The market's long-term upward bias can make short selling difficult to master, and shorting has only been made harder by the generational bull market we're in today.

But the case of ITT Educational Services Inc. (NYSE: ESI) proves that when you know how to spot a company posturing for a fall, short selling can help you double your gains - or do even better...

In fact, spotting the profit opportunity stemming from ESI allowed Money Morning Capital Wave Strategist Shah Gilani to deliver a 345.5% profit on ESI...

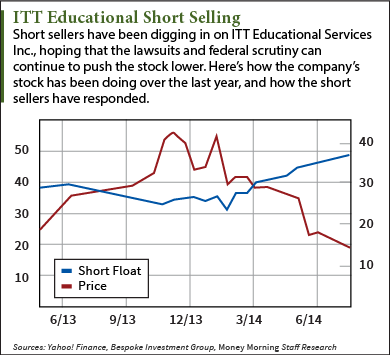

You see, this for-profit educational services firm saw its stock rise 35.2% at the start of the year - but savvy short sellers knew this rally wasn't sustainable.

The short float - the percentage of shares floated that are in short positions - has been steadily climbing since the end of January, and is currently flirting with 50%, according to recent data from BeSpoke Investment Group.

To put that in perspective, the S&P 1500 - an index that combines the S&P 500, the S&P MidCap 400, and the S&P SmallCap 600 - has a short float of 5.7%.

Heightened short selling hastened an 83% collapse of ESI stock this year. In late January shares were selling at $45.40, and on Aug. 4 they had slipped to $7.72.

ESI has felt the pain of investor backlash on for-profit educational institutions, a sector that really began to attract scorn in 2010...

This Sector's Short-Selling Appeal

At a June hearing with the U.S. Senate Committee on Health, Education, Labor and Pensions in 2010, Steve Eisman, the noted money manager who put himself on the map by shorting subprime mortgages just before the housing collapse, condemned for-profit colleges as "marketing machines masquerading as universities."

This prompted a federal inquiry, and in August 2010, the U.S. Government Accountability Office released the results of an undercover probe that revealed for-profit colleges encouraged fraud and employed deceptive marketing in their business model.

2014 has been an even tougher year for this sector - specifically for ESI.

While ESI has long been a popular short, its detractors were vindicated in February when Consumer Financial Protection Bureau Director Rich Cordray filed a lawsuit against the higher education corporation, contending that the company lured students to their for-profit colleges with false promises of high-paying jobs upon graduation, while also prompting those same students to load up on student loan debt at high interest rates.

This is around the time Gilani told his Short-Side Fortunes investment service subscribers to establish a short position on ESI. When the stock was trading at around $30, he recommended buying puts for July sale with a strike price of $25; if ESI fell below that before July, the investment would be profitable.

Sure enough, thrown into a barrage of investigations, ESI started to see its shares plunge. Since Cordray's announcement, shares dropped from $35.61 to $8.40, a 76.4% decline.

Then in May, the education company estimated that they would see a 4% drop in new student enrollment. That sent the already ailing stock down another 20.5%, a drop that eventually dragged the stock below $20 for the first time since May 2013.

On June 11, Zacks Investment Research downgraded its stock to a "Strong Sell" rating, the investor services firm's lowest rating.

The troubles also hit ESI's rivals, further souring investors on for-profit education companies.

Corinthian Colleges Inc. (Nasdaq: COCO) announced in June that because of cash-flow shortages and federal scrutiny, it may have to shut down. COCO eventually cut a deal with the U.S. Department of Education to secure $16 million in federal student aid funding to keep from going under, and at the end of the month announced that it would be selling off 85 of its U.S. schools and closing 12 more.

COCO shares were trading at $0.15 at Friday's close.

The worst of ESI's troubles came Aug. 4, when the company announced that it had missed out on as much as $119.1 million when College Portfolio Buyer LLC abandoned an agreement to buy 24 of ESI's real estate assets. That same day, the Chief Executive Officer Kevin Monday announced that he would step down in February 2015.

ESI shares fell 46%, their biggest decline since December 1994, Bloomberg reported.

ESI: "Fundamentals Trump Technicals"

Now with short sellers continuing to fuel the ESI fire, and its stock hitting 14-year lows, there may be a gimmicky trade at play here.

In this aging bull market, as opportunities for quick gains begin to dry up, big money investors are looking to force a sudden jolt in heavily shorted stocks by forcing short sellers into a squeeze.

When a stock is heavily shorted, some investors will begin to pour big money into the company in hopes that its price will begin to rise. Since short sellers only stand to lose as stock's value grows, they will panic, liquidate their positions and buy long, helping fuel an even bigger price increase.

"The hunt for performance is making traders, activists, and managers try and squeeze shorts where they see significant short interest built up," Gilani said. "It's just a play. There's not a lot of conviction to buying those names other than for the short-term pop they are trying to trigger."

But in this case, ESI is too troubled. The short sellers are smart to continue their heavy-handed approach despite the actions of some fund managers taking the other side of the trade.

"Underlying the shorting are compelling reasons to actually expect the company to falter further. They're dealing with litigation and government probes. They're essentially out on a limb," Gilani said. "Fundamentals usually trump technicals, and this is a good example of that. Fundamentally the company's business model is under attack, and that's going to outweigh the technical prospect of shorts getting squeezed."

More on short selling: The conventional approach to trading is to buy low and sell high, but what the conventional approach doesn't account for is that there are two sides to every trade. Wall Street has made quadruple-digit gains by taking the other side of the trade and Money Morning Members can learn how, too, with The Absolute Beginner's Guide to Short Selling...

Related Articles:

- The Gazette: Everest College Parent Company, U.S. Reach Agreement

- Reuters: ITT Educational Withdraws 2014 Outlook, Shares Slump

- The Christian Science Monitor: Corinthian Colleges Sell-off: Is the For-profit College Crackdown Working?

- Bloomberg: ITT Educational Plunges After Real Estate Deal Abandoned