I believe McDonald's Corp. (NYSE: MCD) stock still has its best days ahead of it.

You won't hear it from the mainstream financial media, where a general sense of doom and gloom over the company seems to have settled in like a late summer thunder boomer because of a 3.7% downturn in global same-store August sales - the worst since 2003. Worse, that comes on the heels of a report showing global sales decreasing by 2.5% in July.

Naturally, this has generated a fresh wave of criticism. Millions of investors have evidently listened, judging from MCD stock's performance as the herd piles on - or "out," as the case may be. It's off 10% from a 52-week high set on May 2014. My personal favorite obituary came from a memo to clients from Janney Capital Markets, stating "That's Not Ketchup... It's Blood."

No doubt it's fashionable to pile up on McDonald's right now; truthfully, there are some troubling indications for the company's short-term outlook. But what's happening now is not the end of the world.

McDonald's stock still makes one heckuvan investment if you've got the right time frame. Subscribers who listened to me when I recommended it several years ago saw gains of more than 40% at the time of our strategic exit in August 2012. And those profits were made under circumstances very similar to today's - public ire and doubt.

So, at the risk of bringing back some of your most iconic childhood memories, let me explain to you why I'm lovin' it.

MCD Stock: A Slump from a Perfect Storm

When I see a sharp downturn in any trend - be it employment numbers, a stock's price, or a company's sales - one question immediately comes to mind: Is this based on the company's fundamentals... or are external factors at work here?

In the case of McDonald's, we can conclude the latter. It's not commonly known, but a geographically broad swath of the world's middle class eats at McDonald's. This makes the company's quarterly profits, and specifically same-store sales, a useful indication of how the world's middle class is powering consumer spending... or causing it to slow down during tougher times.

Two sharp, consecutive drops like we've seen in the last two months are clear signs to me that the world's middle class is feeling pinched, that the "slowcovery" that's been championed by Washington and central bankers around the world since 2010 still shows no sign of taking off.

So yes, it's a global slump. But with more than 40% of all McDonald's stores located in the United States, it's no surprise that a pinched American middle class is the main factor here. In the same time period, sales in Europe were down a mere 0.7%.

After a July meat-packaging scandal in Shanghai, China, August sales were down by 14.5% in the Asia Pacific, Middle Eastern, and African (APMEA) segments. But the U.S. market size dwarfs that of the APMEA's, making the global drop-off far closer to the 2.8% seen in America.

Now, while these trends are a problem for the company that will cost it billions of dollars in revenue this year, there's no reason to think that they're here to stay.

McDonald's is facing headwinds on two major fronts, but like most short-term market influences, they'll both stop blowing sooner or later. It was hurt terribly in Asia when Beijing, in response to the Shanghai meat scandal, enforced bans on imports of products processed by Husi Food Group, therefore suspending the sale of McDonald's chicken nuggets and chicken fillets in many Shanghai branches. Even worse, the scandal spilled over to McDonald's Corp.'s Japanese unit, because 20% of the meat for chicken items in Japan is supplied by Husi. With 3,000 McDonald's stores in Japan, that marked an enormous setback.

As for the struggling American middle class that affected 40% of MCD's revenue last August... this too shall pass. The worst may be yet to come (in fact, I say it will), but that's another story, too. At the end of the day, this company was founded in 1940 on the eve of WWII and has survived wars, recessions, and now the Financial Crisis. It's got plenty of staying power.

A Model for Success

McDonald's may have a U.S. presence that makes it vulnerable to turbulent times here, but that's rapidly changing. The company has undertaken - actually accelerated, to be more accurate - its international expansion both to grow and defend itself against U.S. economic troubles.

Just consider: McDonald's opened up 225 new stores in China in 2013 and is on track to open 300 more by the end of 2014. That's an increase of almost 15% in China this year alone. The company could open more than a 1,000 new outlets and still not achieve anything even remotely resembling the density it has here.

And the focus on China makes sense. A McKinsey & Co. report found that the number of people in China earning between $17,000 and $35,000 a year - China's middle class - is set to explode to more than 50% of China's populace by 2020. That's a more than 800% increase since 2010.

As has been the case in the United States, middle class customers are MCD's best demographic. The fact that McDonald's is expanding in China in such a serious way is an enormously bullish sign. Other regions are similar.

And it's just a fraction of the 1,500 new store openings that McDonald's has planned worldwide for 2014. It's a continuation of the "Plan to Win" laid out in a 2013 conference call by Chief Executive Officer Don Thompson. Thanks to this expansion, the company that serves 69 million customers a day will be able to serve even more.

Just Another Sign of Stability

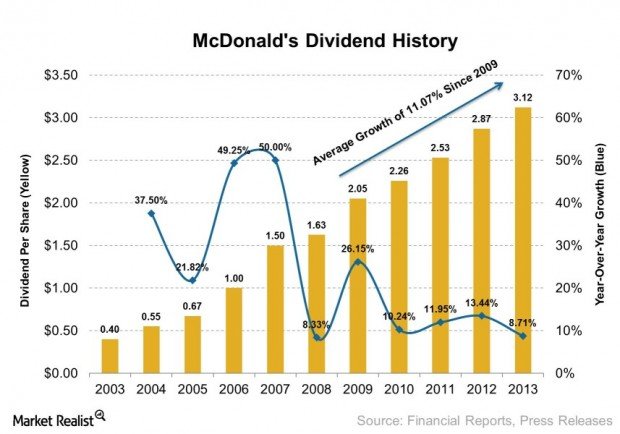

A lot of analysts wondered, in the aftermath of that bad Sept. 9 sales report, what McDonald's would do to reassure MCD stock investors. The answer was already apparent with a glance at the company's basic history: raise dividends.

McDonald's has raised its dividend every year since it began paying one out in 1976. Last Thursday, it announced a 5% hike, bringing its total dividend payout to $0.85 a share, payable to shareholders on December 15, 2014. This makes the company one of precious few worthy of your trust and secures its position as "Dividend Royalty."

All told, it will be paying out $800 million this quarter in the form of dividends... a remarkable feat for a company whose days are supposedly numbered.

I expect that McDonald's will turn the chapter on its sagging sales, perhaps even within the next quarter. That will be a great time to buy MCD stock and take part in its historic dividend.

In the meantime, investors who believe in "buy low and sell high" like I do should acknowledge the setbacks, accept them... and understand that they, too, will pass.

See ya at the Golden Arches.

More from Keith Fitz-Gerald: The Apple-istas aren't going to like this, but Apple - the once-proud brand with seemingly bulletproof profit margins - is in trouble. Here's why Alibaba stock (NYSE: BABA) is a better buy than Apple.

[epom]

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.