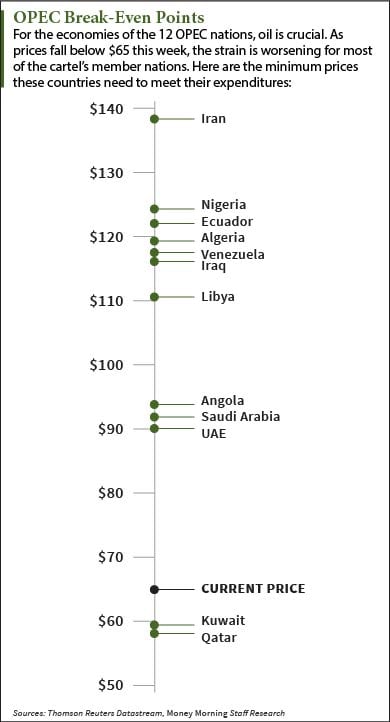

This crude oil chart shows just how hard the steady oil price slump has hit OPEC countries.

Oil is the foundation of OPEC countries' economies. Their budgets feel a tremendous strain when crude oil prices fall as dramatically as they have.

Brent oil for January delivery traded at $64.59 at noon today (Thursday). That's a drop of more than 41% from the $110 mark Brent hit in June. Yesterday was also the first time the global benchmark dipped below the $65 mark since 2009.

Brent oil for January delivery traded at $64.59 at noon today (Thursday). That's a drop of more than 41% from the $110 mark Brent hit in June. Yesterday was also the first time the global benchmark dipped below the $65 mark since 2009.

This oil chart shows the OPEC break-even points - the minimum prices different countries need in order to meet their expenditures.

Iran needs the highest oil price of the 12 OPEC nations, at $136 per barrel. But Iran isn't the only country in trouble right now. Only Kuwait and Qatar have break-even points lower than today's crude oil price.

Oil prices dipped even further this month after OPEC announced it would be maintaining its 30 million barrel-per-day production level. Several nations, including Venezuela and Nigeria, have called for lower production levels. The cartel's biggest member, Saudi Arabia, has refused.

The Saudis don't want to lose global market share and are willing to let prices fall. Saudi Arabia can withstand low prices because it has the largest foreign-exchange reserves of any OPEC nation. Its $750 billion in cash reserves ranks third globally.

A report from Bank of America Corp. (NYSE: BAC) this week says OPEC has lost all competence in failing to stabilize prices. As prices continue lower, the governments Venezuela and Nigeria will struggle to survive.

The United States government is not dependent on oil exports like many Middle Eastern countries, so falling oil prices are not a major crisis stateside. Many large oil stocks have been impacted by the falling price of oil, however.

Get the Best Oil Price Analysis - for Free: Money Morning Global Energy Strategist Dr. Kent Moors has been meeting with some of the world's top oil policymakers in Dubai this month to analyze OPEC's controversial new strategy. OPEC has refused to cut oil production, and in doing so has started an oil price war with U.S. shale producers. But the OPEC oil price war simply won't work, says Moors. Here's his exclusive inside look at the oil market...