Crude oil prices have had a volatile summer, with West Texas Intermediate (WTI) hitting a three-year high of $105.55 a barrel in June before settling back down near $92 this week.

Even with oil's volatility, investors can have a better idea of where the price of oil is headed if they know what causes oil prices to rise.

Fortunately, Money Morning's Global Energy Strategist Dr. Kent Moors is uniquely qualified to help. As a 35-year expert in oil and gas policy, Moors has served as an advisor to governments, private companies, financial institutions, and law firms around the world.

According to Moors, there are numerous factors in play when it comes to determining crude oil prices - but one of the most common factors is a crisis in an oil-producing country.

"Whenever a conflict occurs in an oil-producing country, oil prices rise," said Moors. "It's one of the most predictable patterns in the markets."

That's precisely what happened this summer when crude oil prices reached three-year highs...

In June, ISIS militants overtook much of northern Iraq including the country's second-largest city, Mosul, the city of Fallujah, and one of the country's largest oil-producing provinces, Kirkuk. The fighting also bled across the Syrian border.

The insurgency affected major oil fields and refineries in northern Iraq, where much of the country's proven oil reserves are located. Iraq accounts for 4% of the world's oil supply, and any disruption of that production would have had major ramifications, according to Moors.

The uncertainty in Iraq sent WTI prices over $105 a barrel. Fortunately, it became apparent that the ISIS insurgents would not be targeting the southern Iraq oil fields where the country's oil exports are produced, and oil settled to its current price.

The uncertainty in Iraq sent WTI prices over $105 a barrel. Fortunately, it became apparent that the ISIS insurgents would not be targeting the southern Iraq oil fields where the country's oil exports are produced, and oil settled to its current price.

The Iraq crisis was just the latest example of a geopolitical situation creating a spike in oil prices.

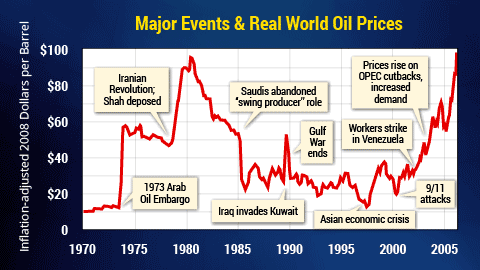

The accompanying chart shows exactly how prices have surged following major geopolitical events from the past four decades. As Moors pointed out, the price spikes are predictable.

But investors have to look at how oil traders react to these situations to get an idea of how oil prices are really driven. They'll notice when looking up oil prices, that the price listed is for delivery in the next month. That plays a huge role in determining pricing.

"In a crisis situation, oil traders set their prices based on the next most expensive barrel of oil in the future," Moors continued." This is the real cause of high oil prices. Not large oil producers. Not gas stations. But the futures markets."

So while crises may spur oil price hikes, it's the futures market that's really driving prices...

How Traders Really Drive Crude Oil Prices

"The key here is to recognize that crude oil prices are still determined by the balance between readily available supply and existing demand," Moors said. "That means that even relatively small swings in either supply or demand can have an outsized effect."

"It's the expectations of future changes in this balance that ultimately drives how traders view the market. After all, these guys are attempting to deal with what the price of oil will look like months in advance. That's the very nature of futures contracts. Traders need to deal with the 'uncertainty factor' in determining their contract pricing."

Therefore, the fear or uncertainty surrounding the supply and demand is really what drives the prices higher. Frequently, the unfolding events have more to do with perception than reality. In fact, sometimes the mere concern that supply or demand will be disrupted is enough to move prices.

Take the last crisis in Iraq for example. While the insurgents were attacking northern Iraq, there was little evidence that the fighting would spread to the southern oil fields. However, the fear that it might, or that any of the oil production would be slowed, sent prices soaring.

"It is merely the fear of disrupted supply that causes the risk premium on oil to rise," Moors said at the time.

Editor's Note: Now, according to Dr. Moors, the chaos in the Middle East is about to "go global." As you'll see, a select group of companies is set to benefit in a very big and unique way.

To get the full report, including what it means for your money, go here.

Join the conversation on Twitter @moneymorning and @KyleAndersonMM using #Oil