"They couldn't possibly be that stupid"...

That's what my friend John, a London-based trader, said when I called him to verify that he saw what I was seeing on my own trading screens here in the wilds of Oregon.

It was Tuesday morning, November 4, and nearly everything in the energy complex was red.

November West Texas crude oil had dropped to $87.31/barrel, while Brent crude oil set a new two-year low at $91.53. Prices have since dropped to four-year lows of around $75 and $78, respectively.

They could fall even further - all because Saudis started another oil price war.

OPEC's largest oil producer had just announced that they were cutting oil prices for customers in the United States. The idea is to squeeze margins on U.S. shale production to where it's not profitable to produce.

Naturally, the Saudis fiercely deny the notion of a price war. But you don't have to be a genius to read between the lines.

The Saudis are very frustrated that they are losing control over pricing power they've held for decades. It's annoying them to no end. So, they're fighting back the only way they know how in an attempt to shift the balance back in their favor - by starting a price war with the United States. Unbelievably, they think they can win!

My take is that the Saudis have just made the biggest strategic "pricing error" in the kingdom's history. And, in doing so, they've actually cleared the way for America's shale energy boom and opened up a killer opportunity for this month's recommendation in particular.

The Saudis Just Picked a Fight They Can't Win

In the late 1980s, the House of Saud brought the rest of the world to its oil pricing knees by increasing output and lowering prices to the point where global producer profitability got crushed.

At the time, they dropped prices so low that even North Sea producers like BP Plc. (NYSE ADR: BP) and Statoil ASA (NYSE ADR: STO) felt their wrath. Profitability vanished because nobody in the global energy complex had enough capacity to offset their actions.

This time around, we've got shale oil.

Like generals who are prepared to fight the last war, Saudi ministers have totally underestimated the impact of this development. They believe that U.S. producers will fail and buyers will come a-running if they jack output and drop prices below $90/barrel. What they're missing is that the cost of shale oil production is already lower than that... and getting lower all the time. The latest data from U.S. producers suggests that they can operate profitably at $65-$69/barrel and that the threshold is dropping daily as production technology improves.

That's because the majority of U.S. shale oil producers have hedged oil prices, already contracted rigs, and long ago written down the cost of the acreage they need to drill.

In reality, U.S. shale oil production will climb for years to come and is now the world's "swing capacity" - meaning it can influence marginal oil pricing that used to be the Saudi's weapon of choice to increase or decrease prices almost at will.

Interestingly, I've seen very little written about this in the press, save one report from Citi. It notes that shale production costs could be "in the significantly lower band of $37-$45/barrel." My own take is that even $30 may not be out of the question.

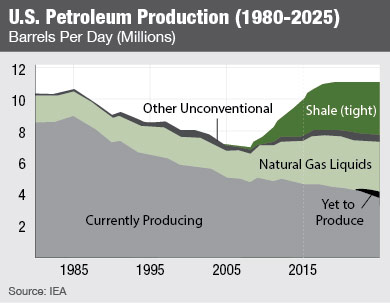

This chart shows the extent of the Saudi miscalculation.

See that big, dark green hump up to the right? That's U.S. shale.

Output hit a record 12 million barrels/day for the first time in October, even amidst prices tumbling. Production can climb for years to come and the more the Saudis posture, the faster U.S. producers will react.

The other thing to consider is a data point from the IMF. That agency estimates that Saudi Arabia needs oil prices to average $89/barrel to balance their budget. Essentially, that means the Saudis are punishing themselves. The country cannot withstand a long-term drain on its finances. Other OPEC producers are going to fare even worse.

The other thing to consider is a data point from the IMF. That agency estimates that Saudi Arabia needs oil prices to average $89/barrel to balance their budget. Essentially, that means the Saudis are punishing themselves. The country cannot withstand a long-term drain on its finances. Other OPEC producers are going to fare even worse.

It's gonna be painful for them...

And profitable for us.

The "Tollbooth Model" That Collected $74 Million Last Year

Most investors are going to try and play that by buying shale exploration and drilling stocks, but those companies are still tied to the price of oil. No doubt there will be big profits to come, but the journey is going to be bumpy if the price of oil keeps dropping.

The better way to play this is to buy into so-called midstream assets.

These are the companies responsible for gathering, processing, and piping oil around the country. They're like toll highways. You dump crude in one end of the network, transport it, and unload it at the other, and they collect the "toll." The actual price of the crude and natural gas being carried is largely moot.

Most of these things are structured as Master Limited Partnerships (MLPs). These are great for investors, because they offer both the liquidity of a common stock and the tax benefits of a limited partnership. Most pay very high income to boot.

My favorite at the moment is FISH.

Buy This Boutique Midstream Player

Marlin Midstream Partners LP (Nasdaq: FISH) is a $300 million small-cap with highly concentrated assets and operations in Texas, Wyoming, and Utah. Of its $74.59 million revenue in the last year, approximately 75% comes from natural gas and 25% from crude oil.

A lot of players emphasize scope and scale. But in this case it benefits you to go after a boutique player that targets smaller projects:

- Those are profitable projects that the bigger competitors can't be bothered to pursue.

- That's where the most attractive margins will be as the Saudi situation unfolds.

Already, FISH has a profit margin of 29.05% - almost 6x better than the industry average of 5.7%. And that's just one way it's crushing the competition.

Return on equity is 13.84%, versus only 11.50%. FISH carries very little debt too, with a debt-to-equity ratio of 7.02, versus 131.61. One more point: FISH sports a trailing P/E ratio of 10.87. So it's very undervalued compared to the average industry P/E of 75.00 - yes, you read that right. Best of all, the yield is an appealing 8.30% right now.

There are two potential drawbacks, but neither is a show stopper in my opinion.

First, average daily volume is only 45,000 shares over the past three months. So the stock can be jumpier than the bigger, better-known, more liquid MLPs. To me, though, this just means there are more low-price buying opportunities at times like this.

Second, FISH operates using a series of shorter-term contracts, many of which have yearly renewal clauses. So there may be some volatility in upcoming cash flow. However, I'm willing to overlook that, because I don't think it will impact dividends. The payout ratio just hit 83%.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.