As an analyst known for making bold and unusual predictions in pursuit of profits, I am usually inclined to celebrate when my "calls" are proven right.

But when it comes to the proliferation of one of the six primary trillion-dollar trends we're following - War, Terrorism, and Ugliness - I've got to be completely honest. There are times when I am uncomfortable with the human cost of being right.

That's certainly the case right now, following the horrific assassinations of 10 journalists and two police officers last week at the Charlie Hebdo magazine offices in Paris. In case you somehow missed the news, the killings were allegedly carried out by two brothers who had become radicalized Muslims in the Parisian ghettos of Gennevilliers acting in response to cartoons portraying the prophet Muhammad.

My stomach is tied in knots and I cannot help but reel in disgust. But I also cannot help but think.

My stomach is tied in knots and I cannot help but reel in disgust. But I also cannot help but think.

The events in Paris reinforce a very important financial relationship that escapes 99% of all observers - the counterintuitive nature of terrorism and what it means for your money.

And that's what we're going to talk about today. This won't be an easy conversation to have, but it's vitally important because most people get the nature of what we're about to discuss completely backwards, and that leaves their investments vulnerable.

You see, in one of the great ironies of the financial world, terrorism actually creates far more opportunity than it destroys.

Let's get rolling.

There's an Upside for Your Money in This Awful Terrorism Trend

Conventional wisdom is that terrorism has a negative impact on your money.

To hear the media and even most analysts tell it, the uncertainty and terror caused by the threat of violence only diminishes investment opportunities and wider economic prospects. Insurance companies are expected to lose money, for example. Airline and transport companies will see a drop in passenger and cargo mile revenue. Urban areas will see a drop in tax revenue because of the perceived greater vulnerability in a densely populated area.

Certainly terrorists want you to believe that's the case as they advance their own cause, whether that be political, religious, or ideological.

Their stated goal is to inflict maximum damage and uncertainty, resulting in the perception that doing something will result in a disproportionate harm - like getting on an airplane, visiting Times Square, watching "The Interview," or producing satirical content that is perceived as an insult to a religious figure.

In reality, the effect is quite the opposite.

Here's why...

When it comes to the nature of investing, the immediate consequences of disruption - chaos, panic, and instant notoriety for people, places, and things - actually create new opportunity.

Charlie Hebdo, for example, the publication that was targeted in Paris, is already pushing back. The latest issue is on sale at online auctions for €100,000, a 2,500,000% increase from its usual price. There are not a lot of estimates for sales this week, but the representatives have said it's "going to print" as usual. The French government has reportedly donated nearly $1 million to ensure the magazine continues.

Just last month, Sony distributed "The Interview" directly despite hacking and an unprecedented cyber-attack and banked $31 million in two weeks. That's already high enough to make it the company's most successful online movie ever, with plenty more upside ahead.

Airlines booked more than $1 billion last year on supposedly temporary baggage fees and other elective purchases put in place after 9/11 like charging for blankets, the Internet, and premier access.

So here's my point...

This Trend Changes the Global Economy (But Doesn't Stop It)

There's a good case to be made that the effects of terrorism are relatively short-lived and the direct cost to output comparatively low because money comes rushing back in much the same way water closes over the initial splash made by a rock thrown in a lake.

I won't go so far as to say they're a non-event like some, but I will draw a distinction that will become important in a moment.

According to terrorism expert Jose Tavares, associate professor of economics at the Universidade Nova de Lisboa in Portugal, there is evidence that "democratic countries are more resilient to attacks." It's the developing world that's at risk where, not surprisingly, there are more terrorism events.

Here's where it gets really interesting.

You'd think that foreign direct investment (FDI) would suffer and that each terrorist event would prompt large outflows away from the carnage, especially once a country is branded a terrorist target. But in reality, there's a good case to make that FDI actually accelerates into these countries, according to a 2006 paper by Daniel Wagner of the Asian Development Bank. It all depends on who's doing the investing.

His thinking seems to be borne out by a subsequent study by economists Subhayu Bandyopadhyay, Javed Younas, and Todd Sandler covering 78 developing countries receiving FDI from developed nations from 1984 to 2008. What they found was that a single standard deviation increase in domestic terrorism incidents per 100,000 people resulted in a decrease in FDI of between $324 and $513 million. Transnational terrorism reduced net FDI by $296 to $736 million.

So clearly, big money thinks twice about flowing to small money when terrorism rears its ugly head. Yet, the same is not true when FDI is flowing from small to large countries.

After 9/11, for example, U.S. companies here suffered more than $50 billion in commercial losses, but the United States remains one of the world's top FDI destinations. GDP, which had been falling the quarter prior to the attacks, began growing in Q4/2001 - right after 9/11.

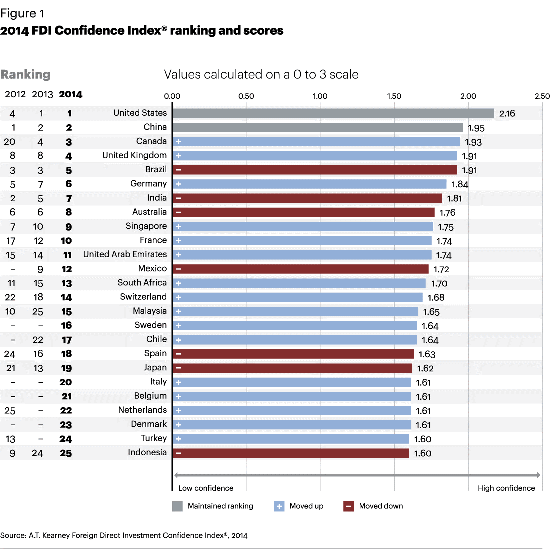

China has convicted more than 7,000 of its own citizens of terrorist charges since 2001 and is a close second to the United States in terms of FDI received last year. Canada, which just last fall experienced a shooting at Parliament, is third, according to A.T. Kearney's 2014 FDI Confidence Index.

So what does all this mean for your money?

Simply this - that the lure of profit and the desire to establish trade partnerships is more often than not a stronger motivational force than perceived political risk is a disincentive to invest.

Ergo, you are better off placing your bets with CEOs who have to quantify the risks on behalf of their shareholders than with politicians who don't.

Cold... perhaps. Clinical... maybe.

But the reality is that terrorism is merely another input in the investing process, not an excuse to abandon it.

Key Takeaway: Position Your Money Accordingly

Again, if you're finding you have a hard time with this concept, I get it. I do, too, but that does not mean I can dismiss the data.

To my way of thinking, there are two kinds of terrorist-related investments - the reactive and the proactive.

The reactive are companies like Sturm, Ruger & Co. Inc. (NYSE: RGR) and Smith & Wesson Holding Corp. (Nasdaq: SWHC), for instance. Both are choices related to personal defense and the products they make play to the impulsive need we all feel to protect ourselves every time terrorists push that behavioral button with some unspeakable act.

Unfortunately, their upside is limited by two things: the size of the personal firearms defense market and political maneuvering related to gun control and constitutional wrangling. That makes both companies short-term investments at best, or perhaps opportunistic trading vehicles for the nimble.

The proactive investments, on the other hand, are much longer term and have correspondingly far higher upside. So while an event like Paris may make you want to own a handgun, the better choice is to invest in companies allied with the government's efforts to prevent future occurrences or take the fight to the bad guys proactively. Love 'em or hate 'em, no politician ever wants to fail because they haven't spent enough money protecting their constituents.

That's companies like Kratos Defense & Security Solutions Inc. (Nasdaq: KTOS) or Raytheon Co. (NYSE: RTN), for example. The former is a small contractor we've talked about doing lots of systems integration, drone work, and training in the very important "standoff warfare" area - meaning they can fight at a distance using technology to aid, prevent, or even avoid conflict in the first place. The latter is producing billions of dollars' worth of missile systems and weapons platforms sold around the world to governments trying to protect their citizens.

KTOS stumbled last year thanks to an earnings miss that was driven by extraneous forces and a hiccup in the competitive bidding process - in other words, a stock slide that had nothing to do with the company's long-term potential. I think it's a great buy at the moment and perfect for "re-entry" if you got stopped out when I originally recommended it. The company seems ripe for a takeover.

In closing, I'd like to call upon the words of Evelyn Beatrice Hall, an English writer best known for her biography of French Enlightenment philosopher Francois-Marie Arouet, a.k.a Voltaire (1694-1778), when she penned, "I disapprove of what you say but I will defend to the death your right to say it."

In essence, freedom is meaningless without free speech. Furthermore, a free people should be able to speak their minds and, in the ultimate twist of irony, invest accordingly.

Je suis Charlie.

Editor's Note: War, Terrorism, and Ugliness is a sobering subject - but Keith has also identified five other "Unstoppable Trends" where profit opportunities abound. In fact, his very first recommendation to Total Wealth readers, based on the Technology trend, returned profits of 100% just six weeks later - and there's far more upside to come. To gain access to this stock ticker and dozens of Keith's other recommendations and insights, sign up for Total Wealth here - it's free.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.