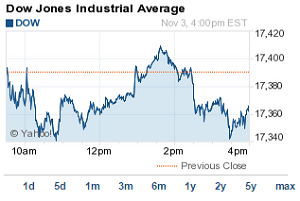

Dow Jones Today: U.S. stock markets were mixed on Monday, although the Dow Jones and S&P 500 hit intraday records during today's session. The market seems content to await the results of Tuesday's midterm elections and the upcoming October unemployment report on Friday. Energy stocks took the biggest hit as oil prices slumped yet again. The S&P 500 Volatility Index (VIX), the market's fear gage was up more than 5.5%.

Dow Jones Today: U.S. stock markets were mixed on Monday, although the Dow Jones and S&P 500 hit intraday records during today's session. The market seems content to await the results of Tuesday's midterm elections and the upcoming October unemployment report on Friday. Energy stocks took the biggest hit as oil prices slumped yet again. The S&P 500 Volatility Index (VIX), the market's fear gage was up more than 5.5%.

Let's take a look at today's scorecard.

Dow Jones: 17,364.24 -23.28 (0.13%)

S&P 500: 2,017.48 -0.57 (0.03%)

Nasdaq: 4,638.91 +8.17 (0.18%)

What moved the markets: The markets gained some support from the recent announcement by the Bank of Japan to accelerate its own massive bond-purchasing program to stave off deflation. However, disappointing economic data from the Eurozone and China weighed on the markets this morning. The Eurozone's final October PMI reading registered at 50.6, missing consensus estimates of 50.7. Meanwhile, China reported weaker-than-expected numbers in its service sector, and it registered a five-month low in its October PMI level. Energy stocks also dragged down the Dow as oil prices slid again.

Most notable economic news: Updates on manufacturing and construction dominated the news. The Markit Manufacturing report offered a final October reading of 55.9, its lowest figures since August. Still, the October reading from the Institute for Supply Management index hit 59.0, a strong gain from September's 56.6 level. Meanwhile, U.S. construction spending in October fell by 0.4%, a rather heavy miss from the expected 0.7% level of growth.

Here's a breakdown of today's other top stories and stock performances:

- Oil Slumps Again: December futures on West Texas Intermediate oil, the U.S. benchmark priced in New York, closed below $78.50 on the day. This is the first time that U.S. oil prices slipped and closed at this level since June 2012. Global oil prices are under intense pressure as the dollar continues to soar against rival currencies and Saudi Arabia prepares for another possible slash in prices. Multinational oil companies took the biggest hit from the decline. Shares of Chevron Corp. (NYSE: CVX) fell by nearly 3%, while drilling giant Diamond Offshore Drilling Inc. (NYSE: DO) saw shares fall by more than 6%.

- Apple Hits New Record: Shares of Apple Inc. (Nasdaq: AAPL) hit yet another record today, rising 1.1%. The stock hit a new intraday high of $110.30 on news that the company is considering issuing dual-currency or euro-denominated bonds. The tech giant is looking to take advantage of record-low borrowing costs in Europe. If The Wall Street Journal report is true, this would be the first time that Apple has issued bonds in any denomination that isn't the U.S. dollar. The company's valuation soared past $640 billion.

- Merger Mania: Shares of Covance Inc. (NYSE: CVD) soared more than 25% on news that it will be acquired for $6.1 billion by Laboratory Corp. of America Holdings (NYSE: LH). Shares of Laboratory Corp. slipped by more than 7.5% on the news.

- Car Problems: Shares of General Motors Co. (NYSE: GM) slipped more than 0.6% on news that the company missed October sales estimates by 5,000 vehicles. Overall, sales of the nation's six largest auto companies increased 6% in October 2014 compared to the same period a year ago. Shares of Ford Motor Co. (NYSE: F) also slipped 1% on the day after the company announced reduced production of its best-selling F-150.

- Daily Decliner: Shares of The Home Depot Inc. (NYSE: HD) slipped more than 1.3% on news that the stock received a downgrade to hold from Raymond James. This is a blow for the company after it saw strong earnings during its last report on August 19.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

- How to Profit from a Stronger U.S. Dollar: The Federal Reserve plans to wind down its asset purchases this month, but Japan and the United Kingdom are still buying, full swing. Meanwhile, the European Union is just looking to get started with its stimulus efforts. That's sent the U.S. dollar into a major run up, with the euro and yen on the losing side. This adds up to a global currency conflict. And our resource expert Peter Krauth, a 20-year commodity guru and portfolio advisor, has identified a very rare, very lucrative opportunity...

- How to Profit from Unrest in Hong Kong: Most investors haven't got a clue about what Hong Kong's riots represent, let alone the investment potential that's being unleashed there. As a result, they're going to miss out on some really terrific profit opportunities. But before we get to the best way to play this, understanding what's driving the unrest is our key...

- How to Get a Piece of Wall Street Profits Without the Wall Street Corruption: There's simply no limit to how far Wall Street will go to make a buck. It's no wonder. With corporate offenses and "bad behavior" routinely going unpunished, perpetrators have developed a sense of immunity. But we can strike back against banks that are behaving badly. And here's how we're going to play a non-bank investment against a rigged services industry...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.