This week two events have occurred that may indicate the situation in two global hotspots is getting worse, and both have the potential to have a significant impact on crude oil prices in the future.

First, the Islamic State (IS), the terrorist group formerly known as the Islamic State of Iraq and the Levant (ISIL), attacked the Mosul Dam.

Second, the mayor of Kiev in Ukraine turned off the hot water.

Neither one of these is a good sign and each promises to shake up gas and oil prices moving forward...

The Uncertainty Factor and Crude Oil Prices

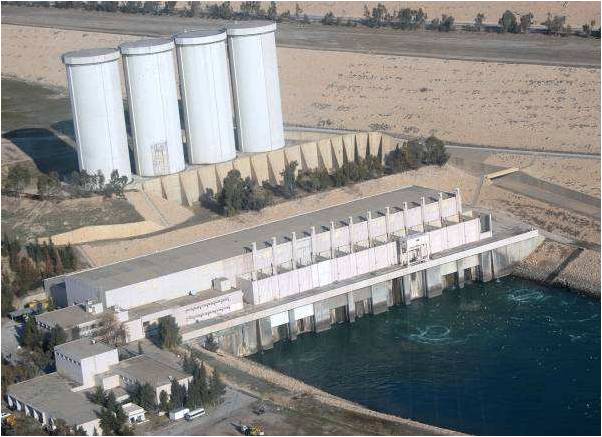

Mosul Dam in Iraq

Mosul Dam in IraqNow, it is true: We have just come out of a trough in crude oil prices.

Through close on Friday, West Texas Intermediate (WTI) - the daily benchmark set on the NYMEX in New York - had shed 5.5% for the month and 4% for the most recent week. Meanwhile, BRENT, set in London, had given back 2.5% for the month and 1.8% for the week.

At first view, this seems very counterintuitive...

How could the two primary global pricing standards be falling in the face of three major global crises (Ukraine, Iraq, and Gaza)?

Increasing tension, after all, is supposed to translate into angst, then into market uncertainty, followed by volatility - all resulting in higher prices.

But in this case, two separate factors have subdued the expected trend. The "normal" spike in prices has been curbed by both the time of year and the curious way in which traders calculate geopolitical impact.

The first has to do with the winding down of the peak driving season and the dog days of summer cutting into oil demand.

The second refers to those who really set the price of crude oil, essentially by playing the spread between futures contracts for the product ("paper" barrels) and actual shipments to meet market demand ("wet" barrels).

For these guys, a crisis just isn't a crisis unless it has staying power. Futures contracts allow a significant amount of arbitrage, while the use of options provides a way to insure against significant moves in either direction.

At least in normal times...

The trading world hates "open-ended" global problems. It's the uncertainty factor, rather than the actuality, of a crisis that unnerves the traders (and the resulting price). But if the situation can be contained, it is discounted as a concern.

The Dam That Could Unhinge Iraq

Well, now two things have happened that may just unhinge this trading system.

Let me be clear: I don't think that crude oil prices are headed to $150 a barrel overnight. But I do believe we are likely to be hit with another wave of pricing volatility, precisely because uncertainty is on the rise again.

The first deals with the IS threat to Iraq's largest hydroelectric project.

As of Tuesday morning there were conflicting reports on whether or not the insurgents have actually taken control of the huge complex on the Tigris River north of Baghdad. Reinforcements for the peshmerga (Kurdish militia) who are defending the facility and nearby town were due to arrive shortly.

However, what's worrisome is that the IS has threatened to blow up the dam and flood the area to the south - straight into the capital city.

That would be the most unsettling development as it relates to crude oil prices. Thus far, traders have been able to just about ignore what is occurring in Iraq because it has had little impact on oil production.

So far, IS has managed to capture a few fields in the north but has had no impact on production in the south, which is the source of about 80% of the nation's crude oil flow.

The weak link in the situation, however, is something I noted more than a month ago. If the insurgency succeeds in immobilizing the central government, everything changes.

Without an administration to oversee production, exports, and regulations, the southern oil fields would be thrown into disarray. As a result, IS could succeed in crippling the Shiite majority without ever taking over the city.

And causing a breakdown of the oversight function of the Iraqi government could happen in a number of ways other than military action.

A massive flood racing down the historic Tigris would certainly be one of them.

A Fast-Approaching Crisis in Kiev

The second new element is taking place in Ukraine, where an ongoing civil war pitting the West against Moscow continues even after the downing of MH17.

And in this case there's a time limit that is approaching fast.

As I've previously explained, Ukraine must begin putting natural gas in storage next month to prepare for the cold season. Short term, the country remains dependent on gas flow from Russia.

Liquefied natural gas (LNG) deliveries from the United States will be ramping up in what may be a game-changing scenario. But that's still more than a year away. There is also some possibility of moving gas in reverse on a small pipeline from Europe to Ukraine.

But neither will be of much real help in meeting the need this winter.

Of course, everybody expects there will be a knock-on effect for Europe, since it still relies on Ukrainian throughput of Russian gas for about 15% of its daily needs. The failure of Kiev to pay its past due bills owed to Russian Gazprom will prompt a longer cut of Russian supply. Some of that cut will undoubtedly mean that less gas reaches Europe.

However, there is no plan in place to deal with the very real energy crunch that is fast approaching in Ukraine. That's what makes the move made by the mayor of Kiev a clear signal of the developing problems.

Vitali Klitschko, the heavyweight-boxing-champion-turned-mayor of Kiev, announced Monday that all hot water provided by municipal boilers to older, centrally controlled apartment buildings would be shut off through "September, the end of September."

The measure is touted as a way to save gas now that Gazprom has cut the supply. The mayor says this will allow them to make it through the winter. But the figures hardly warrant such a conclusion.

So matters are about to get a whole lot less pleasant in Ukraine, with no remedy in sight.

These two developments - an Iraqi dam and cold showers in Kiev - introduce what the oil market dislikes most.

It's called uncertainty.

Give it a week or so to percolate and then see what happens to crude oil prices.

In fact, in case you missed it, I delivered an urgent briefing last week on how the chaos in the Middle East is about to "go global." To get the full report, including what it means for your money, just go here.

About the Author

Dr. Kent Moors is an internationally recognized expert in oil and natural gas policy, risk assessment, and emerging market economic development. He serves as an advisor to many U.S. governors and foreign governments. Kent details his latest global travels in his free Oil & Energy Investor e-letter. He makes specific investment recommendations in his newsletter, the Energy Advantage. For more active investors, he issues shorter-term trades in his Energy Inner Circle.