The term "Santa Claus Rally" refers to a seasonal bump in stock prices over the last week of the year - specifically, the last five trading days of December, and the first two of January. This year it falls from Dec. 24 to Jan. 5.

While the name may seem hokey, the phenomenon is real.

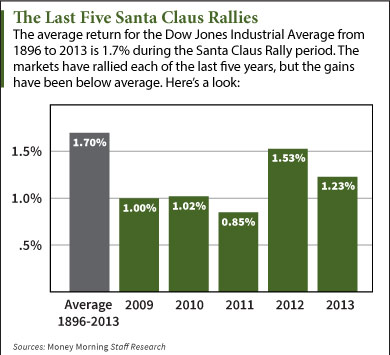

In fact, the Dow has seen a Santa Claus Rally more than 77% of the time since 1896. Over that 117-year span, the Dow Jones Industrial Average has gained an average of 1.7% during that week.

And it isn't just the Dow that sees a bump. Since 1929, the S&P 500 Index has averaged a gain of almost 1.8%. In those 84 years, stocks have risen nearly 80% of the time.

And it isn't just the Dow that sees a bump. Since 1929, the S&P 500 Index has averaged a gain of almost 1.8%. In those 84 years, stocks have risen nearly 80% of the time.

There are several reasons for the Santa Claus Rally. Frequently, an influx of cash enters the market as people invest their year-end bonuses. Others invest with year-end tax considerations in mind. Some attribute the bump to a happier mood on Wall Street during the holiday season - cheery traders tend to buy more.

So, will there be a Santa Claus Rally in 2014?

Money Morning's Capital Wave Strategist Shah Gilani - a 30-year veteran of the market - said investors can expect stocks to rise before 2015, but not for the same reasons we typically see a Santa Claus rally...

2014: Not Your Typical Santa Claus Rally

According to Gilani, there's a simple reason why the markets will continue higher into 2015.

"The one almost overriding reason markets will likely keep rallying through year end is Wall Street players need a good rally to make year-end bonuses and keep their jobs," Gilani said.

Through mid-November, roughly 74% of long-only money managers lagged behind the 10% gains of the S&P 500 by 3%. They weren't alone. Many hedge funds have also underperformed compared to the market.

"In spite of markets making new highs repeatedly in 2014, it hasn't been a smooth ride," Gilani continued. "The bumps throughout the year, especially the mid-October swoon, kept managers on edge and too often took them to the sidelines and out of the action. And worse, a lot of hedge funds were betting against the rising tide of stocks and shorting U.S. government bonds."

And because these money managers and hedge funds have missed some of 2014's biggest gains, they're intent on driving the markets higher.

"As complicated as markets are, understanding why and how a year-end rally is likely isn't complicated," Gilani said. "It's really just a matter of understanding motivations among Wall Street's players." Gilani knows exactly how traders operate. He ran his first hedge fund in 1982 from his seat on the floor of the Chicago Board Options Exchange.

"The easiest path for managers lagging the S&P 500's positive performance is the path of least resistance - which is up, up, and away," said Gilani. "That's what they're betting on. That's how Wall Street wants to play through year-end, and why we can benefit from the panic..."

More from Shah Gilani: A U.S. court recently overturned the insider trading convictions of two high-profile hedge fund managers, and the decision was as surprising as it was profound. In fact, it may have changed trading forever...

Related Articles:

- MarketWatch: Don't Fall for the 'Santa Claus Rally'