Last week's OPEC meeting in Vienna, Austria, was billed as the most important gathering of the cartel in years, with huge implications for crude oil prices.

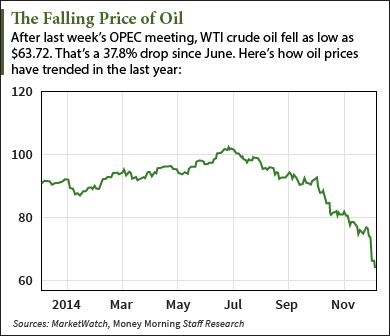

The meeting's importance was felt almost immediately. After OPEC nations announced they would not cut oil production, oil prices plummeted.

WTI crude oil hit a low of $63.72 per barrel this week. That's a drop of 37.8% since June. Brent oil tanked too, hitting a five-year low after the meeting. The global benchmark traded below $72 per barrel today (Tuesday). That's about 40% lower than its June price.

As Money Morning pointed out before the meeting, maintaining production was the most likely outcome of the OPEC meeting.

As Money Morning pointed out before the meeting, maintaining production was the most likely outcome of the OPEC meeting.

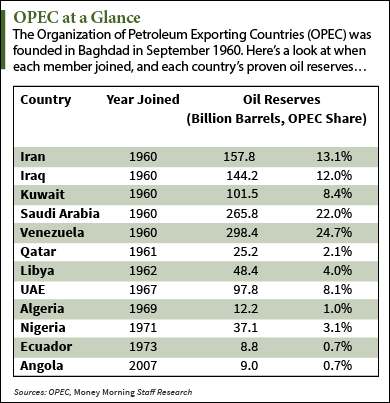

Not all of the OPEC members want production to remain high, however. Several countries like Venezuela and Iran have called for production cuts. But Saudi Arabia, the largest OPEC exporter, refuses to budge. The Saudis are content to let prices fall much lower in an attempt to curb U.S. shale oil production.

But according to Money Morning's Global Energy Strategist Dr. Kent Moors, this is a losing strategy for the Saudis. In fact, Moors is in Dubai this week stressing this point to some of the world's top oil policy makers.

"With all the attention being accorded to U.S. shale and tight oil, the argument that American production is responsible for the pricing problem is a bit disingenuous," Moors said. "As I've recently noted, the impact of shale at the moment is limited to its effect on American imports."

"The export of crude from the U.S. is still prohibited," he continued. "However, U.S. reliance on OPEC imports has been waning for years. Given the new-found economic impact of oil production back home, I quickly pointed out that the OPEC decision will likely give the new Congress added impetus to liberalize the very exports the cartel fears."

Therefore, U.S. oil producers are unlikely to curb production in order to raise prices. It's an oil price war in which everyone involved refuses to blink.

Therefore, U.S. oil producers are unlikely to curb production in order to raise prices. It's an oil price war in which everyone involved refuses to blink.

And because of that, investors should not expect a major rally in oil prices any time soon. Until someone cuts production levels, the price of oil will remain low.

"The physical crude oil market is well supplied and that oversupply will last into the second quarter of next year," Petromatrix's Oil Analyst Olivier Jakob told Reuters. "The market is trying to find some equilibrium level."

For investors wondering what to do with their oil stocks, here's the strategy that Moors recommends now...

How to Play Oil Stocks Now

Because of falling oil prices, investors have been fleeing the energy sector for months. And big name oil stocks have gotten crushed.

Major fracking companies like Continental Resources Inc. (NYSE: CLR) and Whiting Petroleum Corp. (NYSE: WLL) have dropped 51% and 58% since September. Even major oil conglomerates like Exxon Mobil Corp. (NYSE: XOM) and Chevron Corp. (NYSE: CVX) are down 10% and 15% from summer highs.

And despite strong financials and production numbers, many of these oil stocks will continue lower as prices stay down. They may be trading at discounted prices, but now is not the right time to buy back in.

"This is the time of year investors prune portfolios for tax purposes," Moors said. "OPEC just pushed our hand a bit with its decision (or its failure to decide, depending on how you look at it) on production levels."

"Of course, the energy sector has been weakening for several weeks with the cartel merely providing a reason for an expanded sell-off," he continued. "As I have mentioned several times, this is now a very oversold sector. However, until the dust settles, we need to take a conservative view of moving back in.

"The overreach beyond oil has been remarkable and largely unjustified given the fundamentals involved. But emotional market swings tend to paint with very broad brushes."

This is why Moors typically suggests investors use 30% trailing stops from a stock's highest value. It ensures most of the losses on oil stocks are mitigated.

Moors said a bottom is developing that will allow for oversold shares to recover - and investors will want to take advantage of that. Stay tuned to Money Morning for those opportunities.

More from Dr. Kent Moors: Whenever oil prices drop, everyone always wonders how it will affect wind and solar power. But the landscape for renewable energy has changed significantly in recent years and oil prices don't have the same impact. Here's why lower oil prices won't kill the renewable energy boom...

Related Articles: