Most people invest in companies hoping to catch a stock on the upswing - and bring in mega-returns for themselves in the process.

But what if you found a company that could rack up mega-returns even if its stock price stays flat?

That's the situation with the high-yield dividend stock Altria Group Inc. (NYSE: MO) - a company I've recommended to my subscribers for doing just that.

Most people think of Altria as a once-great tobacco giant that's merely hanging in there, having been hit by crippling lawsuits left and right. Admittedly, the anemic long-term growth that this company has seen over the last decade doesn't exactly dispel this view.

Most people think of Altria as a once-great tobacco giant that's merely hanging in there, having been hit by crippling lawsuits left and right. Admittedly, the anemic long-term growth that this company has seen over the last decade doesn't exactly dispel this view.

Yet, this is nothing new. In fact, Altria has had its share of stock spikes and slumps over the last 15 years. Today, it's actually trading slightly lower than it was 10 years ago in absolute price terms, but that's understandable considering it spun off Philip Morris International in 2005.

What makes this company a real gem for investors is its dividend gains. That's why I'm eager to explain their power... and why they're really just the beginning of your financial future.

The 48th Dividend Hike in 45 Years

On Thursday, Aug. 21, the company announced it was raising its quarterly dividend by $0.04, to $0.52 a share. This represents an 8.3% dividend hike and results in a 4.70% yield, given that it's trading at around $43 per share as I write.

What's really impressive, though, is that this latest dividend hike represents the company's 48th increase in 45 years. That's right: Going all the way back to 1969, Altria (then going by another name) has increased its dividend payouts at a rate greater than once a year.

While that's fabulous for any investor, some have really made out like proverbial bandits. I bring this up because, depending on when they originally purchased shares, they've had the chance to receive more in dividends than they originally paid for the stock itself. Which means, practically speaking, that they own the stock for "free."

I cannot overstate the importance of reinvesting in high-yield dividend stocks like Altria that I consider "dividend royalty" for their consistency and the length of their tenure in the marketplace.

That's because doing so - buying additional shares using dividends to pay for your purchase - results in long-term compounding. That's not only key to building huge fortunes, but it's also one of the single most powerful investment wealth builders of all.

Don't take my word for it. The effect of big dividends over time is well documented and validated. Scientist Albert Einstein felt so strongly that he reportedly quipped that compounding interest "may be the most powerful force in the universe."

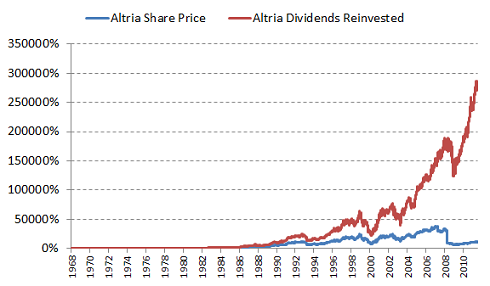

I can see why, and thanks to charts like this, you can too.

Source: Capital IQ, a division of Standard & Poor's; Motley Fool. |

Over time, the difference between the simple appreciation most people focus on and the effects of continual dividend reinvestment are jaw-dropping. Had you invested on Jan. 2, 1970, and left that money alone until the close of trading on Sept. 2, 2014, your return would be 431,800%, adjusted for dividends and stock splits.

Apple, Facebook, Google... none of today's media darlings can come close to that.

You don't have to wait 44 years to see monster gains building. Just consider: In the years spanning 1999-2012, Altria's shareholders who reinvested their dividends saw returns of well over 1,000% - and Altria has raised its dividend payout twice in the two years since.

My point is that it's never too late to begin charting your course to total wealth by investing in Altria or another high-yield dividend powerhouse just like it.

And if you don't have a lot of money to get started?

That's another excuse I hear a lot, and my answer is always the same... That's all the more reason to get started right now.

Invest for High Yield with Little Cash

Check out DRIPs. That's short for "dividend reinvestment plan." This is a special equity investment option offered directly by many of the finest companies in the world as a means of purchasing shares over time. Investors can start with a small number of shares and, instead of receiving dividends as cash, reinvest continually in the company's stock.

This is great because it does two things: 1.) it puts the plan on autopilot and makes it harder for antsy investors to screw it up by trying to time the markets, and 2.) it helps you maximize the effectiveness of dollar cost averaging over time because you'll be spreading your purchases out and never have to lift a finger to do so.

Some DRIP programs are free and others involve a fee, so you'll want to look before you leap.

And, as you might expect, you'll have to pay taxes on dividends received, even though the money's not in your pocket.

Because it takes a few years for the benefits to accrue, the DRIP strategy isn't a get-rich-quick strategy by any means. But for investors with an eye toward the long term, its power is unrivaled in transforming modest investments into mega-returns down the road.

Best of all, it converts the passage of time - that inevitability that most investors scramble in vain to overcome - into your biggest ally.

Change that dynamic and you change your life.

Don't Miss Today's Top Story: Icy methane hydrates, also known as "fire ice," are touted by some as the next major source of energy. But there's a dangerous flip side to this ice-like substance. This deadly "fuel of the future" could also destroy the planet...

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.