Democrats and Republicans alike in Washington are unhappy about the increasing number of so-called tax inversion deals, but instead of blaming Wall Street they need to look at the real cause of the problem - themselves.

A tax inversion deal is a merger between a U.S and a foreign company specifically designed to allow the U.S. company to move its headquarters out of the United States to escape America's high corporate tax rate.

A tax inversion deal is a merger between a U.S and a foreign company specifically designed to allow the U.S. company to move its headquarters out of the United States to escape America's high corporate tax rate.

Several recent high-profile tax inversions, such as AbbVie Inc.'s (NYSE: ABBV) merger with Ireland-based Shire Plc. (Nasdaq ADR: SHPG) and Medtronic Inc.'s (NYSE: MDT) deal to buy Ireland-based Covidien Plc. (NYSE: COV), have resulted in much wailing and gnashing of teeth in our nation's capital.

Walgreen Co. (NYSE: WAG) is thought to be considering a deal, while Pfizer Inc.'s (NYSE: PFE) attempt via a deal with Britain's AstraZeneca Plc. (NYSE ADR: AZN) fell apart.

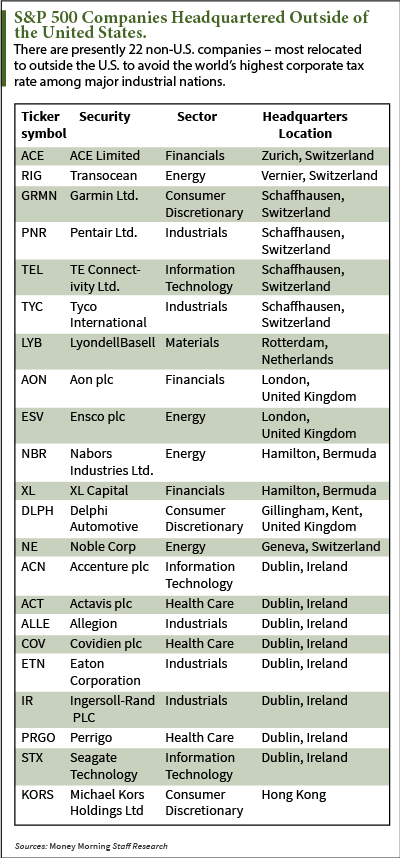

Over the past 10 years about 50 U.S. companies have reincorporated overseas via tax inversion to tax-friendly countries like Ireland, about half of which are in the Standard & Poor's 500, but the practice has accelerated in recent years.

And it's not surprising that the federal government doesn't like it; the Joint Commission on Taxation has said corporate tax inversion could cost the Treasury as much as $20 billion in tax revenue over the next decade.

President Barack Obama has returned to the topic several times over the past week or so, but urged "closing this unpatriotic loophole for good" in his budget proposal earlier this year.

"Even as corporate profits are as high as ever, a small but growing group of big corporations are fleeing the country to get out of paying taxes," President Obama said in his weekly radio address on Saturday. "They're keeping most of their business inside the United States, but they're basically renouncing their citizenship and declaring that they're based somewhere else, just to avoid paying their fair share."

Democratic leaders like Sen. Chuck Schumer, D-N.Y., have gone a step further, calling for legislation that would not only prevent future tax inversions, but include retroactive language to deprive the sought-after tax breaks to any company that executed such a deal after May 8.

That would affect the AbbVie and Medtronic deals, and create uncertainty among other U.S. companies that might be considering a tax inversion themselves.

But for all the political hot air, the law now being discussed in Washington treats the symptom, not the disease. What the politicians seem to forget is that their own failure to reform the corporate tax laws is the root cause of this problem...

Why Tax Inversion Deals Are Washington's Fault

The fact is the U.S. has the highest corporate tax rate in the world - 35%. Worse still, the U.S. taxes all profits a company makes, no matter where they are earned. Other major economies only tax profits earned domestically.

This punitive combination strongly incentivizes the use of loopholes like tax inversion deals.

It's also the reason that so many U.S. multinational corporations refuse to repatriate some $2 trillion worth of profits made overseas.

And companies have gotten very good at using these loopholes to the point that many pay an average of only about 12% of profits in taxes, and some pay zero or near zero. Overall, corporate tax loopholes cost the U.S. about $150 billion annually.

So the rules that were intended to maximize revenue instead have had the opposite effect.

But while this is easy for politicians to spin this as "unpatriotic" corporate behavior, the truth is every company has a fiduciary responsibility to their shareholders to minimize all taxes.

It's a silly accusation, and one that the politicians know is silly.

You see, when they're not insinuating that U.S. corporations are tax cheats, both Democrats and Republicans acknowledge that what's really needed is a major overhaul of the corporate tax code.

Both parties also agree that something needs to be done as soon as possible about the tax inversion loophole to stop the bleeding.

And yet, despite the urgency, it's unlikely Congress will do anything, as partisan bickering over how to fix any part of the problem - tax inversions specifically or the corporate tax code in general - quickly bog down on the details.

That leaves a status quo that's not good for anybody - U.S. companies will continue to be forced to find increasingly creative ways to get relief from a burdensome tax code, while the Treasury watches tax revenue from corporations dry up.

"My concern is that tax reform is moving slowly, inversions are moving rapidly and that is a prescription for chaos," Finance Committee Chairman Ron Wyden, D-Ore., told The Wall Street Journal.

How do you feel about tax inversion deals? Do you blame corporations for trying to minimize their tax burden, or Washington for not reforming the corporate tax code? Let us know on Twitter @moneymorning or Facebook.

UP NEXT: At least the worst thing you can say about Congress and the corporate tax code is that they've failed to fix it. When it comes to their own stock trading habits, however, things get a good bit uglier. After promising to behave as recently as 2012, some members of Congress, well, haven't...

Related Articles:

- The Wall Street Journal: Congress Is Split on Taxing of Corporate Inversions

- The Economist: How to Stop the Inversion Perversion

- MarketWatch: Slim Chances Seen for Tax 'Inversion' Clampdown, Analysts Say

- Associated Press: Obama: Offshore 'Tax Inversions' Are Unpatriotic

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.