A falling yen and euro are creating big profit opportunities for currencies in 2015.

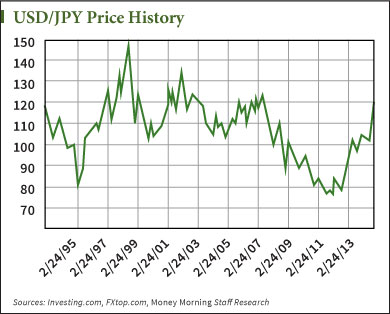

The U.S. dollar has gained about 12% on the yen this year, with the USD/JPY currency pair trading above 120 for the first time since July 2007. The euro has fallen about 12% since peaking at $1.3934 in March. It hasn't touched off these kinds of lows since August 2012.

Both Japan and the Eurozone are on the edge of a deflationary spiral. They want to see their currencies devalued in global forex markets. This would have the one-two punch of boosting export growth and helping flagging domestic demand.

Both currencies could bounce in the short-term, but in the long-term there's still a pretty big floor for losses.

But how far?

Here's where both are headed, plus how you can bank profits on this trend...

Currency Forecast: The Euro in 2015

European Central Bank President Mario Draghi held a press conference Dec. 4 where he was expected to shed light on potential ECB QE. He largely punted any decision to 2015.

But that doesn't change the sentiment of traders. They still see QE as a matter of 'when', not 'if'. And in the meantime, they're going to keep pushing down the euro as they wait for QE-induced inflation.

"The ECB is certainly trying their best to keep this thing heading down," Money Morning Technical Trading Strategist D.R. Barton. "They really want to be able to pick up their export businesses in several countries."

"The ECB is certainly trying their best to keep this thing heading down," Money Morning Technical Trading Strategist D.R. Barton. "They really want to be able to pick up their export businesses in several countries."

The euro established a key support level in July 2013 at $1.2781. From then it bounced between that and a resistance near $1.40 for the next year.

But on Sept. 24, it broached that support level and continued to fall. And it never really made a move back to its $1.3934 resistance established in March.

"We've basically been riding below big moving averages since the summer and it really never peaked through the 50-day in the summer," Barton said of the euro. "We haven't broken any key resistance levels to the upside in a long time."

This shows that technical traders are unfazed. They are more than willing to see the currency keep falling.

Barton said the euro may be able to fall as low as summer 2012 support levels of 1.206. There's even a good chance it will test the summer 2010 lows around $1.19.

Falling below $1.19 will likely be tough. The euro hasn't established any support levels below that since 2006.

But the euro is still hovering around $1.23. And over the last couple months since the stimulus talk has heated up, it's only been testing support on the downside without ever moving toward resistance.

That means you're wise to enter a short trade on the euro. You can do this by either trading the currency pairs outright, or buying the ProShares UltraShort Euro ETF (NYSE Arca: EUO), an exchange-traded fund that aims to generate twice the inverse daily returns of the dollar price of the euro.

The yen is a similar case. But its momentum is taking it even further...

Currency Forecast: The Yen in 2015

In late August, the USD/JPY's 50-day moving average moved above its 200-day moving average.

In late August, the USD/JPY's 50-day moving average moved above its 200-day moving average.

This is a bullish dollar signal (and bearish yen signal) that indicates the dollar is experiencing a prolonged appreciation against the yen. Since then, the dollar has advanced 13% against the yen.

And just since Oct. 31, when the Bank of Japan announced a more aggressive quantitative easing policy aimed at devaluing the yen, the dollar has risen 6% against it.

Now the yen has been up over 120 this past week. It's breaking through resistance levels it hasn't seen since 2007. And what's more, it's been routinely crashing through previous resistance levels unabated.

"Technically, we're in somewhat uncharted territory," Barton said.

Barton said with the yen will likely test resistance at 124, a level it traded at in 2007. Anything after that will be tough. The USD/JPY hasn't touched resistance above the 2007 level since 2002. And at that time it closed near 135, which is still far off.

Since the USD/JPY bottomed out at 75.76 on Oct. 30, 2011, it has only been heading up. With this momentum, a short order is a good trade. An easy way to do this is to buy shares in the ProShares UltraShort Yen ETF (NYSE Arca: YCS), an ETF whose share price rises whenever the yen falls against the U.S. dollar.

More from D.R. Barton: As crude oil continues to fall, some companies stand to gain. Money Morning Technical Trading Strategist D.R. Barton weighed in on some of these key stocks last week on Bloomberg Radio...