Updated July 29, 2014: Herbalife Ltd. (NYSE: HLF) shares are down about 12% in pre-market trading following the release second-quarter earnings yesterday (Monday) that fell short of analysts' expectations. This all while the nutrition company continues to be a high-priced target for short sellers who are skeptical of HLF's marketing practices.

HLF sales growth was well below analyst expectations of 11.5%, as the supplement company grew by only 7.1%. Earnings were down 16.5% from the quarter before, with earnings per share (EPS) of $1.39, also well below the $1.57 EPS that analysts forecasted. HLF made $1.3 billion in sales compared to last year's $1.2 billion, but earnings were only $119.5 million compared to 2013's second-quarter reported earnings of $143.1 million.

Growth is also down significantly from the second quarter of 2013. Last year, earnings grew 8.5% and sales grew 18.1%.

The nutritional marketer also ended a streak of 21 straight quarters beating out analyst expectations, The Wall Street Journal reported, a streak that began in 2008.

Click to Enlarge |

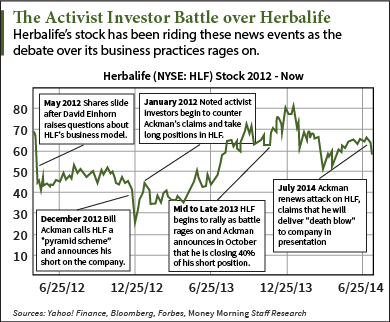

Among its major challenges, HLF has had to defend itself against the attacks of billionaire hedge fund manager Bill Ackman, who has maintained that the company's practice of recruiting salespeople to act as distributors of their products constitutes a "pyramid scheme," and that most of the company's revenues come from sales to these members as opposed to actual consumers. This all began December 2012.

He announced his intention to short the company's stock, deeming the shares worthless and placing a $1 billion bet on the company's downside. The company fired back in a number of statements, calling to question Ackman's negative campaign and alleging that it was all a ploy to send the shares tumbling for a trading profit.

Not long after Ackman's initial announcement, billionaire money manager Carl Icahn derided Ackman's public battle with HLF.

Icahn, along with a team of noted investors that included William Stiritz and George Soros, took the other side of the trade in the face of Ackman's accusations, pushing shares up and forcing Ackman to swallow up to $500 million in losses on the short come this past November.

This fight over Herbalife has continued to be of great concern to the company, which has seen a lot of volatility in share prices since Ackman's initial blow.

"While a number of traders have publicly announced that they have taken long positions contrary to the hedge fund shorting our shares, the existence of such a significant short interest position and the related publicity may lead to continued volatility," according a 2013 HLF SEC filing. "The volatility of our stock may cause the value of a shareholder's investment to decline rapidly."

Ackman's "Deathblow" Falls on Deaf Ears; HLF Shares Soar

HLF, though always a controversial company since the 1980s when it faced civil litigation and had to swallow steep out-of-court settlement payments, has been facing intense scrutiny amid a public battle between Wall Street heavyweights over the company's multi-level marketing. David Einhorn, chief executive officer and founder of Greenlight Capital, fired the opening salvo in an earnings call last year when he raised questions about HLF's complex sales structure.

Then Ackman, of Pershing Square Capital Management LLC, continued the attack in December with a 343-slide presentation calling HLF a pyramid scheme, and alleging that the majority of sales are to independent distributors of HLF's products, and not to consumers actually using the products.

HLF has more than 500,000 members in the U.S. and 3.9 million worldwide who buy and sell their products, acting as distributors. This network of distributors is essentially comprised of discounted customers who can sell HLF products if they "seek part-time or full-time income." A part of this campaign against HLF alleges that of these members 88% make no money, and 96% make less than the minimum wage.

Last week, Ackman renewed his attacks and reinforced the notion that HLF's business practices hit low-income distributors the hardest, who are lured into "nutrition clubs" with the false promise of getting rich, in a presentation at the AXA Equitable Center in New York.

"It's a tragedy. They don't realize they're being defrauded," Ackman said. "They are selling the American dream to these people."

While Ackman said this presentation would be the "deathblow" to this company, traders remained bullish on the stock and Ackman's plea fell on deaf ears. Shares rose 25.5% on the day after losing 11% the day before when Ackman announced that the New York presentation would be "the most important presentation" of his career.

In its 34 years, HLF has been grappling with regulators, skeptics, and poor management. The unusual history of HLF provides an interesting look at the company underlying this debate.