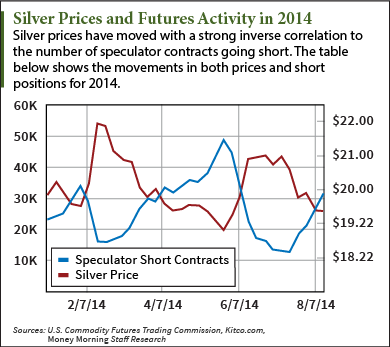

As of Friday, the U.S. Commodity Futures Trading Commission (CFTC) reported that silver speculators added further to their short positions, which no doubt kept a lid on the current price of silver.

But the ceiling for mounting short positions is fast approaching as these positions escalate.

As of last Tuesday, speculators had staked out 31,632 short positions on silver through short contracts - paper bets on future price declines - with an underlying 158.2 million ounces of the physical metal. On the year, this is the 12th largest volume of short contracts taken out for silver, and it's building ever closer to this year's previous highs.

As of last Tuesday, speculators had staked out 31,632 short positions on silver through short contracts - paper bets on future price declines - with an underlying 158.2 million ounces of the physical metal. On the year, this is the 12th largest volume of short contracts taken out for silver, and it's building ever closer to this year's previous highs.

Not surprisingly, this buildup of short action has had a depressing effect on the silver price. It is now below its 2013 closing price of $19.565 an ounce, trading as low as $19.17 in the early morning today (Tuesday).

The silver futures market and speculator activity has been a highly telling indicator for the future of silver price movements. When speculators begin buying up short positions in droves, the price of silver enters a bear session where declines become routine. But when silver speculation hits its peak and prices dive down to new lows, the speculators will begin to liquidate their short contracts and buy long.

And when this happens, silver is taken for a ride...

How Short Contracts Have Moved Silver Prices This Year

Two good examples of this recurring cycle happened just this year.

For the first month of 2014, speculators added to their short positions each week, growing that figure from 116 million ounces of physical silver underlying 23,206 contracts to 33,993 short contracts backed by 170 million ounces. In that period, silver price activity was effectively subdued, as prices dropped about $0.34 to $19.51, lower than the trading price of the white metal at the year's open.

But it turned out that 33,993 was the magic number...

With the current price of silver trading near yearly lows, speculators reversed course and began liquidating those positions quickly and buying long. Short contracts fell all the way to 15,904 contracts, or 79.4 million ounces, and prices shot up $2.455 an ounce to $21.965. This was the highest closing price for silver on the year, reached on Feb. 24.

But sure enough, this too was short-lived, and this year-long high that has yet to be reached again was followed by a protracted session of bearish speculation and substantial price declines. Traders reestablished their short positions, and those 15,904 short contracts ballooned threefold to 48,984, the highest recorded number of silver short contracts. Silver was at its lowest price of the year, trading at $18.76 an ounce.

And once again, from that point on, the shorts were liquidated and large price gains were felt in the silver market. Silver topped out at three-month highs by July, closing in on its February highs but not quite getting there, and on July 11, silver closed the trading day at $21.445 an ounce.

Now, the current price of silver reflects the bearish end of this cycle...

Silver Short-Side Speculation: Reaching a Peak?

By July 29, silver shorts had reached 12,603, the lowest number on the year, and a low not breached since February 2013. While on its own it may seem bullish that contracts hit a new low, it only provided further downward pressure on prices because it left the door open for more shorts.

Since reaching that low, silver has fallen $1.10.

Fortunately, silver shorts can only be piled on for so long before they build to peaks and inevitably get squeezed.

As these positions build, the white metal will become less and less vulnerable to renewed short selling, and the bulls will have to take hold. And with those contracts eclipsing the 30,000 mark, the peak should not be far off.

More on Silver: Numerous factors are building that make today's silver prices look downright cheap. Here's how you can invest in silver today for double-digit gains...