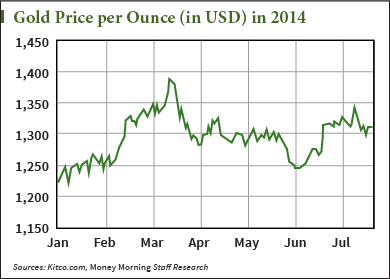

Gold prices declined 3.29% in July. Gold kicked off the month at $1,327.50 an ounce on July 1, and finished at $1,285.25 on July 31.

The highest close for gold prices occurred on July 10 with $1,340.25 an ounce; the lowest close was on the final day of the month, and was also a five-week low.

Gold's still up for the year - as the following gold price chart shows - but has had a bumpy ride.

August Comex gold was last down $12.70 at $1,282.50 an ounce on July 31. Spot gold was down $12.90 at $1,281.60 an ounce.

Here's a recap of the top gold news that shaped the yellow metal in July...

What Moved Gold Prices in July 2014

One big reason gold was expected to gain this month is the severe geopolitical contests happening today.

One big reason gold was expected to gain this month is the severe geopolitical contests happening today.

In the Middle East, Israel launched a military offensive in the Gaza strip in early July. As of Friday, 3,209 targets in Gaza had been struck by Israel, 2,153 rockets were launched at Israel from Gaza, 800 Palestinians have died, and there have been 36 Israeli deaths, according to The New York Times. The escalation in violence between Israel and Gaza militants has become the worst since November 2012.

The second conflict involves Russia and Ukraine. On July 17, the price of gold spiked when news that Malaysia Airlines Flight 17 - a passenger plane that carried 298 people - was potentially shot down by pro-Russian separatists in Ukraine. Flight 17 was just the tip of the iceberg - last week, the Obama administration announced plans to introduce further sanctions against Russia and its President Vladimir Putin if the Duma refuses to quell political and social unrest in the region. The European Union is preparing to ban its citizens from buying or selling bonds or stocks from Russia's largest banks.

"Geopolitics remains on the front burner of the market place. Tensions in Israel and Ukraine remain high. Pundits are now saying the U.S.-Russia relations have deteriorated to Cold War levels," metals analyst and Kitco columnist Jim Wyckoff wrote on July 22.

Gold is a safe-haven investment, and tends to see gains when fear arises. Indeed, the morning Flight 17 was shot down, spot gold had gained 1.3% by midday, and August gold futures climbed by $9 an ounce.

"Some investors are buying gold as the Middle East region is very tense," R.J. O'Brien & Associates senior commodity broker Phil Streible said in a telephone interview with Bloomberg. "We have been seeing an increase in the safe-haven premium since the violence in Ukraine started."

Amidst the tension, the gold prices had rallied with a 9.5% gain in 2014 through mid-July.

But as the yellow metal climbed higher, investors hunting for profits triggered the biggest one-day drop for gold prices in 2014...

"A lot of people are taking gold profits and putting it back into stocks," Money Morning Chief Investment Strategist Keith Fitz-Gerald explained in an appearance on FOX Business' "Varney & Co."

The move sent gold down 2.3% on July 14.

That drop continued as investors digested news this week from the Federal Open Market Committee (FOMC). All eyes were on possible changes to interest rates and inflation.

Earlier in July, Fed Chairwoman Janet Yellen said that interest rate increases may come "sooner and be more rapid than currently envisioned" should the labor market improve more quickly than anticipated.

Interest rates are important for gold investors because higher interest rates are bad news for gold prices. Gold prices will typically weaken when rates go up as investors seek out higher-yielding assets.

"It's tough to say how gold prices will react this week, even if we know exactly what the Fed will say," Money Morning Resource Specialist Peter Krauth said on Monday. "However, with low interest rates that are likely to stay low for some time, the opportunity cost of owning gold is next to zero, making it an attractive asset. I actually expect long term-rates to continue to trend downward for some time."

Meanwhile, inflation has been heating up in the last several months. The latest U.S. inflation rate data covers the 12 months ended January 2014 (published Feb. 20). The rate was 1.6%, but Americans could be facing inflation greater than 3% or even 4% for the rest of 2014 and 2015.

That would send gold prices - and gold stocks - higher.

Precious metals tend to move in tandem with inflation. As the value of a currency decreases - which is an effect of inflation - the price of precious metals increases. A declining value of a currency means that it takes more of that currency to purchase an ounce of the metal.

Since there is fear of inflation in the United States, and there's also a specific attempt to produce inflation in Europe right now, there is upward pressure on the price of gold.

"While the inflation rate is still relatively low, there are increasing signs of rising inflation," Krauth said. "It's still early in this trend, but once we have a few consecutive quarters of close to 2% inflation, I think the market will start to expect continuing rising inflation, making gold more attractive."

Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.

For more discussion on current gold prices, join the conversation on Twitter and follow @MoneyMorning. Also, join in the gold discussion on Money Morning's Facebook page.

Related Articles: