Silver prices this month may run into trouble.

Silver prices this month may run into trouble.

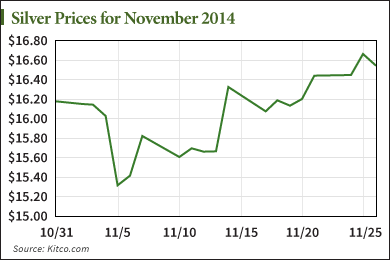

This is after a short-lived November boost.

Silver spot prices were up $0.37 an ounce last month. This was good for a 2.3% gain to $16.54 going into the Thanksgiving weekend.

This morning (Monday), those gains were all but erased before shooting back up, highlighting just how volatile silver has been. Silver prices had dipped below their October close of $16.175 an ounce before heading back up to above $16.40.

November's gains are still a good sign, despite these violent price moves to start December.

Commodities are falling across the board. Just look at crude oil.

Silver's no exception as sentiment is almost unreasonably bearish on the white metal. It's a welcome change for silver to turn in at least one productive month.

Silver's 2.3% November gain comes after the following tallies in the four months prior:

- -4.7% for July

- -12.8% for August

- -4.5% for September

- -2.8% for October

In this span, silver prices fell almost 23%, from $20.96 at the end of June. That makes even a slight gain (and even this morning's slight decline) a much more welcome change.

Silver is always a good investment. It is a good portfolio hedge, and will get a boost from market panic as the top stocks take a hit.

But silver prices could continue to see downward pressure. December is likely to produce a lot of headwinds that will keep a lid on any substantial gains.

Money Morning Resource Specialist Peter Krauth said $12 silver is not a stretch.

Here's what will be affecting silver prices in December:

Silver Prices in December Face Historically High Bearish Sentiment

Speculators are holding a lot of silver short right now. The total: about 225 million ounces. While not at the 260 million ounce record touched in October, the numbers are still historic. This puts selling pressure on silver. At these levels, silver will not be able to break out of this sell-side sentiment and rally. The good news: speculators have shed almost 33 million ounces since its peak. This could signal a massive short covering, which would boost prices considerably either to end 2014, or beginning next year.

Money Morning members - keep reading to get the next two factors affecting silver prices in December...

Soaring Markets to End 2014

The rise in the broader markets is going to rob silver of safe-haven demand. This generally helps silver rise as markets fall. And momentum will be in the Dow's favor as we close out the year.

The Dow Jones Industrial Average at one point declined 7% in October. Even so, it has continued to reestablish new highs. Last week, it hit record close No. 30 and 31. It closed out Black Friday at 17,828.24.

A Dow at 18,000 is right around the corner.

Many hedge funds that have thus far underperformed the markets are going to be clamoring for end-of- year gains. Also, there aren't any real headwinds in the broader market to keep this momentum from subsiding. Look at this end-of-the-year rally to keep silver prices from gaining any substantial ground, at least until the end of 2014.

Rising Dollar Value

When the dollar's value is up, inflation-minded investors flee the silver market and there are fewer opportunities for silver price gains. And at the moment, the dollar is very strong. It has been pushing up against five-year highs as the U.S. Federal Reserve begins to climb down from its more six years of monetary easing and preps for rate hikes, all while the Eurozone prepares for the opposite, and the Bank of Japan has called for even more central bank stimulus.

All these factors taken together will boost the dollar's strength. Central bank action, however, is not likely to actually spark inflation if the funds being poured into the system aren't being lent out, and with consumers and businesses still paying down debts, there's a good chance that all this central bank money printing will not spark inflation as the Eurozone and Japan want. That means all of the dollar strength is coming from investor expectations that will likely not pan out, and when the markets do catch wind of this, you can expect the dollar to retreat from its new highs. That may take a while.

More on Precious Metal Investing: Gold prices have been down with silver prices lately, and so too have the world's top precious metal miners. But these miners may be oversold as a result, and that's why this particular company was last week's "Unloved Pick of the Week..."