The Microsoft stock forecast for 2015 is for another strong year as Microsoft Corp. (Nasdaq: MSFT) continues to adjust to a tech landscape radically different from the one it dominated in the 1990s.

Microsoft stock has had two good years following a decade in which it had drifted sideways. In 2013 MSFT stock rose more than 35%. In 2014 MSFT has gone up 26%.

Microsoft stock has had two good years following a decade in which it had drifted sideways. In 2013 MSFT stock rose more than 35%. In 2014 MSFT has gone up 26%.

The positive move started in August 2013 when Chief Executive Officer Steve Ballmer announced he would step down. Microsoft stock really picked up momentum after new CEO Satya Nadella officially took over Feb. 4.

Under Ballmer, the Redmond, Wash.-based Microsoft was stuck in the past. Nadella's willingness to break with that past has re-energized the company. He's willing to focus on areas with the most potential to grow earnings, particularly the cloud. His vision for Microsoft will become much clearer in 2015.

Microsoft has much at stake in 2015, including the launch of Windows 10, a major revision of the iconic operating system that helped build the MSFT empire.

That's just one way Microsoft has laid the groundwork for a big year. Let's dig into the details...

Microsoft Stock Forecast 2015: Windows 10 Makes Amends

The single biggest event for Microsoft in 2015 will be the release of Windows 10. A consumer preview is slated for Jan. 21, with the release date coming mid-year.

Windows accounts for almost 28% of Microsoft's revenue. More to the point, it's the foundation on which almost everything the company makes is built.

Windows 8, released a little over two years ago, belly flopped. Many users disliked the look and feel of Windows 8, which was designed to unify the experience on PCs and mobile devices.

The reaction was so negative that Microsoft is skipping the name "Windows 9" altogether to emphasize just how much better Windows 10 will be.

The company has listened to its customers. Microsoft says Windows 10 will achieve the goal of a unified operating system across all types of devices by doing a better job of adapting to the device on which it's running.

So the first goal is to erase the bad taste of Windows 8 and get consumers excited about the new features Windows 10 can offer.

The second goal is more risky...

While Microsoft hasn't made it official, it has hinted it will adopt some kind of subscription pricing model for Windows 10.

Traditionally Microsoft has charged PC makers a licensing fee for each machine. Consumers who upgraded to newer versions of Windows paid out of pocket.

Microsoft started testing the waters of subscription pricing two years ago with its market-dominating Office 365 software.

Microsoft started testing the waters of subscription pricing two years ago with its market-dominating Office 365 software.

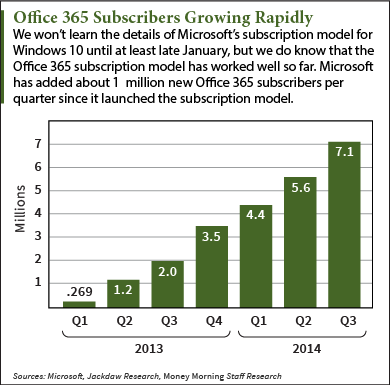

That experiment has gone better than expected. Office 365 subscriptions have increased by about 1 million per quarter since its launch at the beginning of 2013.

Microsoft almost has no choice to switch. Apple Inc. (Nasdaq: AAPL) provides both Mac OS X and the iPhone's iOS at no cost. Google Inc.'s (Nasdaq: GOOGL, GOOG) Android system and Chrome OS are also both free.

Under the new model, a basic copy of Windows will be free, as will future upgrades. But additional features will require a monthly or annual subscription fee. That means Microsoft must convince users that subscriptions provide good value.

It seems risky, but Microsoft has a lot of options to make a Windows subscription compelling.

A subscription will go beyond the free security updates to include new features and improvements. It also could include extra cloud storage as well as Windows updates for more than one device.

A Windows 10 subscription model also helps MSFT stock. It will replace the uncertainty of the three-year upgrade cycle with a steady revenue stream. And it will keep more customers on the current version of Windows.

That will save Microsoft money in the long run because it won't have to support old versions for a decade or more after their release.

Microsoft Stock Forecast 2015: Capitalizing on the Cloud

Less visible - but just as important to Microsoft stock in 2015 - will be the company's progress in expanding its cloud business. One of the first things Nadella did when he became CEO was to set the cloud as a priority.

The cloud has become Microsoft's most promising area of growth. In the last quarter it reported cloud revenue growth of 128%.

Microsoft has strengths in all three primary areas of cloud computing. It has Software as a Service (SaaS) in Office 365. And its Azure cloud service, aimed at businesses, offers both infrastructure as a service and platform as a service.

MSFT has focused in particular on the "Internet of Things" - using the cloud to let devices "talk" to each other and share data. The company already offers IoT solutions for manufacturing, healthcare, retail, and the urban areas.

As a $4.5 billion business, the cloud represents only about 5% of Microsoft's total revenue. But that's the beauty of it. Unlike the mature Windows and Office businesses, the cloud is still at an early stage. Research firm IDC projects that worldwide cloud spending will rocket from $56.6 billion in 2014 to $127.5 billion in 2018.

And while Microsoft got a late start in the race with Amazon.com Inc.'s (Nasdaq: AMZN) cloud services, analysts say it has rapidly closed the gap.

"The overall magnitude of our cloud business today shows that we've caught the trend at the right time, jumped on it with a unique value proposition and we're now further accelerating," Nadella told CNBC in an October interview.

He said Microsoft had invested billions in the cloud over the past few years - an investment it expects will pay off in 2015 and beyond.

"One of the things that we've really invested in is this enterprise cloud - we have data centers in 19 countries," Nadella said. He added that getting certified to operate in multiple countries is "hard work."

"We now are the only public cloud company from North America, or global public cloud company, that operates in China. Both Office 365 and Azure. And it's doing very, very well for us," he said.

Microsoft Stock Forecast 2015: Mobile, Wearable Tech, and More

Microsoft will keep pushing ahead in other areas in 2015 as well, such as mobile, wearable tech, and the Internet of Things.

Having dropped $7 billion to buy Nokia Corp.'s (NYSE ADR: NOK) devices division, Microsoft would like to get a little more traction in mobile in 2015.

Mobile is the other area of emphasis Nadella announced when he became CEO. But he's had trouble gaining ground on market leaders Apple and Google. Market share in 2014 for Windows tablets was about 5%, and for smartphones just 3%.

But now at least MSFT has a viable strategy. Windows 10 will bring "universal apps" - software that will be able to run on a Windows tablet or phone as easily as on a Windows PC.

It's an attempt to address the huge gap between the Windows phone ecosystem and those of the iPhone and Android. The ploy might not make Microsoft a leader in mobile, but any significant increase would be progress.

Wearable tech is another "fresh market" opportunity for Microsoft. Unit sales of wearable tech devices is expected to leap from 33 million units in 2014 to more than 50 million units in 2015.

The company took its first step in 2014 with the $199 Microsoft Band. But the Apple Watch will likely ignite wearable tech in 2015.

So the pressure will be on. Right now we only have rumors that Microsoft is working on a wearable device that integrates with the Xbox One. But Microsoft will need to truly innovate to stand out in what promises to be a crowded field.

Still, one thing that has marked the Nadella era is a determination not to let major tech trends pass the company by, as happened under Ballmer.

The aggressive moves into new areas, combined with the subscription business model for its veteran products, will propel Microsoft stock higher through 2015.

"I love the turnaround I've seen, I love the new management, I love where they're going," said Money Morning Capital Wave Strategist Shah Gilani on the FOX Business program "Varney & Co." in late November.

Gilani first recommended MSFT stock in July 2013 when it was trading at about $30. Now it's trading at about $47. He thinks it will get to $100 within five years.

I think it's got a good ways to go higher," Gilani said. "I think it's something you have to own and hold."

The 7 Biggest (And Most Profitable) Tech Stocks for 2015 - Free Download: Michael Robinson's 2015 Tech Investor's Forecast has just been released, giving you the strategies, tactics, and 7 stock picks that'll ensure you cash in on the greatest commercialization era Silicon Valley has ever seen. Get details on your free copy here.

Related Articles:

- CNBC: Microsoft's Nadella Talks Cloud, Inequality, and Why He's Against a Spinoff

- ExtremeTech: With Windows 10, Microsoft Could Move to a Subscription-Based Model

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.