Uber CEO Travis Kalanick announced Dec. 4 the company raised $1.2 billion in a recent round of funding. Multiple reports indicate Uber is now valued at $40 billion.

For investors, that also means there will be another delay for the Uber IPO. With that investor support, Uber can likely forego an initial public offering through the first half of 2015.

For investors, that also means there will be another delay for the Uber IPO. With that investor support, Uber can likely forego an initial public offering through the first half of 2015.

"At this valuation, investors appear to be thinking that when Uber goes public, it might be worth $80 billion to $100 billion," CB Insights' Chief Executive Officer Anand Sanwal told Bloomberg. "This type of mega-financing affords Uber a great deal of flexibility in terms of when they might go public."

The latest valuation would make Uber almost as large as Twitter Inc. (Nasdaq: TWTR) and Netflix Inc. (Nasdaq: NFLX) combined. That ensures it will be one of the most-watched 2015 IPOs.

In a Dec. 4 blog post, Kalanick left the door open for additional funding when he stated there is "additional capacity remaining for strategic investments." He also said the company will add more than 1 million jobs in 2015, and will expand in the Asia Pacific region.

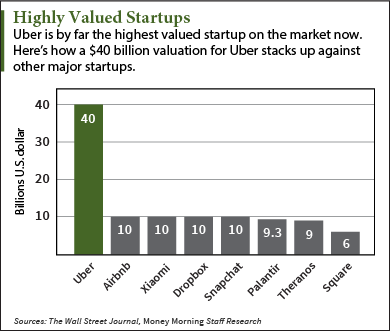

With a $40 billion valuation Uber is the highest valued startup in the world by $30 billion. In June, it completed a round of funding that valued the company at $17 billion.

The timing is interesting for Uber as the company made headlines with two separate scandals this month.

First, Senior Vice President of Business Emil Michael made comments to a BuzzFeed reporter saying Uber should hire a team of researchers to smear the reputation of a female reporter who had criticized the company.

Then privacy concerns arose when BuzzFeed reported Uber executives use a secret tracking-service known as "God View" to access the location of prominent clients.

Kalanick addressed those scandals in his blog post.

"This kind of growth has also come with significant growing pains," he wrote. "The events of the recent weeks have shown us that we also need to invest in internal growth and change. Acknowledging mistakes and learning from them are the first steps."

Despite these "growing pains," investors are clearly still bullish on Uber. Through today, it has now raised more than $2.8 billion through six rounds of funding since 2009.

And while there are issues with the company's operations, it does possess a truly disruptive technology...

Uber IPO: Changing an Industry Despite Issues

Money Morning's Defense and Tech Specialist Michael Robinson says one of the biggest allures for Uber is its market.

"If ever there was an industry ripe for high-tech disruption it would have to be taxicabs," Robinson said. "Many critics argue that when it comes to providing fast service, not much has changed with taxis in the past 400 years. But that all got turned 180 degrees when Uber was founded in 2009, and its mobile app was launched in 2010 in San Francisco."

Customers have been flocking to the car-booking service. A TechCrunch report earlier this year indicated Uber had roughly $213 million in revenue in 2013. They also reported revenue had been doubling every six months. That's an annual growth rate near 145%.

"Once you use an app like Uber, you can't go back," Robinson said. "It really is a great service. I could see a cab parked across the street, and I'd still rather wait for an uber to show up."

The New York Times claims that Uber could potentially bring in $1 billion in annual revenue if it's able to capture a 50% market share of the U.S. taxi industry. Mind you, that's in the United States alone.

There's no doubt that Uber's technology is a game-changer. But according to Robinson, there are also some significant issues facing the company. Chief among them are the recent scandals.

"The comments made by Emil Michael were ignorant, arrogant, and incredibly stupid," Robinson said. "There is really no way to describe the stupidity in that statement."

The privacy scandal can't be overlooked either, says Robinson. Consumers are willing to tolerate some tracking information - many applications track locations - but Uber may have crossed the line with its "God View" policy.

Finally, Uber's competition is growing. Lyft is Uber's biggest competitor, operating in 61 cities in the United States. Apps have also become popular in the taxi business, allowing customers to hail a cab using a similar technology. As the Uber IPO date approaches, the company needs to differentiate itself from this growing list of competitors.

More from Michael Robinson: When Robinson first recommended this stock in August 2013 it was trading at $17.50. Right now, it's worth more than $48 a share. That's a gain of 163% in just 16 months. And this stock is just getting started...

Related Articles:

- Bloomberg: At $40 Billion, Uber Would Eclipse Twitter and Hertz

- The Wall Street Journal: The Billion-Dollar Startup Club