Don't underestimate Vladimir Putin: he knows how to fight back.

And right now, that trait might be all that keeps Russia from a catastrophic collapse.

The facts on the ground in Russia are, at best, chaotic...

Oil prices are way down, and its currency, the ruble, has crashed.

But while the West may think it's got Russia under its thumb, Vladimir has plenty more tricks up his sleeve to stave off his country's mounting problems and see his people through the crisis.

Indeed, this one "nuclear" currency option in his pocket may just be his way out, and it has major implications for the global economy...

Russia's Problems Only Seem Insurmountable

Russia's ruble has lost 50% against the U.S. dollar so far this year, even trading intraday to an all-time low of 80 per dollar before recently recovering to about 65.

And that was despite the Russian Central Bank's fifth rate hike, and its most dramatic revision from 10.5% to 17%, in order to stem the ruble's free fall. Indeed, traders were beginning to price in a possible Russian default.

At the same time, a weak ruble is a headwind for Russian companies and banks that owe in stronger foreign currencies.

Central Bank chief Elvira Nabiullina has already spent $90 billion to support the ruble, and is willing to tap another $85 billion next year from its $430 billion hoard of international reserves.

It's all thanks to biting Western sanctions and the oil price crash.

You see, Russia gets roughly 50% of its government revenues from taxes on oil and gas. Keep in mind that government budget projections are based on $95 per barrel oil. Lower oil prices means less taxes, and that's a serious dilemma as the price of oil works its way down below $60 per barrel.

So on Putin's orders, most government departments will cut expenses by 5%.

Yet, the jury is still out on whether these steps are enough.

However, the coin has another side...

Europe Will Always Need Russian Energy

Besides hefty foreign reserves, Russia's foreign debt is a manageable $675 billion, down by nearly $55 billion in the past year.

What's more, despite sanctions, Europe - especially Germany - needs Russian energy so Chancellor Merkel (who, let's remember, was the deputy spokesperson for the first democratic government in East Germany) has no intentions of backing any tough sanctions.

Russia has also been signing numerous energy mega-deals with China, including a $400 billion 30-year agreement. Putin's recent 1-day visit to India produced no less than 20 high-profile deals worth some $100 billion in commercial contracts, half of which is in oil and gas and $40 billion of which is in nuclear energy.

Suffice it to say that, even at lower oil prices, Russia has plenty of willing buyers for its oil and gas, and increasingly they're paying for it outside the dollar.

But what if it's still not enough?

Putin's Secret Weapon

Sanctions have meant Western companies are avoiding doing business with Russia.

But the Eurasian nation has a golden option, should it be necessary...

Russia has been an aggressive buyer of gold.

The country's reserves have tripled to 1,150 tonnes since 2005, making Russia's central bank the world's sixth-largest holder of official national gold. It's likely that China's been buying even more, but they've shied from reporting their holdings since 2009.

In the first half of 2014 Russian gold production was up 27%, putting the country on pace to surpass Australia and move it into second spot, behind China.

It added around 150 tonnes to reserves this year, easily doubling last year's 77 tonnes,

Perhaps in response to slower sanction-induced foreign gold sales, Russia's been buying up a lot of its domestic production. Gold holdings currently make up 10.8% of total reserves.

That has many contemplating Russia selling off some of its gold to shore up the ruble.

But I don't buy it...

While the move would help pay for imported goods on world markets, it would result in pushed up demand for U.S. dollars, and I don't see Russia ready to do that.

At least not at this juncture.

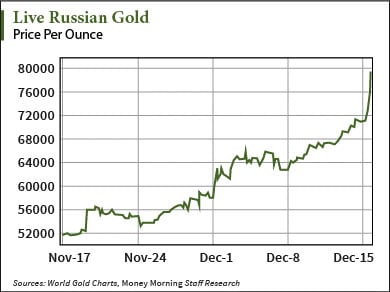

A look at the chart below, which shows gold priced in rubles, makes this all clear. That spike you see on Dec. 16 was the ruble's virtual freefall moment against the greenback. Clearly gold is protection.

So as investors, what should we expect next?

Why Putin May Just Pull Off a Miracle

Why Putin May Just Pull Off a Miracle

Fears of further ruble declines have capital flowing out, so much so that the possibility of capital controls is making its way around the rumor mills.

According to the economy ministry, $125 billion fled this year, the most since 2008, and projected GDP is expected to contract 0.8% next year, signaling a likely recession.

Inflation could reach 10% next year on the back of a weak ruble and lack of western imports banned by sanctions.

But in a perverted way, depending on how this currency crisis plays out, we could actually see a major surge in GDP.

Russia boasts a strong budget surplus (remember those?) and a positive balance of payments.

But more interestingly, a quickly depreciating currency, and the anticipation of such, could move consumption forward into the much nearer future. After all, why spend later when your rubles will buy you less?

The currency's fall has triggered somewhat of a rush to buy durables like automobiles, real estate, and even furniture. But getting Russian hands on those items may be tough: recent reports say Apple Inc. (Nasdaq: AAPL), followed by General Motors Co. (NYSE: GM), Audi AG (ETR: NSU), Jaguar (a subsidiary of Tata Motors Ltd. (NYSE ADR: TTM), and now Inter IKEA Systems B.V. have halted sales thanks to ruble volatility.

Consumers rightly expect prices will soon be revised upwards. Then the buying will slow dramatically unless the ruble regains some value against other currencies.

As the velocity of money in Russia surges, it's a temporary reprieve to be sure.

Of course, it's difficult to know if it's going get any worse before it gets better.

Meanwhile, the two Russian investments I've highlighted before have both put in major reversals. Over the course of trading on in the past week, the Market Vectors Russia ETF (NYSE Arca: RSX) and Gazprom OAO (OTCMKTS ADR: OGZPY) surged by 27% and 28% respectively.

Gold, however, may still remain Putin's ultimate "nuclear" currency option.

That's because the Russian leader may be working towards implementing a payment system based on gold, which would allow oil to be priced in the metal, rather than fiat dollars or euros.

Despite all the concerns and problems, Putin's approval ratings are high and are in fact rising. Soon after annexing Crimea, his approval shot from 53% to an all-time high of 80%. They remain near those levels. And Russians are willing to endure a fair bit of hardship while their leader stands up to the West.

Just last week he took to the Russian airwaves to reassure his citizens:

"Our economy will overcome the current situation. How much time will be needed for that? Under the most unfavorable circumstances I think it will take about two years."

Besides, oil is likely to be much higher way before then, making his promise a lot easier to achieve.

And if anyone could pull that off, it's Putin.