Money Morning's "unloved" pick of the week is oil and gas explorer and producer Northern Oil and Gas Inc. (NYSE: NOG).

An unloved investment is one that's been beaten down - but is actually a great value. Investors then get an amazing entry point into a good long-term investment.

With the recent plunge in oil prices, Money Morning Chief Investment Strategist Keith Fitz-Gerald has been on the lookout for beaten-down bargains. And he believes NOG stock fits the bill.

Northern Oil and Gas: About the Company

Northern Oil and Gas is a small-cap ($365 million) company founded in 2006. Its focus is the oil and gas reserves in the Bakken and Three Forks formations stretching across parts of North Dakota and Montana. NOG owns about 185,000 acres in those formations.

Northern Oil and Gas is a small-cap ($365 million) company founded in 2006. Its focus is the oil and gas reserves in the Bakken and Three Forks formations stretching across parts of North Dakota and Montana. NOG owns about 185,000 acres in those formations.

Northern Oil and Gas uses the "non-operator" model. That means it works with partners to drill and operate wells on the land it owns. NOG pays a percentage of the expenses of running the well and gets a percentage of the profits. Headquartered in Wayzata, Minn., the company employs about 20 people.

Northern Oil and Gas (NYSE: NOG) Stock: Why It's Unloved

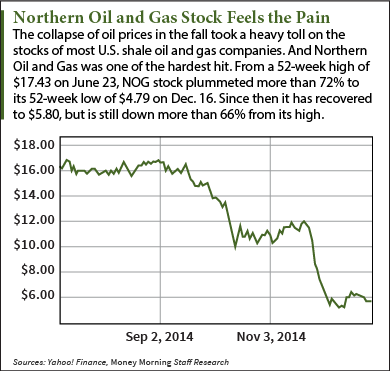

The almost 50% fall in oil prices since June has crushed many of the U.S. shale oil and gas producers. NOG stock has been hit especially hard. From a 52-week high of $17.43 on June 23, NOG stock plummeted more than 72% to its 52-week low of $4.79 on Dec. 16.

The almost 50% fall in oil prices since June has crushed many of the U.S. shale oil and gas producers. NOG stock has been hit especially hard. From a 52-week high of $17.43 on June 23, NOG stock plummeted more than 72% to its 52-week low of $4.79 on Dec. 16.

Critics saw the non-operator model as a disadvantage. Then the analysts piled on.

Global Hunter Securities downgraded NOG stock on Dec. 2, followed three days later by Iberia Capital. Wunderlich Securities downgraded NOG on Dec. 16.

That got the attention of the short sellers. By mid-December, short interest had grown to nearly 27% of the float.

It's ugly. But it's also easy to see why NOG stock is tremendously oversold...

Why NOG Stock Is a Buy

Despite the drop in oil prices, NOG's position is not as bad as it seems. Fitz-Gerald points out that Northern Oil and Gas is well-hedged against lower oil prices. In fact, it has 69% of its projected 2015 production hedged at about $89 a barrel. And NOG has hedges at $90 for about half that amount though the first half of 2016.

Even if oil doesn't go up much over the next year, NOG should report earnings close to 2014's numbers. If oil prices rebound just to $70 a barrel, Northern Oil and Gas will earn more in 2015 than it did in 2014.

Fitz-Gerald believes a rebound is inevitable.

"There's no question those prices are going to come back; it's just when," Fitz-Gerald said. "Global demand will ensure that. According to the IEA, energy is going to see some $48 trillion worth of spending by 2035."

Finally, let's talk about that non-operator model. The critics have it backwards. It's an advantage right now, not a disadvantage. Every well is a standalone decision. So NOG can pass on wells that won't deliver a sufficient return. That flexibility will help Northern Oil and Gas weather low oil prices for a long time.

Investing in Northern Oil and Gas Stock (NYSE: NOG)

NOG stock is an incredible bargain right now and unlikely to dip much lower. So investors should buy all of their desired position now.

The price-to-earnings ratio is a remarkable 4.54. That's one-quarter of the S&P 500 average and less than half the industry average. A rise in the P/E to more typical levels would drive a big jump in the NOG stock price.

Even after several downgrades, the one-year target is $9.33, a 61% increase from the current price. And rising oil prices will push NOG stock back to its highs in the long term - giving investors a triple.

Last Week's "Unloved" Stock Pick: Defense is another area that Fitz-Gerald likes at the moment. And one of his favorite picks is Kratos Defense and Security Solutions (Nasdaq: KTOS), a tiny defense contractor. In fact, Fitz-Gerald thinks KTOS stock will double by this time next year...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.