Many investors trying to figure out what stocks do after midterm elections have focused on whether the Republicans will take enough seats in the Senate to gain the majority.

The Republicans are heavily favored to take the Senate. But it won't make much difference.

You see, when it comes to what stocks do after midterm elections, it's best to look beyond what might happen this week or next and instead take a long-term view.

You see, when it comes to what stocks do after midterm elections, it's best to look beyond what might happen this week or next and instead take a long-term view.

History gives us a lot of reasons for optimism.

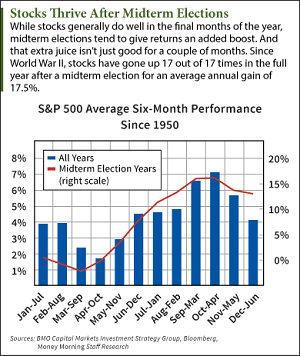

First of all, the November-April period is the best season for the market, midterms or no midterms. On average, the Standard & Poor's 500 index has risen 7.1% in this period.

But midterms have been a turbocharger, more than doubling the average return to 15.3%. And that midterm boost has been remarkably consistent, occurring 94% of the time.

The real surprise, though, is the impact of a midterm election one year out.

"If you wait 12 months, meaning October to October in that third year [of a presidency], the market has risen 17 of 17 times since World War II, gaining an average of 17.5%," S&P Capital IQ's Sam Stovall told Yahoo! Finance.

That's not as odd as it might seem.

"Stocks have rallied post-election regardless of the political outcome... suggesting that the elimination of uncertainty and an end to the political rhetoric is constructive for the markets," Carmine Grigoli, chief investment strategist at Mizuho Securities USA, told USA Today.

And while the stock markets will do well no matter who wins, a Republican win does add a bit more spice to the mix.

Since 1945 the combination of a Democratic president with a unified Republican Congress has yielded better stock returns - 15.1% - than any other variant.

So history is on the side of the markets in more ways than one. But it's not the only element working in favor of higher stock prices...

What Stocks Do After Midterm Elections: Beyond the Numbers

Having the Republicans in control of both houses of Congress could help ease some of the gridlock in Washington.

With full control of Congress, the GOP needs to prove it can do more than just harass Democrats. The Republicans will actually need to govern to have any hope of consolidating their gains in 2016.

That gives them an incentive to come up with solutions for improving the economy - as well as to cooperate with President Barack Obama.

And even if the GOP can't do that, at least they're likely to avoid the kind of foolish grandstanding that the markets hate. You know, like shutting down the government.

And even if the GOP can't do that, at least they're likely to avoid the kind of foolish grandstanding that the markets hate. You know, like shutting down the government.

Money Morning Chief Investment Strategist Keith Fitz-Gerald agrees that a cohesive GOP plan would indeed bolster stocks. But he sees another near-term catalyst for the markets as well.

"There's a lot of fund managers that have got to chase performance. So if they want to keep their jobs and get their bonuses they've got to be buying coming into the end of the year," said Fitz-Gerald, a seasoned market analyst with 33 years of experience.

Sure enough, hedge funds were up just 3% over the first three quarters of the year. That's well below the 8.33% gain of the S&P 500 over the same period.

It means fund managers have a lot of catching up to do. And all that money pouring into the market will help drive stocks higher.

The bottom line: Given the history of what stocks do after midterm elections - combined with other tailwinds - investors need to stay in the market.

The Book Washington Doesn't Want You to Read: Elections can change who's running the show in our nation's capital, but some problems - like wasteful government spending - never seem to get better. Oklahoma Sen. Tom Coburn found $25 billion worth of wasted taxpayer dollars. Be sure to take your blood pressure pill before you read this...

Follow me on Twitter @DavidGZeiler.

Related Articles:

- Marketwatch: A Breakdown of How the Market Performs After Midterm Elections

- Yahoo! Finance: Bulls Set to Win Midterm Election

- USA Today: November Starts a Great Stretch for Wall Street

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.