Quantitative easing doesn't work.

That's a tough pill to swallow - especially for the world's central bankers who continue to aggressively employ QE strategies in hopes of economic growth.

U.S. Federal Reserve Chairman Ben Bernanke staked his whole chairmanship on the supposed efficacy of QE in spurring an economic recovery. In fact, he was so convinced he deployed three rounds of it. That added $2.5 trillion to the Fed's balance sheet.

Then there's Japan, which is now in the grips of recession. Despite an ill-fated QE program between 2001 and 2006 that didn't work, the Bank of Japan is starting to more aggressively pursue this tactic.

QE hasn't happened yet in Europe. But European Central Bank president Mario Draghi has made it clear that QE is now a matter of when, not if.

But the world's central bankers continue to operate on a false premise. Namely, that money printing in itself sparks inflation.

And that's not the case...

Why QE Doesn't Trigger Inflation

Central bankers' main goal is to combat deflation and spur economic growth. Specifically, foreign central banks want to arrest the deflation crisis that has plagued Japan for 20 years, and reverse a dangerous disinflationary trend in Europe before it becomes the next Japan.

They think QE will trigger inflation. QE aims to flood the banking system with money and push down interest rates so borrowing is more attractive. This will supposedly revive an ailing economy.

The problem is the Fed-induced cash infusion is just sitting on bank balance sheets.

You see, inflation is "too many dollars chasing too few goods." The key word is "chasing" - the QE dollars aren't chasing anything. There's low velocity of money.

The Federal Reserve's attempts with QE are a perfect example.

"You can print all the money you want, but if people are not borrowing it, if they're not spending it, then your economy is collapsing, even with money printing," CIA economist Jim Rickards told Money Morning earlier this year. "The Fed doesn't know what they're doing."

Richard Koo is an economist at the Nomura Research Institute. He has referred to the problems facing world economies as "balance sheet recessions."

In the current economy, businesses and consumers are paying down debt. And appropriately so. The financial crisis that slammed so many of them was largely precipitated by an overextension of credit and large debt loads.

That's why flooding the banking system with money as QE does won't work. Even at low interest rates, and with the monetary base growing so much, consumers and businesses don't want to borrow.

That leaves the banking system awash with unborrowed savings.

That leaves the banking system awash with unborrowed savings.

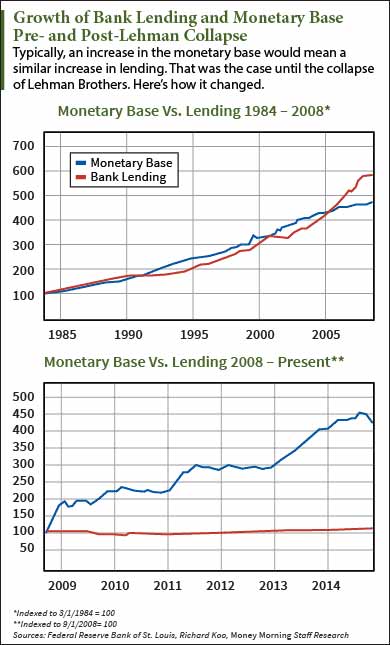

This can all be seen in a comparison of the money supply, the monetary base, and private lending.

Editor's Note: The U.S. economy is setting up for a 25-year Great Depression, and the Fed hasn't been of much help with its QE push. CIA economist Jim Rickards tells you how you can weather this coming economic storm here...

"Traditional economics teaches these three indicators should move together," Koo writes in his book The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World Economy. "But this correlation between these three indicators has broken down completely in the post-Lehman world."

The accompanying chart shows this. The monetary base has far outstripped private lending. This is what happens in the deleveraging of a balance sheet recession. And money printing isn't the remedy in these extraordinary times.

This is why inflation won't suddenly happen overnight in Japan and the Eurozone.

Surely the yen will fall and so will the euro. It's already happening.

But that's because of investor sentiment. Investors expect inflation, and are shorting the currency in droves. This doesn't mean inflation is taking hold.

How to Invest in a QE-Crazy Environment

There are a couple of steps investors can take to benefit from a world where central banks have become addicted to QE and easy money policies.

The first is to hold precious metals. Money Morning Chief Investment Strategist Keith Fitz-Gerald said gold is one of your best bets in times of crisis.

"Gold has been proven to be a great crisis hedge and one that is more perfectly correlated to interest rates, which are, in turn, driven by inflationary pressures and global risk," Fitz-Gerald said. Check out his "secret" gold investing strategy.

And as always when looking for stocks to buy, Fitz-Gerald suggests buying those "need-to-have" investments that won't be fazed by central banks' poor decisions. "Need-to-have" companies address global trends and fulfill widespread needs.

For example, look at ABB Ltd. (NYSE ADR: ABB). This Swedish multinational energy and utility company is going to be a crucial player in keeping the lights on as the global electrical grid expands in developing countries and emerging markets. This is where you can find long-term value.

Up Next: The U.S. is setting up for an imminent $100 trillion collapse. At least, that's what the post-9/11 CIA operation "Project Prophecy" shows us. This operation helped foil a 2006 London terrorist attack, and warned of the 2008 recession well before the fall of Lehman Brothers. Now it has spotted signs that a 25-year Great Depression is in our future, and you'll want to do all you can to preserve your wealth before the storm comes. CIA economist Jim Rickards tells you how to here...