Wearable Tech Stocks 2015: Expect a lot of major developments in wearable technology this year as the big tech companies fight for turf in this rapidly growing market.

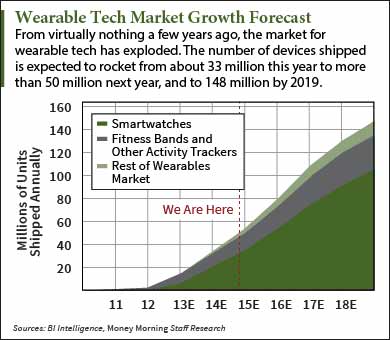

BI Intelligence estimates that sales of wearable tech devices will rise from about 33 million units shipped this year to over 50 million in 2015. From there, BI says the wearable tech market will nearly triple by 2019, to 148 million units.

But getting there will come in fits and starts. Much experimentation will mark the 2015 wearable tech market as companies try to figure out what customers will wear - and buy.

But getting there will come in fits and starts. Much experimentation will mark the 2015 wearable tech market as companies try to figure out what customers will wear - and buy.

We've already seen Google Inc. (Nasdaq: GOOG, GOOGL) stumble with Google Glass. Critics slammed the pioneering device as too expensive ($1,500) and just plain dorky.

Worse, those who wore the device in public were often harassed by people afraid it could be used to secretly record them.

Likewise, most of the smartwatches so far have flopped. Customers were unimpressed by bulky devices with poor battery life that offered hardly any benefit over smartphone capabilities.

But companies are determined to succeed as there is much money to be made. Juniper Research has forecast that sales will reach $19 billion by 2018.

Most of the first wave of wearable technology has failed because the devices didn't solve any unmet need, or create a better way to deal with all the data that swamps us every day.

That will start to change in 2015...

Wearable Tech Forecast 2015: How Companies Can Succeed

PricewaterhouseCoopers LLP put out a report in October with several great tips for how to succeed in the wearable tech business. It's a blueprint for success in the wearable market.

PwC asked 1,000 consumers not just what they thought of wearable tech, but what they want it to do for them.

What they found is that people want wearable technology to do more than just provide more data. They want devices that make it useful.

"[Consumers] want wearable devices that not only turn data into insights, but also help them turn insights into decisions and actions," the PwC report said. "This is the opportunity for wearable tech makers, and for enterprise. If they learn to equip consumers with the right information at the right time, yielding actionable insights that can be integrated into experiences and become part of the solution, they can radically alter - and improve - the landscape of business, entertainment, health, and more."

"[Consumers] want wearable devices that not only turn data into insights, but also help them turn insights into decisions and actions," the PwC report said. "This is the opportunity for wearable tech makers, and for enterprise. If they learn to equip consumers with the right information at the right time, yielding actionable insights that can be integrated into experiences and become part of the solution, they can radically alter - and improve - the landscape of business, entertainment, health, and more."

Business is a huge opportunity.

In retail, for example, a wearable device for employees could negate the need for checkout lines as well as improve customer service. In fields like manufacturing and medicine, wearable devices could serve as specialized tools to streamline procedures and provide ready access to data.

The companies that best address these needs will win - and reward their investors.

Here's a breakdown of the top contenders in wearable tech and what they will deliver in 2015...

Wearable Tech Stocks 2015: What to Expect from the Tech Titans

While smaller companies like Pebble, Fitbit, and Jawbone have had some success in wearable technology, in the long run the tech titans will dominate.

If the big players can't figure out how to make winning products, they'll buy up the smaller companies that do.

The major tech companies also have the advantage of brand recognition. The PwC report asked consumers to rate how excited they'd be to buy wearable tech from each tech company. Apple Inc. (Nasdaq: AAPL) topped the list, with 59% saying they'd be very or somewhat excited. Google had 53% and Microsoft Corp. (Nasdaq: MSFT) 51%.

Here's what they're working on:

- Apple Inc. (Nasdaq: AAPL): The Apple Watch is expected to be the product that ignites the wearable tech market because, well, that's what Apple is known for. Announced in September but unavailable to buy until sometime in 2015, the Apple Watch will start at $349. But fancier versions (like one with a gold band) will cost thousands of dollars. If anyone can make wearable tech useful and desirable to consumers, it should be Apple. Between its own design expertise and the brain power of several freshly recruited top fashion executives, all signs point to Apple Watch success. UBS analyst Steven Milunovich estimates sales of 24 million Apple Watches in its first nine months. He forecast that will grow to about 68 million by 2018, creating a powerful catalyst for Apple stock.

- Google Inc. (Nasdaq: GOOG, GOOGL): The folks at the Googleplex are working hard on Google Glass 2, which should arrive around the middle of 2015. This despite sluggish sales of the original Google Glass, which debuted in 2012. Presumably Google Glass 2 will reflect the wisdom gained from the first version's failures. One promising sign: a program called "Glass at Work" aimed at encouraging use of the device in industries such as healthcare, construction, and manufacturing. Google has no plans to stop pushing Glass as a consumer device, however. Deal-happy Google is also likely to make a big acquisition in the area of wearable tech. For instance, CSS Insight recently predicted that GOOG would buy red-hot wearable camera firm GoPro Inc. (Nasdaq: GPRO) in 2015.

- Microsoft Corp (Nasdaq: MSFT): It went mostly unnoticed, but Microsoft beat Apple to shipping a wearable device with its "Microsoft Band" in early November. Following CEO Satya Nadella's philosophy of platform neutrality, the $199 fitness band works with Android and iOS devices as well as Windows Phone. MSFT also introduced Microsoft Health, a cloud-based platform to store and interpret personal health data. For 2015, Microsoft is expected to deliver a wearable device that integrates with the Xbox One. The big question, though, is whether MSFT can get any traction in this market. With a wretched track record in the closely related mobile market, Microsoft's only shot is to wow consumers with unique, standout products. Is Nadella up to the challenge?

- Intel Corp. (Nasdaq: INTC): The world's biggest chipmaker jumped into the device side of this market this month with a $495 gold-plated bracelet called MICA ("My Intelligent Communications Accessory" - catchy, eh?). But Intel knows that to succeed in wearable tech, it must get its chips into other companies' devices. That's why it's been pushing its wearable-specific Quark chip and Edison "computer on a card" introduced earlier this year. INTC got a big win by elbowing out Texas Instruments Inc. (Nasdaq: TXN) to supply the main processor in Google Glass 2. But smaller chipmakers are also hungry for this market.

- Facebook Inc. (Nasdaq: FB): The dark horse of wearable tech, Facebook is approaching it from a different angle. Its $2 billion purchase of Oculus Rift has given Facebook a wearable tech platform that in the long run could prove more significant than anything Apple or Google is doing. CEO Mark Zuckerberg loves gaming, but that's not what he has in mind for the Oculus VR platform. He sees it as a tool to extend social media in new ways. Imagine attending sporting events or visiting a doctor via virtual reality. We probably won't see those things in 2015, but Facebook will likely tease us with more details.

Many other tech companies, including such Asian giants as Sony Corp. (NYSE ADR: SNE) and Samsung Electronics Ltd. (OTCMKTS: SSNLF), are also contenders in the wearable tech fray. But as we saw with mobile devices, only a few real winners (that is, companies that can turn a profit) will emerge. The U.S. tech titans, with their vast cash reserves and name recognition, have the early edge.

Wearable Tech Stocks to Buy in 2015

Any of the big tech companies are good bets for investors looking for wearable tech stocks to buy. Over the past few months, Money Morning's experts have recommended all of them to readers.

But investors seeking to catch as much of this growth market as possible may want to cast a wider net with the Vanguard Information Technology ETF (NYSE ARCA: VGT).

An exchange-traded fund makes sense in this case because wearable technology is at such an early stage. It's simply too soon to predict the winners and losers.

The Vanguard Info Tech ETF is 89% tech stocks. The tech titans in the list above are all among the fund's top 10 holdings. So are a lot of chip companies likely to play a big role in wearable tech, such as Qualcomm Inc. (Nasdaq: QCOM) and Ambarella Inc. (Nasdaq: AMBA).

Google Is Inventing the Future: Wearable tech is just one area of interest to Google. The company has a wide range of projects under way aimed at improving how we live and work. Here are five amazing innovations we saw from Google in 2014...

Follow me on Twitter @DavidGZeiler.

Related Articles:

- PricewaterhouseCoopers: Wearable Technology Future Is Ripe for Growth

- BI Intelligence: The Wearables Report: Growth Trends, Consumer Attitudes, and Why Smartwatches Will Dominate

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.