the digital currency's recent stability; as with other markets, Bitcoin traders make money from volatility.

Still, the drop on the CoinDesk Bitcoin Price Index from about $618 to $595 is nothing like the dramatic swings of late last year, when the digital currency first came under attack from the Chinese government, or earlier this year when the Mt. Gox bankruptcy news sent many Bitcoin investors rushing to the exits.

But the decreasing volatility is just about what one would expect at this point in Bitcoin's history.

"The price is stagnant because we're going through a trough of technology adoption for crypto currencies, where the world is working how to take it," Joe Lee, a trader and founder of Bitcoin derivatives exchange BTC.sx, told CoinDesk.

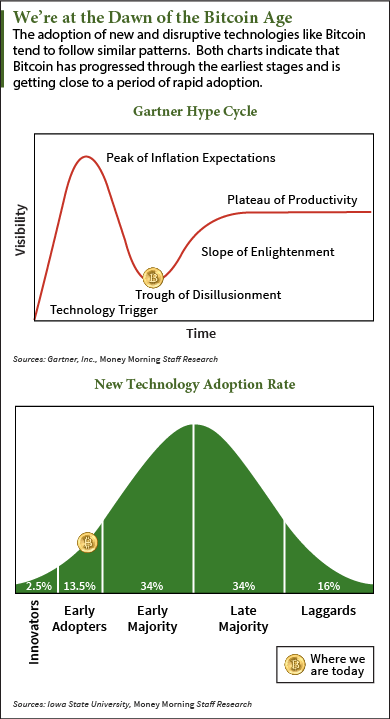

Lee pointed out that right now Bitcoin is languishing in what research firm Gartner Inc. calls the "trough of disillusionment" in the technology adoption "hype cycle." Gartner developed the hype cycle concept as a tool to help investors and business executives assess where an emerging technology stands so they can determine when the time is right to jump in.

But when you look at the chart, it's clear that the "trough of disillusionment" is followed by the "slope of enlightenment" - a period of rapid adoption by the general population which will trigger an equally rapid increase in the Bitcoin price.

And Gartner's chart is just one reason the Bitcoin price is likely to soon start moving up...

More Reasons to Expect a Rise in the Bitcoin Price

A technical analysis also supports the idea that the Bitcoin price is on the verge of a breakout to the upside.

George Sammantic, a co-founder of BTC.SX, told CoinDesk that high support levels and tight Bollinger Bands indicate that we could see a move soon.

"Generally, minus some kind of news event, we should see the price start to move in either direction and only afterwards will we find out why. For now I see bullish patterns forming," he said.

"Generally, minus some kind of news event, we should see the price start to move in either direction and only afterwards will we find out why. For now I see bullish patterns forming," he said.

And then there's the building wave of wealthy investor money that's begun to move into the digital currency via a flurry of new Bitcoin hedge funds this year. This is the first phase of what will soon become a flood of investment into Bitcoin from a range of Wall Street heavyweights, which will act as yet another catalyst to drive the Bitcoin price higher.

"We are in the early stages of this institutional money buying Bitcoin and finding digital currencies as a new asset class," said SecondMarket Chairman Barry Silbert at a conference last month. SecondMarket runs the Bitcoin Investment Trust, a Bitcoin hedge fund.

Other Bitcoin News This Week

The Bitcoin price drop was on everyone's mind yesterday, but it wasn't the only noteworthy thing that happened in the world of Bitcoin this week.

- A Bitcoin Exchange for Wall Street: Coinsetter, a New-York based Bitcoin exchange, exited its trial stage yesterday. Unlike other Bitcoin exchanges that have been aimed at regular users, CoinSetter is targeted mainly at institutional investors and boasts trading speeds as fast as 40 milliseconds. "By expanding our platform's capabilities, we now offer an institutional-class, plug-and-play package for Bitcoin ATMs, bitcoin payment processors, brokerages, and other businesses that need to connect to a bitcoin exchange for liquidity," said CoinSetter CEO Jaron Lukasiewicz.

- Mt. Gox Answers Still Lacking: Bitcoin investors got few answers at the first meeting for creditors of the failed Mt. Gox Bitcoin exchange, which filed for bankruptcy in March. The meeting was held in Tokyo, where Mt. Gox was based, and drew about 100 people wanting to know how 750,000 customer bitcoins could have been lost. "They say it's under investigation. That's all they say," one anonymous French investor complained to Agence France-Presse. "They seem to refuse to make public more precise information about Mt. Gox's own [information] and how and when it was stolen, if it was really stolen."

- Bitcoin Stock Thriving: DigitalBTC (ASX: DCC), a Bitcoin mining company that technically became the world's first Bitcoin stock to trade on a major exchange when it executed a reversed takeover in June to get listed on the Australian Securities Exchange, announced earnings yesterday. DCC said it mined 2,600 bitcoin in May, giving it enough money to complete payment on its $4 million investment in BitFury Group mining equipment. DigitalBTC also said its Bitcoin trading desk generated a 34% return.

Do you believe the Bitcoin price is poised to make a major move in the next few months? Tell us what you think on Twitter @moneymorning or Facebook.

UP NEXT: A tsunami of disruption - courtesy of Bitcoin - is headed directly for several sectors of the financial services industry. Yes, some companies will adapt. But most are likely to struggle, or even disappear, unless they start to make serious changes - and soon. This is what a $3.4 trillion disruption to the U.S. economy looks like...

Related Articles:

- CoinDesk: Bitcoin Price Drops Below $600 After Relative Stability

- Agence France-Presse: Angry Bitcoin Investors Demand Answers at Tokyo Creditors' Meet

- Press Release: NYC Bitcoin Exchange Coinsetter Launches out of Beta with Institutional and Consumer Trading

- DigitalBTC: Bitcoin Mining and Trading Operations Market Update

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.