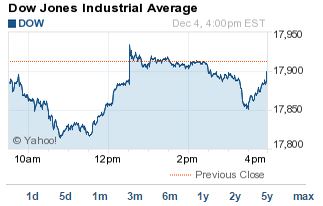

The Dow Jones today slipped 12 points, retreating from yesterday's record high. The markets were weighed down by weak job figures and news the European Central Bank won't explore stimulus efforts until January. Volatile oil stocks also dragged down the S&P 500 and the Dow Jones.

The Dow Jones today slipped 12 points, retreating from yesterday's record high. The markets were weighed down by weak job figures and news the European Central Bank won't explore stimulus efforts until January. Volatile oil stocks also dragged down the S&P 500 and the Dow Jones.

Today's Scorecard:

Dow: 17,900.10, -12.52, -0.07%

S&P 500: 2,071.92, -2.41, -0.12%

Nasdaq: 4,769.44, -5.04, -0.11%

What Moved the Markets Today: European Central Bank President Mario Draghi said this morning the bank will not engage in speculation for more financial stimulus until January. Draghi said falling oil prices could affect the bank's goal of boosting inflation. Gold prices for February delivery retreated on the news, remaining just above $1,200 per ounce. Meanwhile, U.S. weekly jobless claims narrowly missed consensus expectations, but still fell below the 300,000 mark.

Now check out the day's most important market notes:

- Up in the Air: U.S. oil prices ticked downward on news Saudi Arabia would sustain on falling prices. Brent prices slipped below $70 per barrel, while West Texas Intermediate prices were down to $66.78 on the day. Falling oil prices continue to benefit U.S airline companies, particularly those purchasing at spot prices. Shares of Delta Airlines Inc. (NYSE: DAL) were up nearly 4% on the day; United Continental Holdings Inc. (NYSE: UAL) rose more than 4%, and American Airlines Group Inc. (Nasdaq: AAL) jumped 2.9%.

- Dining Dynasty: Shares of GrubHub Inc. (NYSE: GRUB) fell 5.63% on the day on news that Amazon.com Inc. (Nasdaq: AMZN) is launching its own local delivery service. Amazon's delivery service will be available through the Amazon Local app and website and will partner with restaurants in certain cities across the country.

- Retailer Rout: Shares of Sears Holdings Corp. (Nasdaq: SHLD) slipped more 4% on news the company reported a $548 million loss and plans to close 235 stores. Despite the downturn, the company assured investors it has enough money to cover current obligations. Meanwhile, the world's largest retailer Wal-Mart Stores Inc. (NYSE: WMT) had been one of the largest drags on the Dow for the day. The stock rallied back from session lows to fall just 0.2% on the day.

- We're Number Two: In a surprise announcement this morning, the International Monetary Fund said the United States will no longer be the world's largest economy. According to a report released today, China has surpassed the United States in terms of economic output in "real" terms of goods and services. China will hit $17.6 trillion in real output compared to $17.4 trillion from the United States. However, Americans still have significantly higher purchasing power than their economic rivals do, challenging the importance of the IMF's report.

- Book Bailout: Shares of Barnes & Noble Inc. (NYSE: BKS) dropped 5.44% on news it has ended a deal with Microsoft Corp. (Nasdaq: MSFT) over its e-reader and digital content division. Barnes & Noble said it bought out Microsoft's share in Nook Media LLC. BKS now plans to spin off the digital business, which it initially formed to target Amazon.com Inc.'s Kindle business. Shares of Microsoft increased more than 1.5% on the day.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

- This Country's Huge "Pricing Error" Will Send These Shares Soaring: The Saudis are very frustrated about losing control over pricing power they've held for decades. It's annoying them to no end, in fact. So, they're fighting back the only way they know how to shift the balance back in their favor - by starting a price war with the United States. But Money Morning Chief Investment Strategist Keith Fitz-Gerald says they've made the biggest strategic "pricing error" in the kingdom's history. And in doing so, they've actually cleared the way for America's shale energy boom and opened up a killer opportunity for one company in particular.

- One Stock That Will Profit from a New, Breakthrough Medical Direction: Modern medicine, for all of its sophisticated drugs, complex gadgets, and amazing surgical procedures, rarely cures anything. It treats. It manages. It postpones the inevitable. But return a patient to normal, optimal health? Rarely. So when an innovation comes along that can effect a complete and permanent remission of disease or restore damaged organs to a pristine state, it should cause your keenest investing instincts to perk up and pay attention...

- How We'll Play the 2014 Year-End Rally: Stocks are headed higher through year end for many reasons, but one in particular is telling. It's really simple, yet too many people have overlooked it. Indeed, most wouldn't even give it enough thought. And that would be a big mistake. As Money Morning's Shah Gilani explains, if you understand that one compelling reason, you can pick some winners - and pocket big profits - yourself.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.