What comes to mind when you think of e-commerce stocks to buy?

For most investors, it's big online retailers like Amazon.com (Nasdaq: AMZN) and Alibaba Group Holding Ltd. (NYSE: BABA).

Some may also think of the package delivery companies like FedEx Corp. (NYSE: FDX) and United Parcel Service Inc. (NYSE: UPS).

But few would think to mention Zebra Technologies Corp. (Nasdaq: ZBRA).

That's because Zebra's role in the e-commerce ecosystem is very much behind the scenes.

That's because Zebra's role in the e-commerce ecosystem is very much behind the scenes.

This Lincolnshire, Ill.-based company makes the printers that make the labels that get slapped on millions of e-commerce shipping packages.

It's not a sexy business, but it is profitable. Zebra posted gross margins of 50% in its third-quarter earnings report. Revenue was up 15.1% from the same period a year ago. And earnings per share (EPS) rose 22.9% from a year earlier, excluding one-time expense incurred from its $3.5 billion acquisition of Motorola Solutions in October.

ZBRA stock has gone up 47% over the past 12 months as more investors, including hedge funds, have discovered this growth story.

And the gains aren't over...

Why Zebra's a Stock to Buy

The rise of e-commerce has played a major role in Zebra's growth.

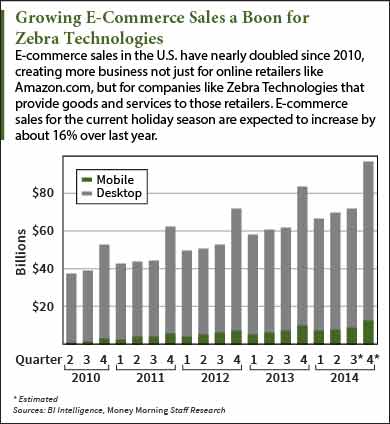

Since 2010, e-commerce sales have nearly doubled. According to eMarketer, e-commerce in November and December of this year will rise 16.6%, a trend that is expected to continue.

People sometimes forget that it's not just the exclusively online retailers like Amazon behind the growth of e-commerce. Brick-and-mortar retailers are seeing more online sales as well.

Consumers have become increasingly comfortable with shopping online. And for those that hate the crowds and traffic, nothing beats ordering from the comfort of your home and having it all show up on your doorstep within days... in a package with a label.

Consumers have become increasingly comfortable with shopping online. And for those that hate the crowds and traffic, nothing beats ordering from the comfort of your home and having it all show up on your doorstep within days... in a package with a label.

That's great news for Zebra stock.

You see, Zebra is deeply entrenched in the bar-code printer label business that makes up 75% of its revenue. Zebra equipment is used by 90% of Fortune 500 companies, and the company has customers in 100 countries.

E-commerce will feed Zebra's growth for years, but it's not the only reason ZBRA is a stock to buy.

The company makes more than just printers. In fact, the National Football League adopted one of its products this year...

ZBRA Is Not a One-Trick Pony

Zebra's decision to add RFID (radio-frequency identification) technology several years ago is about to add another major profit center to the company.

Zebra developed RFID labels to help retailers track product inventory more efficiently than the bar-code labels. Wal-Mart Stores Inc. (NYSE: WMT) already uses Zebra's RFID technology.

But RFID has many more uses than bar codes, as the NFL discovered this year.

In a real-world application of wearable tech, the Zebra MotionWorks chips were placed in players' shoulder pads for the 2014 season. The chips capture in real time a player's position, speed and distance. Coaches and fans alike can use the data to evaluate player performance, and gain a better understanding of what's happening on the field.

Zebra says the technology will work for just about any sport.

But even that is only a hint of what RFID could mean for ZBRA stock. RFID will be an integral part of the Internet of Things. Gartner expects the market for the Internet of Things to grow by a stunning 30% a year through 2020.

And this is also where Zebra's acquisition of Motorola Solutions will pay off. Zebra took a chance buying a company more than twice its size, but gained more expertise in RFID as well as mobile, wireless, and cloud-based technology.

Zebra plans to integrate these pieces with a cloud-based software service it calls Zatar, which it unveiled last year.

While swallowing up a larger company has kept Zebra preoccupied, it has ambitious plans to exploit its new capabilities and larger size. The company believes it will be able to generate enough cash flow over the next three years to pay off the $3.25 billion in debt needed to fund the Motorola deal.

After that, it's all gravy.

Analysts say company income could triple over the next three years, which should push Zebra stock much higher than yesterday's (Monday) close of $75.28. EPS estimates for 2015 have zoomed from $4.16 a share to $5.28 in just the past 90 days.

The average one-year price target for ZBRA is $84.00, but analysts have been playing catch-up with this stock to buy. This month several analysts upgraded Zebra stock and belatedly raised their price targets above the current trading range.

Zebra is trading at 30.58 times trailing earnings, but just 14.26 its forward P/E. Even if its P/E falls to 20 over the next year, earnings at the projected $5.28 would push ZBRA to $105.60.

Follow me on Twitter @DavidGZeiler.

A Penny Stock with Promise: Ekso Bionics Holdings Inc. (OTC: EKSO) builds wearable robots. The company sells its state-of-the-art suits to both medical facilities and the U.S. Department of Defense. EKSO also happens to be one of Money Morning Chief Investment Strategist Keith Fitz-Gerald's favorite stocks to buy. Find out why he thinks Ekso will rise more than 13-fold over the next five years...

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.