The Marcellus Shale region has been a top U.S. natural gas producer for 10 years, and it's still delivering some of the best options for investing in natural gas stocks.

The Marcellus Shale Formation is the largest producing natural gas basin in the United States, delivering nearly 40% of the country's natural gas production. It spans a large part of the Eastern United States, including New York, Pennsylvania, and West Virginia.

The Marcellus Shale's booming production was a major contributor to the United States becoming the world's largest natural gas producer in 2010, and the world's largest producer of oil and natural gas liquids in June 2014.

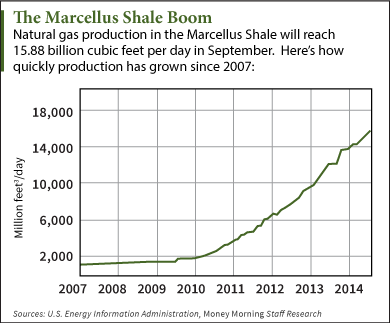

What's truly astounding about the Marcellus Shale is how much its production has grown. In 2010, the Marcellus was producing 2 billion cubic feet per day (bcfd) of natural gas. In August, it produced 15.63 bcfd. In September, production is expected to reach 15.88 bcfd.

What's truly astounding about the Marcellus Shale is how much its production has grown. In 2010, the Marcellus was producing 2 billion cubic feet per day (bcfd) of natural gas. In August, it produced 15.63 bcfd. In September, production is expected to reach 15.88 bcfd.

That growth is especially impressive considering the number of rigs in the area has remained steady for some time. According to the U.S. Energy Information Administration (EIA), the total number of rigs in the region has hovered near 100 for the past 10 months.

Instead, it's drilling technique improvement that has boosted production.

"We're seeing the results of technical developments that allow much greater efficiency," Money Morning's Global Energy Strategist Dr. Kent Moors, said at the World Affairs Council of Pittsburgh this month.

Moors first alerted readers to the Marcellus' massive potential back in 2009, when production was under 2 billion bcfd. Since then, production from the region has increased nearly eight-fold.

According to Moors, companies have used the experience from drilling in the region over the past 10 years to improve their operations and increase output.

The growth is expected to continue through 2014, as the EIA expects each rig in the region to support 6 million cubic feet of new production per day. With 100 rigs currently operational, that's an increase of 600 million cubic feet per day from the Marcellus Shale.

And the growth has translated to profits for investors...

One of the natural gas stocks Moors recommended when he first introduced readers to the Marcellus has gained more than 107% since. Another natural gas stock has seen its oil and gas revenue increase more than 17% in the past five years - mostly due to growing Marcellus production.

If you've missed profiting from this region's growth, it's not too late. Marcellus stocks still have room to run.

Here are three of the best natural gas stocks to buy to start profiting from the Marcellus now.

Three Natural Gas Stocks to Buy Now

Marcellus Shale Play No. 1: Chesapeake Energy Corp. (NYSE: CHK) is a natural gas and oil exploration company, and the Marcellus is the company's largest hydrocarbon play.

CHK reported last quarter that its net production from the Northern Marcellus was 878 million cubic feet equivalent (mmfce) per day, an increase of 12% from the previous year. The company also reported operating an average of six rigs in the area, up from five the previous quarter.

In the southern Marcellus, Chesapeake reported net production of 58,000 barrels of oil equivalent (boe) per day, which was an increase of 67% year over year. In the southern region, Chesapeake produces oil, natural gas, and liquefied natural gas.

In its last earnings report, CHK had increased revenue by 10% and lowered capital expenditures 27% from the previous year.

Recently, CHK stock has been impacted by falling natural gas prices, due to increased production across the United States. However, the stock is still up 3% in the last six months. Currently, CHK shares trade at $26.46.

Marcellus Shale Play No. 2: Anadarko Petroleum Corp. (NYSE: APC) is an independent exploration and production company that operated in the Rocky Mountains region, the southern United States, and in the Appalachian Basin.

Anadarko owns approximately 260,000 net acres of land in the Marcellus Shale region. In the fourth quarter of 2013, APC produced more than 553 million cubic feet of natural gas from the region. According to the company, that's enough natural gas to cool or heat 2.5 million American homes on average.

Year to date, APC stock has gained more than 41%. Today the stock trades at $112.05 per share with a 52-week range of $73.60 to $11351. In the upcoming quarter, analysts expect APC to post revenue growth of nearly 15% compared to 2013.

Marcellus Shale Play No. 3: Gastar Exploration Inc. (NYSE: GST) is a natural gas exploration and production company with operations in the West Virginia portion of the Marcellus Shale.

At the end of 2013, Gastar had natural gas proved reserves of approximately 327.8 million cubic feet across the United States. Specific to its Marcellus Shale operation, GST owns 75,500 acres in northern West Virginia.

In the second quarter of 2014, GST averaged 5.4 million barrels of oil equivalent per day from the Marcellus. Currently, the company is working to bring 13 new wells online in West Virginia by the end of 2014.

GST stock has climbed an impressive 135% in the last 12 months. The stock currently trades at $7.62 and has a 52-week range of $2.60 to $9.10. A recent survey of 13 brokers by Thomson/First Call placed an average price target of $10.15 on the stock, which would be a 33% gain from today's price.

Join the conversation on Twitter @moneymorning and @KyleAndersonMM using #NaturalGasStocks

Now: The Apple-IBM deal is great for both firms, because it unites the best of both companies. But for investors, one stock is the clear winner...

Related Articles:

- Pittsburgh Tribune Review: Gas Production from Marcellus Shale Sets Record Despite Fewer New Wells Going Online