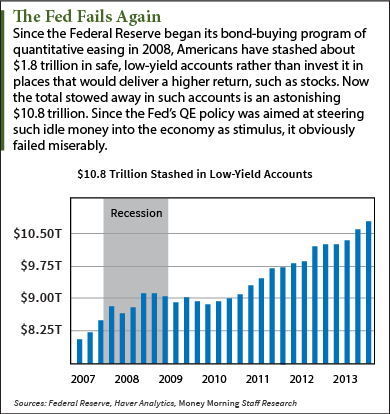

Despite billions in bond-buying "quantitative easing" and near-zero interest rates courtesy of the U.S. Federal Reserve policy, Americans stashed $1.8 trillion in low-yield accounts since the QE program started in 2008.

The flight from risk resulting from this poor Fed policy has raised the total stashed away in such accounts to an absurd $10.8 trillion.

The flight from risk resulting from this poor Fed policy has raised the total stashed away in such accounts to an absurd $10.8 trillion.

It's yet another piece of evidence that the Fed's ill-conceived maneuvers to fix the economy have utterly failed.

Stowing money away in "safe" accounts is the exact opposite of what the Fed's "easy money" policies were supposed to do. The goal was to prod Americans to spend and invest more money to stimulate the struggling U.S. economy.

Not that you'll be hearing an apology from the Fed governors any time soon. As the U.S. central bank winds down QE, it speaks of it less and less, perhaps hoping it will be forgotten.

At this past weekend's conference at Jackson Hole, Wyo., Fed Chairwoman Janet Yellen instead agonized over whether unemployment had fallen enough for the central bank to start thinking about raising interest rates.

In fact, no one at the Federal Reserve is talking about this embarrassing failure of Fed policy.

The number we're talking about is buried in the Fed's own quarterly "Financial Accounts of the United States" report.

Americans Had No Faith in the Fed's QE

Back in 2008, at the height of the financial crisis, Americans had about $9 trillion in low-yielding accounts.

Over the next several years, the Fed invested some $2.3 trillion in QE1, QE2, and QE3 in a furious attempt to stimulate spending and investment. Most of that money ended up in the reserve accounts of the Big Banks, while Americans burned by two stock market crashes in less than a decade refused to take the bait, instead squirreling away $1.8 trillion.

"We are still afraid, so we prefer to put a large part of our savings in assets that are guaranteed, like FDIC-insured bank accounts, or into money-market funds whose sponsor guarantees the return of the principal," Marketwatch columnist Rex Nutting wrote in a recent article on the subject.

So much for stimulus.

At the end of 2014's first quarter, 84.5% of annual disposable personal income was sitting in low-yield accounts, the highest proportion in 23 years.

What's more, all that QE hasn't been able to even hold things even.

More and more Americans have turned their backs on the stock market, actually taking money out of equities altogether.

Households are on track to withdraw $430 billion from stocks this year, the biggest outflow since 2007. But back then the market was crashing; this year the market has hit new highs.

Even wealthier Americans aren't investing like they once were. It's not that they don't have the money - they're saving about $400 billion more than they were during the recession.

But much of it is going into retirement accounts, saving for college, and rainy day funds - not consumer spending or stocks.

The misguided Fed policies that were supposed to unlock all this money to flow into the economy have done no such thing.

Now that the FOMC is waffling on when it will raise interest rates, the real concern is not that the Fed's policies haven't done any good, but how much damage they'll cause in the long term.

The Fed's QE-Fueled Inflation Bomb

About 80% of the trillions in QE the Fed created is sitting quietly in the vaults of the Big Banks, where for the present it's doing no harm. That's because the Fed is paying them interest on that money - $4 billion worth in 2012 alone.

But should the Big Banks ever have reason to change their mind, the huge infusion of dollars would trigger massive inflation, and possibly even a dollar-destroying episode of hyperinflation.

"You are in uncharted territory in many ways. This is what the ancient mapmakers would call, 'Terra incognita, or 'Land unknown,'" Wall Street veteran trader Art Cashin told King World News recently. Cashin is director of Floor Operations for UBS Financial Services.

At the moment, the early warning signal for inflation - the velocity of money - remains in decline. But Cashin said that's what investors want to watch for signs that the FOMC's QE dormant inflation monster is about to awaken.

"The ingredients are set up for spontaneous combustion. It's not there yet," Cashin said. "When people start to lend it and spend it, step back, because the Fed may not be able to put that genie back in the bottle."

Follow me on Twitter @DavidGZeiler.

UP NEXT: Last week, when the Fed released the FOMC meeting minutes from July, we learned that the central bankers still don't seem to have a solid grasp on what's happening in the U.S. economy, and what their role should be. As Money Morning Chief Investment Strategist Keith Fitz-Gerald put it: "They're just making things up as they go along."

Related Articles:

- Marketwatch: The 10.8 Trillion Failures of the Federal Reserve

- ZeroHedge: US Households to Withdraw $430 Billion from Stocks in 2014

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.