Last week was punishing for silver prices once again, as the silver futures market sent out bearish signals and the white metal fell below its lowest levels on the year.

As of the close of markets on Friday, silver traded at $18.61 an ounce and fell as low as $18.40. On the week, the spot silver bid price fell $0.58, or 3%, and is down 4.9% on the month. Additionally, it's trading well below 2013's closing price of $19.565, and it's also fallen under the 2014 low of $18.76 it reached in June.

Taken all together, the prospects for silver seem dismal - but a look at the silver futures markets this year shows these doldrums typically precede a much more substantial rally.

And the current signals suggest that the next rally could be bigger than the two that preceded it in 2014.

The first silver price rally of 2014 began at the end of January. After losing 2% on the year, falling $0.40 from $19.565 to $19.165, the white metal reversed its fortunes in February and rallied to its 2014 high of $21.965.

That high was followed by a torturous bear session where, over the next three months, the price of silver fell from its February peak by 14.6%, trading at $18.76 on June 2.

But from then on, silver experienced another rally, and between June 2 and its next peak close on July 11, it rose 14.3% to $21.445.

Sure enough though, the bears entered the silver market once again, and since that July peak, prices have dropped 13.2% as of Friday's close.

While silver is now experiencing new lows, it shouldn't encourage silver bulls to flee the market. The sub-$19 prices only now make it cheaper to get in on what is an investment that is sure to pick up ground in the coming weeks.

Here's why silver is gearing up for a rally, and why now it is a good time to jump in...

Silver Futures Market Will Pick Silver Up in the Near Term

If you look at the factors underlying silver's two big rallies this year, it becomes clear why another rally is not far off.

The answer lies in the futures market, and more specifically, speculators going short on the white metal.

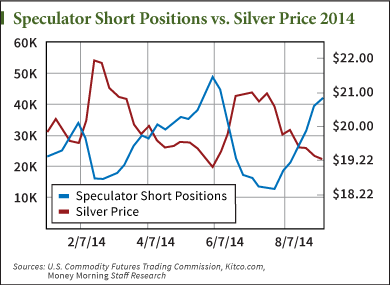

At the start of the year, traders betting on silver's downside, who are holding short contracts that rise in value as prices slide, held 23,206 contracts representing 116 million ounces of physical silver. Prices around this time were at about $19.85 an ounce.

Over January, speculators built that short position up to a peak by Feb. 4 to 170 million ounces of silver underlying 33,993 short contracts. As these positions mounted, silver fell to $19.51.

But at this peak, traders saw low silver prices and feared that at prices this cheap, investors would begin buying long and put upward pressure on the prices. The result was two weeks of speculators covering their short positions, and by Feb. 18, shorts fell to 15,877 contracts. It was around this time prices traded almost as high as $22.

When short contracts fell to this low, speculators began reestablishing short positions, and over the next three months sustained a growing short position.

Shorts grew to 48,984 contracts by June 2, the highest number of silver shorts on record. Silver was trading down to $18.76 an ounce.

But this also reversed itself, and in a similar fashion, a period of short liquidation lifted prices back up to $21.445 an ounce.

Silver is once again fighting against growing short positions. On July 29, shorts were at their lowest levels since Feb. 2013, totaling 12,603 contracts.

At this low level of short contracts, silver was open to another attack by the short sellers. For the last six weeks, this figure has swelled to 41,667.

With shorts this high and prices this low, short sellers are going to be feeling pressure soon.

It's going to be hard for silver to trade this low without attracting some investor interest, and as soon as the shorts see long buyers enter the market, they too will begin buying long to cover their shorts and silver prices will flourish.

Short contracts on silver have been growing at a pace of about 5,000 contracts a week since the late July low. At this pace, if silver short contracts don't eclipse their peak in early June, you can expect this short liquidation and subsequent silver rally to kick in within the next two weeks.

More on What Could Affect Silver: Inflation will be a big determinant in silver prices, as a weakening dollar will cause investors to flock to precious metals as a safe haven asset. But there's one counter-inflationary policy that the Fed might be too afraid to consider, given what's at stake...