Last week, tiny Windstream Holdings Inc. (Nasdaq: WIN) unveiled a "game-changing" strategy that turned the entire telecom sector upside down.

The rural telephone company announced a breakup plan that will transform the company from a sleepy dividend payer into a deal-making broadband firm.

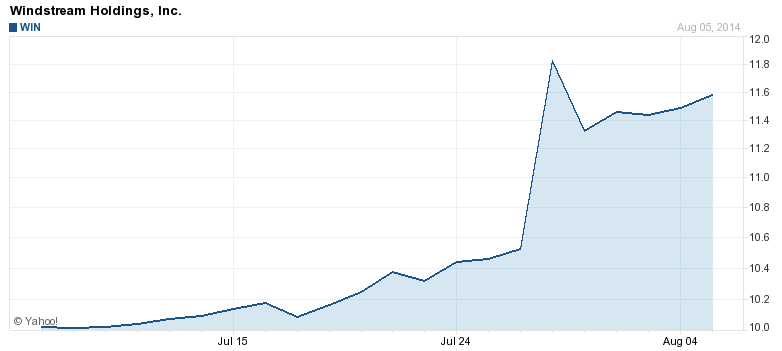

WIN shares jumped a stunning 12.4% in a single session. And telecom stocks soared across the board as folks grasped the sector-wide windfall opportunity this makeover strategy has created.

Several rural carriers experienced single-day price spikes of as much as 16%. And even the big boys - AT&T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ) - reaped the benefits.

We recommended Windstream in Strategic Tech Investor back on May 2. And folks who followed our lead are now sitting on a 29% gain.

But this is just the start. With this single move, the Little Rock, Ark.-based Windstream has rewritten the rules on telecom competition. Rivals will have to react or fall behind.

Now it's time to look at where Windstream will take the sector next: The money that's been made to date will be dwarfed by what's to come.

You just have to understand how to play this...

WIN Just Gave Investors a Telecom "Twofer"

Windstream's "gift" is one of our favorites - a "spin-off."

It plans to spin off its network assets, including fiber-optic and copper lines, into an independent, publicly traded real estate investment trust (REIT).

Windstream operates in 48 states and 86 metropolitan markets. It has 115,000 miles of high-speed fiber-optic cable for web and voice service, with broadband accounts accounting for nearly three-fourths of sales. It runs 26 data centers throughout the United States and counts more than 600,000 business clients and 3.3 million residential consumers.

Most REITs, securities that sell like a stock on the major exchanges, focus on commercial real estate such as office buildings, apartments, warehouses, hotels, and shopping centers. And they make their money through rent.

This, however, is a highly unique and unusual deal. Here's why...

There must be some canny, creative executives at Windstream. Because never before have a telecom company's network assets - broadband web connections, TV cable and phone lines - been the "real estate" in a REIT.

Windstream, which dates back to 1943, will retain operational control over those assets through a long-term leasing arrangement that will include annual payments of about $650 million.

And that will allow Windstream to act like a high-growth broadband company. The REIT spin-off will generate the funds Windstream needs to diversify and make acquisitions.

Windstream will find that savings and increased funds because, with federal REIT laws on its side, it will not pay any corporate tax.

And you'll benefit, too, because REITs must pass 90%-plus of their earnings on to investors in the form of high yields.

In a world of inflation and low interest rates, it's the best of two worlds: rising property values and the liquidity that comes with publicly traded investments.

And the big telecoms can't do this - giving Windstream (and us) a big advantage.

That's because Verizon and AT&T have sprawling networks and a wide range of operations, all of which require huge expenditures. Smaller telecoms, on the other hand, just have to maintain their networks.

For instance, if AT&T moved a large chunk of its assets to a REIT, that would likely trigger huge pension liabilities. Worse, a REIT spin-off could leave some of its best assets open to acquisition by competitors.

The company also wants to beef up the quality of its network at a time when Internet service providers are rushing to give customers faster broadband speeds.

Windstream intends to bring web connections with speeds of 24 megabits a second to 30% of its customers by 2018 - now, only about 15% of its customers enjoy this kind of speed. Current average U.S. broadband speeds are 10 megabits per second.

Meanwhile, the company expects the REIT to raise about $3.5 billion of new debt. It will then use that money to repay about $3.2 billion of Windstream debt.

A Dividend Surge

Back in May, when I first recommended Windstream, my key message was that the company provides a very valuable service - paying big dividends.

Therefore, Windstream's 9.9% yield makes it a great "defensive" stock in a market that remains in an overall uptrend but has seen a lot of volatility in recent weeks.

Although Wall Street largely backed Windstream's REIT move, there were some concerns about that dividend.

Windstream is going to restructure its dividend in this manner: In the near term, the aggregate dividend will be $0.70 a share. Of that, $0.10 will come from Windstream and $0.60 will come from the REIT.

Yes, that translates to an up-front cut of 30% from its previous $1 a share.

However, thanks to the new REIT structure, I think the dividend will grow, greatly benefiting your wallet.

With the corporate parent freed from servicing its lines and focused on acquiring other firms and telecom assets, cash flow and profits should rise quickly.

And as a REIT, those higher profits, by law, must flow to shareholders. So, as Windstream expands operations, it will end up paying you more money in the long run.

Trading at about $11.50 a share, WIN has a market cap of nearly $7 billion. It has operating margins of more than 16% and a return on equity (ROE) of nearly 23%.

Add those solid numbers to the REIT announcement and you have an incredible "special situation."

This is a company that has launched an innovative restructuring that has already thoroughly disrupted the telecom sector.

Ma Bell never saw this coming.

So, that means we can watch out for rising dividends and, once Wall Street digests Windstream's moves, an even higher WIN stock price.

This is a brand-new trail that will hot-wire your wallet and your portfolio.

More from Michael Robinson: When volatility spikes, the last thing you want to do is sit on the sidelines - you could miss an opportunity to pick up some great tech stocks at a discount. Here's how to use the "Cowboy Split" investment strategy to protect yourself from volatile markets and maximize gains...

About the Author

Michael A. Robinson is a 36-year Silicon Valley veteran and one of the top tech and biotech financial analysts working today. That's because, as a consultant, senior adviser, and board member for Silicon Valley venture capital firms, Michael enjoys privileged access to pioneering CEOs, scientists, and high-profile players. And he brings this entire world of Silicon Valley "insiders" right to you...

- He was one of five people involved in early meetings for the $160 billion "cloud" computing phenomenon.

- He was there as Lee Iacocca and Roger Smith, the CEOs of Chrysler and GM, led the robotics revolution that saved the U.S. automotive industry.

- As cyber-security was becoming a focus of national security, Michael was with Dave DeWalt, the CEO of McAfee, right before Intel acquired his company for $7.8 billion.

This all means the entire world is constantly seeking Michael's insight.

In addition to being a regular guest and panelist on CNBC and Fox Business, he is also a Pulitzer Prize-nominated writer and reporter. His first book Overdrawn: The Bailout of American Savings warned people about the coming financial collapse - years before the word "bailout" became a household word.

Silicon Valley defense publications vie for his analysis. He's worked for Defense Media Network and Signal Magazine, as well as The New York Times, American Enterprise, and The Wall Street Journal.

And even with decades of experience, Michael believes there has never been a moment in time quite like this.

Right now, medical breakthroughs that once took years to develop are moving at a record speed. And that means we are going to see highly lucrative biotech investment opportunities come in fast and furious.

To help you navigate the historic opportunity in biotech, Michael launched the Bio-Tech Profit Alliance.

His other publications include: Strategic Tech Investor, The Nova-X Report, Bio-Technology Profit Alliance and Nexus-9 Network.