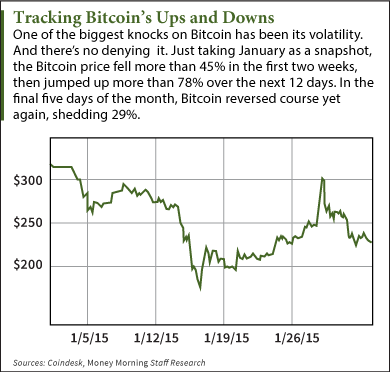

The Bitcoin price chart for January shows volatility is still a major factor slowing the digital currency's progress.

The price chart shows how Bitcoin started the month at $318.23, according to data from CoinDesk. Over the next two weeks it slid 46% to $172.28. For the next 12 days Bitcoin zoomed back up 78.3% to $307.16. Then it slumped 29.4% over the final five days of the month.

And in the first few days of February the price of Bitcoin has reversed direction again, rising as a high as $245, for a gain of nearly 13% in three days.

And in the first few days of February the price of Bitcoin has reversed direction again, rising as a high as $245, for a gain of nearly 13% in three days.

Unfortunately, that's been the norm for Bitcoin through most of its six-year life.

For Bitcoin to gain mainstream adoption, this price volatility needs to be reduced. Bitcoin's tendency to lose 20% to 40% of its value in a matter of days, or even hours, discourages its use for daily transactions.

It's also why most of the merchants that accept Bitcoin immediately convert what they receive into a fiat currency like the U.S. dollar. Fiat money certainly has its issues, but major currencies like the dollar and euro are relatively stable compared to Bitcoin.

Now, we've told you before how the real value of Bitcoin lies not in its price, but in the underlying technology of the blockchain. While that's true, a major part of Bitcoin's utility is as a decentralized tool for transmitting money between individuals. Even applications built on the blockchain will benefit from price stability.

In that sense, the actual price of Bitcoin - whether its $100 or $1 million - matters less than getting away from the wild price swings that make it difficult to use.

But there's good news. The mechanisms to achieve Bitcoin price stability have already begun to appear...

We're Getting Closer to a Less Volatile Bitcoin Price Chart

Some of the factors driving Bitcoin volatility stem from its nature as a new, experimental form of money.

For one, Bitcoin's low trading volume amplifies volatility. The number of people buying and selling Bitcoin has grown tremendously over the past two years, but remains relatively small compared with other currencies or commodities like gold and silver. Bad news will make any commodity fall in price. But with fewer traders, it's harder to match buyers and sellers. Prices have to keep falling to find buyers.

This is where having more Wall Street involvement will help. Things like the Winklevoss Bitcoin ETF, the Winklevoss Bitcoin Trust (Nasdaq: COIN), will help add volume to Bitcoin trading. The Winklevoss ETF plans to sell shares in dollars but will buy and hold bitcoins representing the investment, much like the SPDR Gold Trust ETF (NYSE Arca: GLD).

U.S.-based Bitcoin exchanges will also add liquidity. Coinbase launched its U.S.-based Bitcoin exchange Jan. 26, although it's only available in 24 states and appears to have jumped the gun on regulators. The Winklevoss twins have said they're planning a U.S.-based Bitcoin exchange as well once the regulatory picture gets clearer.

Coinsetter, a New York-based Bitcoin exchange designed with Wall Street sophistication, last month added the ability to short Bitcoin as well as trade on margin.

More volume will also make it harder for heavy hands to manipulate the Bitcoin price. A single large order has caused big spikes or plunges in the past.

Ultimately, it's all about price discovery. And the more pieces of that Bitcoin gets into place, the less volatility we'll see. In other markets, derivatives and swaps play a big role in price discovery. Such tools have just started to emerge in the Bitcoin universe.

Last September Summit, N.J.-based TeraExchange launched its platform for Bitcoin swap contracts. It gives traders a place to bet on the direction of the Bitcoin price and merchants a place to hedge against volatility.

Bitcoin futures exchanges also aid price discovery. Last month, BitMEX joined OrderBook.net and OKCoin as places where Bitcoin futures can be traded. Futures are another kind of hedge.

As more ways become available to bet not just on Bitcoin but on the direction of the Bitcoin price, volatility will ease. And as volatility eases, people will feel better about investing in and the public will feel more confident using it.

January's crazy Bitcoin price chart shows that when it comes to Bitcoin volatility, we have a long way to go.

But it's just as clear that getting Bitcoin price volatility under control is just a matter of time.

Bitcoin Forecast 2015: While 2014 was a rocky year for Bitcoin, a lot of positive things happened away from the spotlight. And those powerful trends have set the stage for some big leaps forward in 2015. Here's why this year will be pivotal for Bitcoin...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.