The world will be awash in central bank meetings this week. Global authorities on monetary policy are gearing up for what promises to be a crucial moment in central banking history.

The world will be awash in central bank meetings this week. Global authorities on monetary policy are gearing up for what promises to be a crucial moment in central banking history.

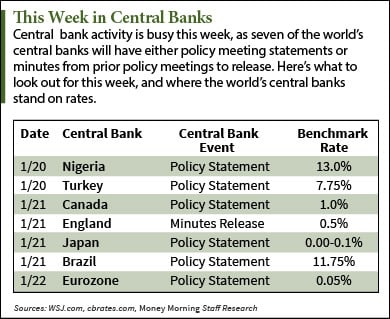

Seven central banks will release policy statements or minutes, as shown in the chart to the right.

Today (Tuesday) the Central Bank of the Republic of Turkey and the Central Bank of Nigeria kicked things off. Contrary to what Western economies have been doing, these two emerging economies mulled cuts to high interest rates. Turkey cuts its rate to 7.75% from 8.25%. Nigeria held steady at 13%.

The week will round out with central bank meetings of the more accommodative Bank of Japan and European Central Bank.

Here's what you should be watching for this week...

Bank of Japan: Expect Few Surprises

Japan is still fighting deflation. The struggle has gone on for about 20 years now. Organisation for Economic Co-Operation and Development (OECD) data shows prices fell by 0.4% in November.

The Bank of Japan is going to stick to its 2% inflation target. In an October meeting, the BOJ announced it was accelerating its bond-buying program. The original quantitative easing in Japan had the BOJ buying government bonds at a pace of 60 trillion to 70 trillion yen a year ($505.6 billion to $590 billion). The October announcement upped that figure by 10 trillion yen ($83.4 billion).

There will likely be no big surprises on the bond-buying front.

Several news reports did suggest the BOJ may take some new action, however. This will likely come in the form of an extension of certain bank lending incentive programs set to expire in March. The two programs include the Growth-Support Funding Facility and the Stimulating Bank Lending Facility.

The efficacy of Japan's monetary policy regime is still very much unproven. Rates are already extremely low. The average overnight call rate is 0.077%, according to the most recent data from the BOJ. It's hard to grasp how effective an extension would be.

Accommodative policies have done little to lift Japan out of its economic malaise. More of the same is not the answer.

Inflation will only come once consumers and businesses are borrowing and spending. Loan demand is still rather low, according to data from the BOJ released in October.

Without an uptick in the velocity of money, you can be sure the Bank of Japan's efforts will bear no fruit.

But the BOJ's monetary policy actions this week are expected to bring little surprises. In the big picture of global central banking, the spotlight will be on the ECB.

Here's why...

The European Central Bank: QE Is Fast Approaching

For many ECB observers, this is the week. Many economists expect that at Thursday's meeting ECB president Mario Draghi will announce Eurozone quantitative easing (QE).

Eurozone QE will not look like U.S. Federal Reserve QE, however. The European financial system is hardly as deep as that of the U.S. So you're not going to see a large-scale twin-buying spree of mortgage-backed securities and government bonds.

Instead, Eurozone QE will be primarily a sovereign bond-buying program, to the tune of about €500 billion.

You can expect an announcement, but when the QE will happen is uncertain. The main goal of Eurozone QE is to depreciate the euro. That will help pick up exports and stave off the deflationary pressures that come with a strengthening currency.

Draghi already has managed some depreciation purely on rhetoric and expectations. Since peaking at $1.3934 in March 2014, the euro has fallen about 11% to 11-year lows.

The euro's current downtrend has come on speculators looking to short the currency for gains ahead of what is expected to be a much larger QE-fueled depreciation. But the sell-side pressure on these expectations has done much of the job already. And the Swiss National Bank's move to unpeg its currency from the euro last week further fueled the descent.

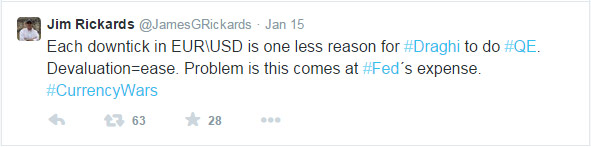

CIA economist and author of The Death of Money James G. Rickards tweeted this last week:

Draghi has sailed by on just his words before. When bond yields were soaring in 2012, he announced the Outright Monetary Transaction program aimed at unlimited bond-buying. The mere mention helped push down yields enough that the actual program was never implemented. Draghi's words already have done so much that any QE talk Thursday may just be a feint.

This isn't to say Eurozone QE won't happen.

But with the Eurozone, it's never as simple as it seems. And for the ECB, this is uncharted territory.

How to Play the Big Central Bank Meetings

Investors have two ways to profit from the central bank meetings. According to Money Morning Chief Investment Strategist Keith Fitz-Gerald, the yen is going to 200 against the dollar in less than two years. An easy way to short the yen is to buy ProShares UltraShort Yen ETF (NYSE Arca: YCS), an ETF whose share price rises whenever the yen falls against the U.S. dollar.

The euro is a little different. It will likely go to dollar parity in the long-term, but QE is already priced into the markets. If you're not short the euro now, you may be better off waiting for a clear-cut announcement that Draghi will employ QE. This will boost the European markets. At that point, the best play will be the Wisdom Tree Europe Hedged Equity ETF (NYSE Arca: HEDJ). It provides the most liquid play for European stocks and hedges against a weakening currency.

More on Big Banks: Remember when banks used to make it worth your while to deposit cash with them? Heck, maybe you even remember teaser offers like free toasters. But in a reprehensible turn of events, now you - the depositor - are about to get toasted...