Silver prices today are trading at their lowest levels on the year, continuing a two-month bear cycle during which the white metal has fallen $2.91 an ounce, or as much as 13.5%.

Silver prices today are trading at their lowest levels on the year, continuing a two-month bear cycle during which the white metal has fallen $2.91 an ounce, or as much as 13.5%.

Earlier this morning (Thursday), silver prices had fallen as low as $18.54 an ounce, below the June 2 closing low of $18.76. With the dollar topping out at 14-month highs and the U.S. Federal Reserve indicating that interest rates could spike sooner rather than later, many silver investors are heading for the exit.

The bid price for 24-hour spot silver is down 3.2% on the year, 2.7% on the month, and 1.3% on the week as of yesterday's (Wednesday) close. It is also down 11.7% since it hit a three-month bull rally peak exactly two months ago, topping out at $21.445 an ounce.

Silver futures - contracts promising the future delivery of physical silver - are trading down 3% on the year at $18.92 as of market close yesterday.

And silver investments are struggling as well. The largest silver exchange-traded fund, iShares Silver Trust (NYSE Arca: SLV), which is backed by physical silver bullion in London and New York vaults, was dangerously flirting with 52-week lows this morning, trading just $0.01 off at $17.92 at one point this morning. A popular alternative to SLV, the ETFS Physical Silver (NYSE Arca: SIVR) was just $0.02 off its 52-week low when it was trading at $18.41 this morning.

Silver's travails have been particularly disappointing given that July and August both produced losses in months that are generally kind to the white metal. In the last decade, silver had averaged a 4.2% return and only once had posted a loss. This year, for the first time since 2010, silver slid, with prices dropping 2.8%.

Similarly, silver was up five years in a row and seven of the last 10 years in August, averaging a return of 3.6%. In 2012 it posted a 13.4% gain, and in 2013 an impressive 19.3% return. However, this year it posted its second-worst month on the year as it lost 4.5%.

So what's working against silver? And when will it hit the bottom and reverse this disappointing two-month downdraft?

Silver Prices Today Restrained by Fed Talk and Dollar Strength

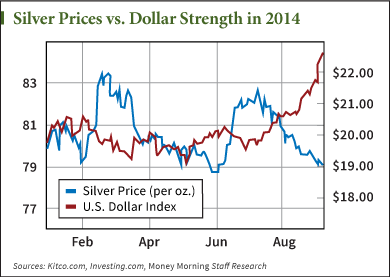

The two most obvious headwinds for silver are the strength of the dollar and Fed expectations.

Over the last week foreign currencies have been faltering as the world's central banks clamor to prop up their stagnant economies with inflationary stimulus measures.

In the Eurozone last week, European Central Bank President Mario Draghi announced a series of rate cuts in its lending and deposit programs and signaled that the region may be drawing ever closer toward a policy of quantitative easing. These announcements pushed the euro to 14-month lows.

Similarly, a move for Scottish independence in the U.K. stoked investor fears about the British pound sterling, as it closed at 2014 lows on Monday of $1.6105.

These two currencies comprise 69.5% of the U.S. Dollar Index, which is a measure of the dollar's strength based on a weighted geometric mean of other world currencies that gains when others fall. Add onto that the substantial 13.6% the yen occupies in that measure (with Japan being a country that has been pursuing more aggressive stimulative policies since early 2013), and it becomes obvious why the dollar looks so attractive right now.

Additionally, silver stands to gain when there are fears that inflation will accelerate. The white metal, much like gold, is sought as a store of value against a weakening currency, and prices will go up if there's any indication that prices will rise and eat away at the dollar's strength.

But this week, the Federal Open Market Committee (FOMC), the Fed's policy-setting arm, sent out a flurry of signals that indicated rates may rise sooner rather than later. Rate hikes are a counter-inflationary policy measure and make silver a less sought after commodity.

Further working against prices has been silver futures activity, but there are also encouraging indicators coming from that very same place that signal a possible rally for silver in the near future...

Silver Futures Add Further Downward Pressure, but Not for Long

According to the most recent data from the U.S. Commodity Futures Trading Commission, speculators holding short positions - contracts betting on future price declines - have grown to 39,025 contracts representing 195.1 million ounces of physical silver.

This was the fifth week in a row short positions grew from a low of 12,603 contracts representing 63 million ounces of silver on July 29. On July 29, silver short positions were at their lowest level since February 2013.

As speculators build up short positions, it puts downward pressure on prices. But alternatively, as they liquidate those short contracts and look to buy long to cover, it begins to help push prices up.

With silver trading at its yearly lows, no doubt those speculators going short are going to look to lock in gains, then buy long. And with short positions just about 10,000 contracts away from reaching historic highs, it's obvious that this period of short building is coming to an end.

At the current pace, if short building does continue, these historic highs would be reached in two weeks. And not long after that, if this year is any indication, the mass liquidation of short positions will occur and silver will begin a new rally.

More on Precious Metal Investments: Money Morning Resource Specialist Peter Krauth was right about palladium when he recommended it in March - it's up almost 14%. Here's another precious metal that isn't on too many investors' radar yet that is ready to head higher...