The Alibaba IPO is just hours away and Money Morning has all the Alibaba Group Holding Ltd. (NYSE: BABA) stock information investors need to know as BABA stock hits the market on Friday, Sept. 19.

All the Alibaba (NYSE: BABA) Stock Information to Know Now

- What Is the Alibaba Stock Price Range?: Alibaba has set a price range of $66 to $68 for its stock price. Previously, the company had set a range of $60 to $66. At the high end of the new range, Alibaba will raise roughly $21.8 billion through the IPO.

- How Big Is the Alibaba IPO?: Currently, the largest IPO on record is the $22 billion deal the Agricultural Bank of China Ltd. held in 2010. Visa Inc. (NYSE: V) holds the record for largest ever U.S. IPO, having raised $19.65 billion in 2008.

[epom]

While pricing at the high end of the range will make Alibaba $21.8 billion, the company could still see that total go higher.

Company officials said that depending on how many shares the deal's underwriters buy following the IPO, the IPO total could be much higher. In fact, it could go as high as $25 billion.

- Where Will Alibaba Stock Trade?: In late June, Alibaba officials announced that its shares will trade on the New York Stock Exchange under the ticker "BABA." Both the Nasdaq and the NYSE had competed for the mega-IPO, but eventually the NYSE won out.

- How Much Is Alibaba Worth?: When Alibaba announced its initial stock price range, the company said it would reach a valuation of $155 billion at the midpoint of that range. Now that Alibaba has lifted the range, it will likely be valued much higher. A survey of Bloomberg analysts concluded that Alibaba could be worth roughly $200 billion following the IPO.

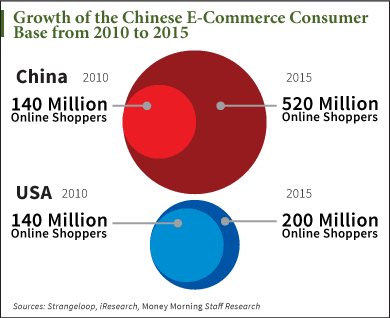

- How Big Is China E-Commerce?: Last year, online shopping in China was a $298 billion business. That easily surpassed the United States' $263 billion, making China the largest e-commerce market in the world.

"Alibaba is the dominant e-commerce player in a marketplace - China - that's seeing incredible growth in online commerce," Money Morning's Executive Editor Bill Patalon said. "According to the research I've seen, e-commerce in China is projected to hit $540 billion by 2015, and that's just for starters. By 2020, China's e-commerce market will be worth more than the United States, the United Kingdom, Japan, Germany, and France combined. So we know that growth is coming... and we know that Alibaba is the No. 1 gun."

By 2015, the number of Chinese e-commerce users is expected to hit 520 million - that's more than double the number expected in the United States.

- Is Alibaba Growing?: A key to Alibaba's growth is mobile. In 2013, Alibaba reported that its mobile sales soared 100% to 351 million units. That accounted for one-third of all global sales.

But that's just the start. According to the research firm IDC, smartphone shipments in China will top 450 million units this year.

Money Morning Members: Continue reading for more "must-know" BABA stock information, plus a way to start profiting from this historic IPO now...

- What Is Alibaba's Market Share?: In 2013, nearly 80% of all online transactions in China took place over Alibaba's network of sites.

- How Much Does Alibaba Make?: The timing of the Alibaba IPO couldn't be any better for the company.

Last month, the company updated its IPO filing and reported that its revenue in the second quarter was $2.54 billion. That was an increase of 46% from the previous year.

In the previous quarter, Alibaba had revenue growth of 39%. The fact that Alibaba's revenue growth is on the upswing just weeks before the IPO should only strengthen investor confidence as Alibaba stock hits the market.

- How Profitable Is Alibaba?: In the second quarter, BABA reported profit of $1.99 billion, nearly triple what it had last year. That came to roughly $0.88 per share.

The company did note that its operating profit margin was down to 43.4% from 50.3% last year, but that should not concern investors. Alibaba's costs rose dramatically in the quarter, 68%, as it increased its marketing efforts and made acquisitions ahead of its public debut. The fact that profits are growing at such a high rate is the most important detail here.

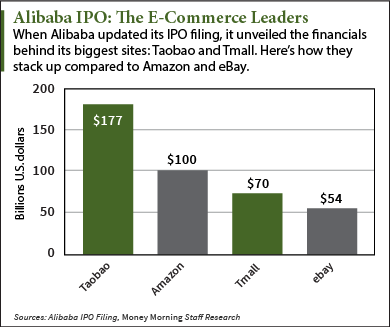

- Is Alibaba Bigger Than Amazon?: When Alibaba updated its prospectus in June, it gave specifics on the volume of its websites. In 2013, its most popular site, Taobao, handled $177 billion in transactions. Approximately $70 billion exchanged hands over Alibaba's second-largest site, Tmall, during the same time. For perspective, Amazon.com Inc. (Nasdaq: AMZN) handled $100 million and eBay Inc. (Nasdaq: EBAY) handled $54 billion in 2013.

- Do Any ETFs Hold Alibaba Stock?: Since Alibaba shares are not public yet, no ETFs or funds currently own a position in Alibaba.

PowerShares Golden Dragon China Portfolio (NYSE: PGJ) has a position in more than 70 companies, and its holdings are all U.S.-listed companies that generate most of their revenue in China. For that reason, Alibaba is the perfect candidate to join PGJ's holdings once it starts trading on the New York Stock Exchange.

The three largest holdings for PGJ are Baidu, Ctrip.com International Ltd. (Nasdaq ADR: CTRP), and Qihoo 360 Technology Co. Ltd. (NYSE: QIHU).

Editor's Note: Many investors are hoping to cash in on the Alibaba IPO by making the "obvious" move. But there's another way. I'm talking about a unique "backdoor" company that most people have never heard of before. Our research shows you can reap huge profits on this play right now - before BABA stock starts trading. Go here to learn more.