Just 27 days ago, Amazon (Nasdaq: AMZN) announced the launch of its "Amazon Local Register." But AMZN isn't the only tech giant that's jumping into the mobile swipe-to-pay market...

Apple (Nasdaq: AAPL) threw its hat into the swipe-to-pay ring at a product launch event this afternoon (Tuesday) when it announced "Apple Pay."

It's no surprise that the companies want a piece of the mobile payment business, which is undergoing tremendous growth.

According to data compiled by Statista, the global mobile payment transaction volume is expected to have grown from $163.1 billion in 2012 to $235.4 billion in 2013. The statistics firm predicts those numbers will jump to a whopping $721 billion by 2017.

What's more, more than 90% of U.S. retail sales still take place in physical stores, according to U.S. government data.

AMZN, AAPL Aim to Capture Mobile Payment Profits

Amazon Local Register |

On Aug. 13, Amazon grabbed for market share when it announced the launch of its Amazon Local Register, a mobile credit card reading device. For $10, users can purchase Local Register and plug it into the headphone jack of a smartphone, tablet, or Kindle. Via the same network that processes Amazon.com purchases, Local Register will process these mobile credit or debit swipes. Amazon believes Local Register will prove the "easiest way for small businesses to get paid."

"Payments are hard and that's one of the things that gets in the way of serving customers, especially for small businesses," Amazon vice president of local commerce Matt Swann said that day. "Payment tools need to be inexpensive, simple, and trusted to get the job done."

Apple Pay |

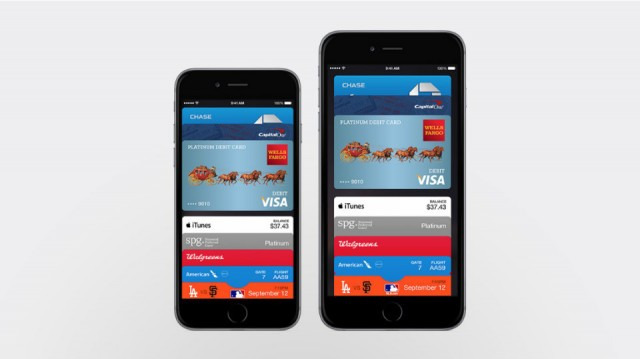

Apple's Pay will be available in October, and allows consumers to hold their iPhones up to a payment device to make a transaction. The iPhone is linked directly to the user's credit card account via Apple's Passbook application that it launched in 2012.

"It's a revenue opportunity. It's a business model opportunity. It's an integration point across multiple parts of their business and their partners' businesses," Gartner analyst Van L. Baker told Mashable. "There's just a lot of things that line up that says this is the right time to do this."

Both will compete against startup Square, which is led by Twitter co-founder Jack Dorsey. Square's Reader, which launched in 2010, links directly with a user's bank account and accepts payments from all major credit card companies. A reading device plugs into smartphone audio jacks or tablets.

Square Reader |

But even though Square got the first crack at the mobile payment arena, Amazon's and Apple's entry is bad news for it. Square's already operating on a paper thin profit margin, and although it's growing fast, it's yet to turn a profit. So far in 2014, the company has lost approximately $100 million and has gone through half of the $340 million in its venture capital funding, according to The Wall Street Journal. The report went on to say that when a deal between Square and Starbucks (Nasdaq: SBUX) fell apart last year, it cost Square around $20 million.

Here's a side-by-side breakdown of the specs of each company's mobile payment offering - you'll see that Square is outmatched...

Amazon Local Register (Nasdaq: AMZN)

- Cost of device: $10, no monthly fee.

- Transaction fee: 1.75% for users who sign up before Oct. 31, and that rate will last through the end of 2015; 2.5% otherwise.

- Launch date: Already available.

- Participating credit cards: Unlimited credit and debit cards.

- How it works: Purchase the Register, and right now you'll get the $10 back in fee credits. Download Amazon's free app. Plug the Register into compatible devices, which includes Kindles, iPads, iPhones, and various Android tablets and smartphones. Swipe the card and Local Register will process these mobile credit or debit swipes on the same network that processes Amazon.com purchases.

Apple Pay (Nasdaq: AAPL)

- Cost of device: Unknown.

- Transaction fee: Unknown, but Bank Innovation reported on Sept. 4 that AAPL has reached agreements with five of the largest financial institutions in the U.S. to get discounted fees.

- Launch date: Available in October 2014.

- Participating credit cards: Apple Pay will accept MasterCard, Visa, or American Express.

- How it works: Participating stores (Apple said there are currently 200,000, including Macy's, Whole Foods, Disney, and Target) will have devices that allow users to scan their iPhones, which are linked to the users' credit card account. When a user pays, the transaction will generate a one-time only code that boosts the security by limiting the user's exposure. Apple Pay will also be available using the Apple Watch, which was also revealed today and will launch in early 2015.

Square Reader

- Cost of device: $10, no monthly fee.

- Transaction fee: 2.75% for swiped transactions and Square Wallet payments; 3.5% plus 15 cents for manually-entered transactions (Square says the higher fee for manually entered transactions is due to the greater risk involved with these payments, as neither the card nor the buyer have to be present for this type of payment to occur.)

- Launch date: Already available.

- Participating credit cards: Square accepts Visa, MasterCard, American Express, and Discover.

- How it works: Plug the Square Reader into the audio jack of compatible smartphones and tablets, and swipe credit cards for mobile payment. Fees are taken out of the total amount of each transaction, including tax and tip.

Is the Amazon Local Register or the Apple Pay going to come out on top in the mobile payment business? Leave us a comment on Money Morning's Facebook page. Also, you can join us on Twitter by following @moneymorning.

Finding a great "safety play" is a good idea for investors in case U.S. stocks begin to sputter - or even stall. We have one for you - its shares could soar thanks to this "20% catalyst" that Money Morning's Executive Editor Bill Patalon has found...

Related Articles:

- Mashable: Apple Unveils NFC Mobile Payments Platform Called Apple Pay

- The Wall Street Journal: Mobile-Payments Startup Square Discusses Possible Sale

- Bank Innovation: Apple Said to Negotiate Deep Payments Discounts from Big Banks