The markets fell hard yesterday (Thursday), in the biggest one-day drop so far this year.

Traders kept their fingers on the sell button pretty much all day. The Dow Jones Industrial Average tumbled 335 points, the much broader S&P 500 Index got shellacked 41 points, and the tech-laden Nasdaq lost 90 points.

Yet this is NOT a "run for the hills" moment.

Instead, it's a fantastic short-term trading opportunity.

Reversals usually are. They result in a fundamental change in the pricing assumptions that otherwise propel prices higher. Most of the time they're the result of changes in some fundamental catalyst like interest rates, Fed notes, or, in this case, the IMF's report that global growth will only hit 3.3% this year.

So what do you do?

There are a lot of ways you can profit when the markets change direction. In fact, the menu of choices makes ordering designer coffee seem positively simple. There are shorts, leveraged inverse funds, spreads, derivatives, and futures contracts with all kinds of exotic names (though most are simply ways to separate you from your money).

If you want simple protection that you can "set and forget" as an investor, consider buying a fund such as the Rydex Inverse S&P 500 Strategy Fund (MUTF: RYURX). It's an inverse fund that tracks the S&P 500 and rises 1% for every 1% the index falls. Studies suggest that having 2% to 5% in a choice like it can not only dampen overall portfolio volatility, but hedge the income stream and principal value of your investments at the same time.

It's so effective that I advocate keeping a permanent allocation to inverse funds for just these kinds of market conditions. That way you're never caught by surprise.

But if your goal is quick profits, get ready to make this trade instead...

If you're more aggressive, I believe you can get the biggest bang for your buck - and take on the least risk - buying cheap, out-of-the-money put options.

Buying puts is one of the most conservative options strategies there are.

It's basically a bet that prices will go down by a certain amount within a certain time frame. They're a great tool because put buyers profit as the underlying stock or index falls. That's what makes them a great tool for reversal trading, especially now with the markets coming out of nosebleed territory.

Reversals are very, very rarely anything more than a short-term adjustment, and that's precisely how you should consider trading this one. If your core portfolio is lined up with an appropriate mix of unstoppable global trends, then allocating a portion of your money to profiting from them is logical in the pursuit of higher profits.

Contrary to what people believe, trading reversals successfully is NOT about timing. It's more about picking logical points at which the markets will be stressed.

If you want to play along, here's what I suggest.

How to Trade After a Market Reversal Using SPY Put Options

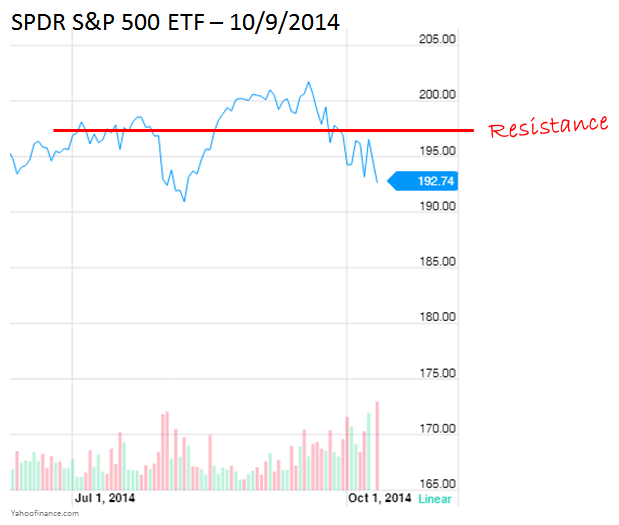

A quick look at the chart of the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) - an ETF proxy for the S&P 500 Index - tells me that any rebound bounce, if we get one, will run into "resistance" at 196.98. Take a look:

So 197 is a logical point to make a stand and place a trade. It's a high probability price point for another tradable short-term reversal.

If you want to have a go, consider buying the SPY January 2016 197 put options (SPY160117C00197000) if the SPY breaks above 197 and falters. That way you're not jumping the gun, nor are you at the mercy of other traders. Patience is a big part of successfully trading reversals - that's why I chose options with a 2016 expiration date. So you have plenty of time to let this trade play out.

Exit the trade if the index doesn't stall and start to retreat within either three days or 25 points, whichever comes first. My suggestion is that you allocate no more than 2% of overall capital to any single position. That way you'll live to trade another day... and so will your money.

Let me give you a recent example of how this kind of trade works.

Back in June, the SPY was trading at 194. Volume was very light and I believed a pullback was very likely.

I saw that there was "support" (definition of both support and resistance here) at 190 or so, which told me that was the next logical stop if the markets temporarily lost their mojo. I also saw that the markets took roughly four weeks to climb to where they stood at the time.

It wasn't a stretch to imagine that any short-term reversal would take us over the same ground by July, nor that the resulting short-term angst would potentially provide a faster path to profits.

Under the circumstances, SPY July 2014 $190 puts were a good place to start. According to Yahoo! Finance, they closed that day at $1.33, or $133 per contract. That means an investor with $2,000 to risk could purchase roughly 15 put contracts, excluding fees. If the markets fell, put prices would shoot higher as a function of the pricing of the S&P 500 Index itself and volatility, which almost always expands as a result of falling prices.

Two down days in a row later, that's exactly what happened. Madness in Iraq had spooked traders, and short-term fear propelled the SPY July 2014 $190 puts to $2.13, for a quick 60.15% gain in two trading sessions. That works out to a $1,200 gain on $2,000 invested (assuming the same 15 contracts).

Not bad for a day's work, eh?

Not every trade is a winner, obviously, but if you time your trades correctly, the downside risk pales in comparison to the potential returns individual investors can achieve.

Three Key Takeaways on This Tactic

- First, if you're not familiar with options or flat-out refuse to learn, you can always buy the RYURX as a fallback. But I really urge you to consider them. Old dogs can learn new tricks.

Options can be a powerful adjunct to your core investments. They can juice your profits, get you into a stock you like at a discount, or even reduce your risk. They don't have to be complicated, either. In reality, if you've ever made a down payment on a house, used an escrow account, or even put something on layaway, you've already used a form of option. Now for the caveats - you knew these were coming and, truth be told, I would be incredibly remiss not to mention them.

- Second, you will need to get approval from your broker to trade options of any kind. I know that sounds funny given that it's your money at risk, but your brokerage firm has to know what its exposure is nightly when it marks every position it's responsible for to market - including yours.

Approval isn't difficult to get, but it may take a few days. You'll submit a series of forms after answering questions related to your risk tolerance, goals, and assets. You'll also be required to receive and be responsible for reading the Characteristics and Risks of Standardized Options, which either your broker will provide or you can get on your own through the Options Clearing Corporation.

- Finally, about risk - perhaps the most important part of any trade. When I talk about options, I am talking about them being used as a complement to the rest of your investments. In that sense, they're no different than buying shares of your favorite speculative tech company - you can invest a few hundred bucks with the possibility of huge returns.

You just have to keep the risks in line with your own financial appetite. I have no way of knowing what that is, so this is a discussion that's between you and a financial professional. Many professional traders limit a single position to no more than 2% of total capital as a Rule of Thumb. Betting the farm is a dumb move. But that's getting ahead of myself as "trade sizing" is an entire discussion unto itself - and we'll cover it in depth in a few weeks. So I'll save it for another time.

My suggestion is that you strictly limit your options activity until you get comfortable with how they work. If needed, open a separate account just for options. Paper trade first - meaning chalk up your wins and losses on an old fashioned yellow pad until you get the hang of it. That way you're not tempted to take on more risk than you can handle.

By the way, there can be a lot more to options, and I've only scratched the surface today. That's why I want to share this FREE options primer from Money Morning, "The Power of Options." Download it immediately by clicking here.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid=""]

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.