Money Morning's "unloved" pick of the week is oil and gas exploration and production company Apache Corp. (NYSE: APA).

An unloved investment is one that's been beaten down - but is actually a great value. Investors then get an amazing entry point into a good long-term investment.

Money Morning Chief Investment Strategist Keith Fitz-Gerald recommended Apache stock last week, calling it a "hated stock" that presents a "terrific opportunity" for investors.

Apache Corp. (NYSE: APA): About the Company

Apache explores for, develops, and produces crude oil and natural gas. Founded in 1954 in Minneapolis, the company drilled its first wells in Cushing Field in Oklahoma. Apache moved its headquarters to Houston in 1991 following its acquisition of MW Petroleum from Amoco. It has operations in Australia, Canada, Egypt, and the U.K. as well as the United States. APA has a market cap of just over $24 billion. The company employs about 5,300 people.

Apache explores for, develops, and produces crude oil and natural gas. Founded in 1954 in Minneapolis, the company drilled its first wells in Cushing Field in Oklahoma. Apache moved its headquarters to Houston in 1991 following its acquisition of MW Petroleum from Amoco. It has operations in Australia, Canada, Egypt, and the U.K. as well as the United States. APA has a market cap of just over $24 billion. The company employs about 5,300 people.

Apache Corp. (NYSE: APA) Stock: Why It's Unloved Right Now

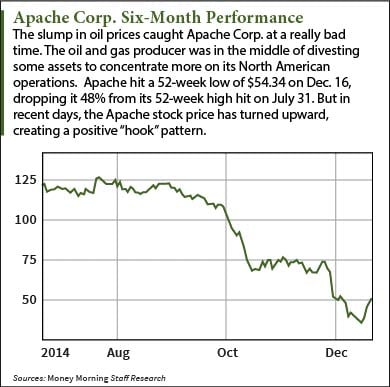

The primary cause for the dramatic sell-off in Apache stock - falling oil prices - is both logical and obvious. APA stock got hit especially hard, though. After hitting a 52-week high of $104.57 on July 31, Apache stock started a 48% slide that ended with a 52-week low of $54.34 on Dec. 16.

With oil plunging, the bad news snowballed. In early November Apache reported a loss of $1.24 billion in its third quarter due to property write-downs and tax adjustments. Even excluding that, earnings fell to $1.38 from $2.32 a year earlier with revenue down 19%.

In early December, Apache was hit with downgrades from Zacks Investment Research and Mizuho Securities. Both expressed concerns about lower commodity prices. Several other analysts slashed their price targets for APA stock. Macquarie lowered its target from $96 to $66; JPMorgan Chase & Co. from $86 to $67; and UBS from $81 to $69.

But those analysts have missed some key points...

Apache Corp. (NYSE: APA) Stock: Why It's a Buy

Apache is a solid company. At the urging of activist investor Jana Partners, Apache announced last week that it will sell its liquefied natural gas projects in Canada and Australia for $2.75 billion. This will remove the uncertainty that came with the foreign operations and free up cash for investment in the company's U.S. operations. The company had already executed $11 billion in similar divestitures.

Apache is a solid company. At the urging of activist investor Jana Partners, Apache announced last week that it will sell its liquefied natural gas projects in Canada and Australia for $2.75 billion. This will remove the uncertainty that came with the foreign operations and free up cash for investment in the company's U.S. operations. The company had already executed $11 billion in similar divestitures.

Despite concern over oil prices, Apache has forecast North American onshore liquids growth of 12% to 16%. What's more, APA added 300,000 acres in key U.S. growth plays. Apache's shift away from its foreign natural gas operations to its U.S.-based oil operations is a winning one over the long term.

More positives include a strong balance sheet and 50 consecutive years of paying a dividend. (The current dividend yield is 1.54%, with a comfortably low payout ratio of 17.4%.) When oil bounces back - and it will eventually - APA stock will be well-positioned to benefit.

"This is a company that's simply been thrown out with the bathwater and they've got a lot of upside potential," Fitz-Gerald said.

Investing in Apache Stock (NYSE: APA)

APA stock is so beaten down now that it's pretty cheap even after its recent recovery to $64.86 (Friday's close). The one-year price target, even after all the steep downgrades, is still $82.91. Investors may want to buy a third of their desired position now and wait for APA stock to dip back into the mid-$50s to buy the second tranche. If the Apache stock drops to $47.50, buy the third tranche. And then have a little patience. Apache will rise along with oil prices, so you may have to wait it out through 2015. But if oil stays low that long, supply and demand will get so far out of whack that a spike to $100 a barrel or higher becomes likely.

Last Week's "Unloved" Pick: Investors haven't been kind to 3D printing stocks, and Organovo Holdings is no exception. But this company, which does 3D printing of human tissue for drug testing, has only recently started to realize its potential. Find out why Organovo is a stock to buy...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.