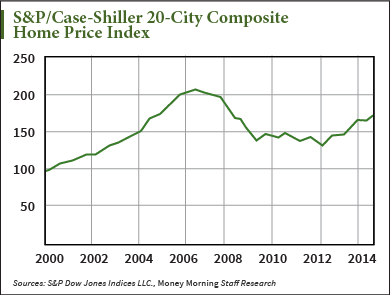

The S&P/Case-Shiller Home Price Index, the premier indicator tracking price changes in residential real estate, released new data today (Tuesday) revealing a widespread slowdown in the value of single family homes for June.

And while that may be discomforting news on its own, it goes without mentioning the sinister forces brewing beneath this so-called housing "recovery."

The Case-Shiller composite tracks monthly changes in the value of single family homes and calculates a weighted benchmark figure indexed to January 2000. The most recent data, an aggregate of home prices sampled from 20 metropolitan areas, revealed that in June, home prices rose only 1%, compared to a 1.2% gain the month before, and compared to June 2013's 2.2% gain.

Additionally, the U.S. National Index, which tracks single family home values in U.S. Census divisions, was up only 0.9% compared to 1.1% the month before.

These numbers represent an unwelcome deceleration in this already middling recovery. The 20-city composite also saw a dip in its year-over-year increases, gaining 8.1% compared to last year's 12.1%.

This stagnation in the real estate market is also coming at an inopportune time.

While the U.S. Federal Reserve has for almost six years pursued accommodative monetary policy and worked to put downward pressure on long-term interest rates, American homebuyers haven't been moving into single family homes in volumes that would help bolster a more substantial recovery.

And with the Fed slated to turn off the easy money spigot, expected to end its almost two-year quantitative easing program in October, rates are likely to take off sooner rather than later.

"Bargain basement mortgage rates won't continue forever; recent improvements in the labor markets and comments from Fed chair Janet Yellen and others hint that interest rates could rise as soon as the first quarter of 2015," David Blitzer, chairman of the Index Committee at S&P Dow Jones Indexes said in a press release. "Rising mortgage rates won't send housing into a tailspin, but will further dampen price gains."

These developments out of the housing market shouldn't come as a surprise, and while these new Case-Shiller figures are disappointing, the housing activity underlying this data is even more unsettling...

Housing Market Recovery Buoyed by Big Investors, Not Average Americans

A picture-perfect recovery would see a new generation of homebuyers flooding into the market to purchase homes.

And the homeowners who saw their properties foreclosed upon during the housing crunch would be reentering the market, further reversing real estate's fortunes and pulling it out from the depths of the crisis that pummeled home values from 2007 to 2012.

But while home values have increased 27.2% since bottoming out in March 2012, that increase isn't coming on the backs of middle-income Americans.

It's coming from Wall Street.

The low-rate policies of the Fed have left institutional investors and wealthy foreigners hungry for yield, and they're getting it from real estate.

Big money is bidding up the value of single family homes, as investors look to park their hordes of cash for a healthy return on investment, a return they wouldn't get from risk-free assets like U.S. Treasuries in this era of near-zero interest rates.

And prospective homebuyers can't compete.

"I don't see that class of people flush with money or readily able to get a lot of credit necessary to move the housing market higher," said Money Morning Capital Wave Strategist Shah Gilani. "The number of buyers that were once looking for homes simply isn't there."

Now even the big money investors are pulling away from the housing market.

In the first quarter of this year, all-cash sales of homes had reached a three-year high, comprising 42% of all U.S. home sales, according to data fromRealtyTrac. But in the second quarter, that figure had retreated to 37.9%.

The second quarter has also seen home sales to institutional investors drop to 4.7% from 5.3% in the previous quarter. The share of these sales hasn't been that low since the market bottomed out in the first quarter of 2012.

Without institutional money and cash sales pouring into real estate, the ceiling for gains in home values will only be lowered and housing will further languish because there won't be another source of buyers to fill the vacuum left by this exodus of cash.

Wall Street will essentially be passing the housing recovery responsibilities off to middle income Americans, the same people who weren't interested in buying homes even when prices and interest rates were at historic lows.

They'll be even less interested when the Fed begins to put upward pressure on rates, and they're left to navigate an overly-expensive housing market inflated by investors eyeing real estate simply as a portfolio builder.

"They bid up home prices so quickly that regular folks can't buy those homes at favorable prices... but now have to step up and pay the highest prices since the housing market implosion," Gilani said.

More from Shah: It's not just institutional money that's souring this housing market "recovery," the government, too, has its hand in poisoning the American Dream...