The mantra of "buy low, sell high" works for going long - but investors can make money from both sides of the trade if they understand these tips for short selling.

Billionaire investor George Soros, for example, famously made a single-day $1 billion profit in 1992 by shorting the British pound because he saw weaknesses in the currency's exchange rate fundamentals.

Billionaire investor George Soros, for example, famously made a single-day $1 billion profit in 1992 by shorting the British pound because he saw weaknesses in the currency's exchange rate fundamentals.

Even in today's five-year bull market you can join the likes of Soros and be rewarded handsomely through short selling. You can do this with currencies, exchange-traded funds, equities, and just about any asset.

Money Morning Chief Investment Strategist Keith Fitz-Gerald put together these tips for short selling success. It's important to understand these crucial factors before trying to profit from a short sale.

Short Selling Tip No. 1: Timing is key.

Timing really is critical when short selling, says Fitz-Gerald. He identifies short-sale candidates primarily from fundamentals, but waits to actually take action until signaled to do so by overall market action or specific technical indicators.

A technical trigger is important because it may take some time for the market to recognize fundamental weakness in a company - and even longer to actually give up on the stock.

Short Selling Tip No. 2: Action on the short side is much quicker than action on the long side.

As a short seller, you can generally expect far quicker results than you'd get on your long positions. Numerous market studies have shown that, on average, stock prices decline three times faster than they rise.

Even so, always be aware that a crash or panic sell-off isn't required for a successful short trade.

In many cases, a simple lack of news will be enough to quell buying interest and cause a price decline sufficient enough to produce a nice short-selling profit.

Here are three more short selling tips, for Money Morning members only...

[mmpazkzone name=“in-story” network=“9794” site=“307044" id=“137008” type=“4"]

Short Selling Tip No. 3: Short selling risks are often overstated and easily remedied.

Conservative advisors scare many clients away from short selling by claiming it has unlimited risk.

"When you buy a stock," they say, "all you can lose is the amount you paid because its price can't go below zero. But there's no limit to how high a stock's price can climb, and your short position will lose money all the way!"

This is actually false on two counts:

- You should never institute a short position without simultaneously entering a stop order to get you out if prices move too far against you. (Your own goals and risk tolerances will help you determine where to put the stop, but we recommend an absolute loss limit of 25% on short sales.)

- Your broker won't allow you to unwittingly lose more than your original margin deposit. If your equity in the position drops too low, you'll be asked to either cover your short or deposit more funds. (Don't!) If you do neither, the brokerage firm will liquidate your position to protect its own assets, since it must cover unsecured client losses.

Another risk is the "short squeeze."

Overpriced companies - even those with terrible fundamentals - can sometimes defy logic and move still higher. If they do so dramatically - perhaps even "gapping up" at the market open, traders who are short the stock may become fearful and put in panic "Buy" orders to cover their positions. This can push prices still higher, triggering protective stops, which can generate another gap, creating a new round of buying and perhaps even a self-generating uptrend - a classic "short squeeze."

There are two ways to avoid the short squeeze:

- Don't short stocks with "squeezable" characteristics, such as a high short-interest ratio, a small float, a low daily trading volume, strong bullish sentiment or advisory support, a record of past short squeezes, or a still-intact uptrend.

- Maintain strict discipline. Always use a stop-loss order, adjust it regularly as the stock price moves in your favor - and, if you see any of the conditions listed above, either tighten the stop or go ahead and take your profits.

Short Selling Tip No. 4: Be mindful of dividends.

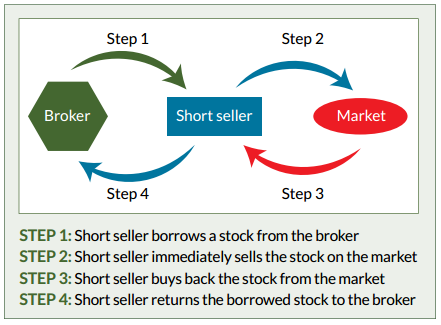

If the stock you sell short pays a dividend while your position is open, you must pay the dividend to the broker you borrow the shares from.

This might not be an issue because a company that pays dividends due to solid earnings will not make for a good short, typically.

On the other hand... if a company cuts or eliminates a dividend, it might be a stock worth shorting, since such a move almost always indicates deeper problems at play.

Short Selling Tip No. 5: Not every stock can be shorted.

As a rule, brokers will not allow you to short a stock priced below $5 a share (too much opportunity for monkey business in the penny stock ranks), nor will you usually be able to short stocks that are very thinly traded or that have too small a float.

In those two latter cases, it's too difficult to find shares to borrow, and the lack of shares means volatility will be high, increasing risks.

Want more on short selling? Money Morning members can check out our Absolute Beginner's Guide to Short Selling.

[epom]