Best ETFs to Own for 2015: Each week our experts dish out the latest profit plays and asset-protection moves for our Money Morning Members - all for free.

Today we want to do something different. Rather than provide a roundup of last week's stock picks, we're going to focus on 10 exchange-traded funds (ETFs) our experts like right now.

They are among the best low-cost ways for you to profit from next year's top trends.

"The great thing about ETFs is that you get a lot of potential upside while also greatly diversifying away your risk," Money Morning Defense & Tech Specialist Michael A. Robinson, a 30-year tech market veteran, said Dec. 11.

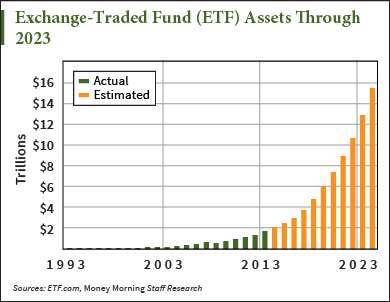

That's one reason ETF investment is booming now. On Dec. 4, MarketWatch reported U.S. ETF assets now approach a record $2 trillion, up from $1.64 trillion in January. According to a January forecast by ETF.com - a publication that correctly predicted ETF assets would hit $2 trillion by 2014's end - ETF assets will grow eightfold by 2028.

That's one reason ETF investment is booming now. On Dec. 4, MarketWatch reported U.S. ETF assets now approach a record $2 trillion, up from $1.64 trillion in January. According to a January forecast by ETF.com - a publication that correctly predicted ETF assets would hit $2 trillion by 2014's end - ETF assets will grow eightfold by 2028.

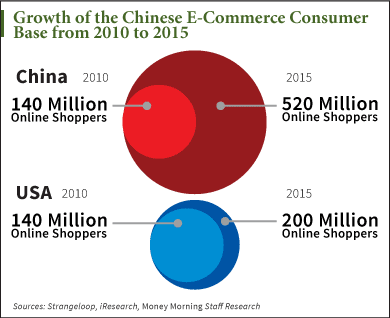

Robinson likes five tech ETF picks for 2015 - three of which he thinks will double over the next three years. Another targets the explosive growth in Chinese e-commerce. In 2012, the country reached $298 billion in online-shopping spending, easily surpassing U.S. sales of $263 billion.

Money Morning Executive Editor Bill Patalon offered another high-octane tech ETF, with a twist - it targets one of the fastest-rising tech markets in Asia.

We also have three currency ETFs and one commodity pick that lets investors own physical silver without a high premium.

Keep reading for all Money Morning's top ETF tips and recommendations in this list of the best ETFs to own in 2015.

Money Morning's Best ETFs to Own for 2015

-

Ho Chi Minh City, Vietnam There's a new tech powerhouse rising in Asia - and it's not China or India. It's Vietnam. The country has become one of the biggest centers for semiconductor production on the globe - and we've got the stats that prove it: roughly 80% of the world's new personal computers (PCs) will be produced there in 2015. Intel Corp.'s (Nasdaq: INTC) Vietnam plant put out $1.8 billion in exports this year alone. Korea's Samsung Electronics Ltd. (OTCMKTS: SSNLF) announced plans in November for a new $3 billion smartphone unit in Vietnam. That'll go next to its existing $2 billion Samsung smartphone plant that employs 16,000 workers. Nokia Corp., which now belongs to Microsoft Corp. (Nasdaq: MSFT), said in July it would move mobile phone production from China to Vietnam, and in October said it will also move an Indian facility to the country. Even Panasonic Corp. (OTCMKTS ADR: PCRFY) plans to open a facility in Vietnam. Money Morning Executive Editor Bill Patalon gave readers two ways to profit early from this Vietnamese tech boom...

- Money Morning Defense & Tech Specialist Michael Robinson predicts 2015 will be another good year for U.S. stocks in general - and will be even better for investors who hitch a ride with several hot tech sectors. Robinson estimates a 7% gain for the S&P 500, based on the U.S. economy's recent strong performance. And because of tech, the Nasdaq 100 will crush overall market gains just like it did this year (it performed 66% better than the overall market). Last week, Robinson picked out three tech ETFs - one in biotech, one in semiconductors, and one in defense - that "every investor should own" heading into 2015. He believes each is set to double...

- E-commerce is another "unstoppable trend" that will soar in 2015. A recent survey by the National Retail Federation shows more than half of Americans plan to do at least some of their holiday shopping on the Internet this year. We already saw that trend over Thanksgiving. Fewer people hit physical retail stores on Black Friday compared to 2013, but Cyber Monday

sales became the largest online shopping day of the year. The number of online shopping sessions shot up 11.8% from 2013's total. Revenue per session gained 7% and the number of people who completed a purchase rose 8.3%. Robinson highlighted "a perfect ground-floor opportunity" e-commerce ETF last week. Just launched in mid-November, the investment gives key exposure to the e-commerce hotbed in Asia...

sales became the largest online shopping day of the year. The number of online shopping sessions shot up 11.8% from 2013's total. Revenue per session gained 7% and the number of people who completed a purchase rose 8.3%. Robinson highlighted "a perfect ground-floor opportunity" e-commerce ETF last week. Just launched in mid-November, the investment gives key exposure to the e-commerce hotbed in Asia...

- On Oct. 19, a money manager told The Wall Street Journal investors should make sure they have exposure to emerging markets. The advice sent Robinson reeling, for two reasons. First, popular emerging market ETFs like iShares MSCI Emerging Markets (NYSE Arca: EEM) and Vanguard FTSE Emerging Markets ETF(NYSE Arca: VWO) have yielded 12.9% and 13.1% losses over the past two years. That compares to a 41% gain for the S&P 500 in the same period. Second, Robinson says American tech firms - not emerging markets - are what investors should have exposure to right now. Tech has consistently driven the market higher. That's why Robinson recommended this broad-play tech ETF that covers IT services (23.88%), semiconductors (22.5%), and software (17.09%). And over the past two years, it has gained 60.7% to beat the S&P 500 by nearly 20%...

- A falling yen and euro are creating big profit opportunities for currencies in 2015. The U.S. dollar has gained about 12% on the yen this year, with the USD/JPY currency pair trading above 120 for the first time since July 2007. Meanwhile, the euro has fallen about 12% since peaking at $1.3934 in March. It hasn't touched off these kinds of lows since August 2012. While both currencies could see a short-term bounce, recent outlooks from the nations' central banks suggest more losses in the year ahead. We've got two currency ETFs that'll let you bank profits from continued European and Japanese deflation in 2015...

- China's currency, the yuan, is on its way to a greater position in the global finance arena. According to the International Monetary Fund (IMF), China has overtaken the United States as the world's largest economy. Despite the country's slowing GDP growth rate, it's still around 7% (nearly triple that of the United States). And China has been snapping up gold to bolster its currency. Some estimates have the country's stash at around 4,000 tonnes, an amount surpassed only by the United States. Money Morning Resource Specialist Peter Krauth told readers about two ways to play the yuan's rise - one is a direct bet on the currency itself, while the other is through Chinese stocks...

- Silver investors can't buy enough coins. This year's sales are near record highs. In fact, on Nov. 5 the Mint ran out of American Silver Eagles. The agency had to suspend sales after selling 2 million ounces in just two hours. This trend is expected to continue into 2015. A Dec. 10 report from the Silver Institute indicated total silver industrial demand will grow 27% next year, adding an additional 142 million ounces of silver demand through 2018 compared with 2013 levels. High demand has triggered steep dealer premiums - Silver Eagles currently go for a whopping 35% premium to the silver spot price. But we found a more affordable way to cash in on silver. On Nov. 18, Krauth highlighted for readers the best silver ETF to buy - unlike competitors, it offers actual physical silver ownership, at a premium that's 95% less than the going market rate...