Early last week, the Nasdaq Composite Index - the bellwether for U.S. tech sector - eclipsed the 5,000 level for the first time in 15 years.

The bears would have you believe this is proof that tech stocks in 2015 are simply surging inside a "bubble" - and that a collapse like the dot-com debacle of 2000 is close at hand.

I'm here to tell you folks that those gloom-and-doomers are wrong.

Over the last two years, I've repeatedly shared my belief that, in the long run, technology shares will beat the broader market - and by a wide margin.

Today I'm going to show you why...

Room to Grow for Tech Stocks in 2015

As a senior advisor to Silicon Valley startups at the time, I had a front-row seat for the dot-com meltdown in 2000.

As a senior advisor to Silicon Valley startups at the time, I had a front-row seat for the dot-com meltdown in 2000.

So when I tell you there simply is no comparison between today's Nasdaq and the go-go years of the Roaring '90s, I speak with authority.

Let's start by comparing the pace of tech investing then and now. This gives us a sense of how the "greed factor" affected stock values in the late 1990s.

Data compiled by market-value experts Birinyi Associates reveals that back in the dot-com era it took the Nasdaq just 49 days to rise from 4,000 to 5,000, a climb of 25%.

This time around, using the Birinyi standard, it has taken nine times as long - or 455 days - to do the same thing.

You can look this up yourself. The Nasdaq closed at 4,017 on Nov. 26, 2013, and closed at 5,008 on March 2.

And despite a much larger economy and 15 years of inflation since then, 2015 tech stocks are substantially cheaper today than they were in the late '90s.

To demonstrate this, let's use a stock-value standard that nearly all investors agree on - the price/earnings (P/E) ratio. By that standard, tech stocks today are 81.7% cheaper than they were in the late '90s.

To demonstrate this, let's use a stock-value standard that nearly all investors agree on - the price/earnings (P/E) ratio. By that standard, tech stocks today are 81.7% cheaper than they were in the late '90s.

At the height of the dot-com rally, Nasdaq stocks traded at 175 times earnings. Today, that figure stands as 32 - making today's stocks five times cheaper than they were then.

When we take inflation into account, the Nasdaq is well below its previous high, Birinyi says. In 2000, the index would have to hit 6908 to have the same value as back then, for an additional rally of 38%.

In other words, tech stocks are nowhere near overheated.

And that means you still have plenty of ways to profit...

The Big Spark

After all, we are at a unique moment in history.

As I explained in the "Million Dollar Tech Portfolio" special report, there's never been a better time to invest in technology.

Indeed, we're at the starting line for the greatest wealth-creation cycle the tech sector has ever seen.

Right now I can identify more than a dozen tech-sector "ignition points" - catalysts for growth - including such areas as digital payments, mobile communications, cloud computing, connected cars, medical tech and biotechnology, miracle materials, the Internet of Everything (IoE), sensors and semiconductors, and Big Data.

Each of these "ignition points" is a vibrant growth market unto itself.

And even more important than that, they are all interconnected. And those connections have created a gigantic, tech-sector-wide "ecosystem" that will supercharge growth across Silicon Valley - creating fortunes for those who invest now.

Just look at what's happening with cloud computing and Big Data. (Cloud computing is the storage of software or data on the Internet, while Big Data is the compilation, collection, distribution and, most importantly, deciphering of enormous amounts of data.)

And the cloud and Big Data are interconnecting. Instead of storing all that data on site, companies pay vendors to store and deliver all that data via remote cloud centers.

Market Research Media says the cloud computing industry will grow at 30% a year to reach $270 billion by 2020. And according to the forecasters at IDC, the market for Big Data technology and services will grow at a 26.24% compound annual growth rate (CAGR) from 2014 to reach $41.52 billion in 2018.

But it's not all about business technology. Billions of people around the world have joined the high-tech revolution.

Just think about the impact cell phones have had.

According to the United Nations, more people today have access to cell phones than to indoor toilets. About 6 billion of the world's 7 billion people have cell phones, while only 4.5 billion have working toilets.

That's an amazing statistic - especially when you consider that the smartphone era only really got started in June 2007 with the release of the iPhone from Apple Inc. (Nasdaq: AAPL).

In 2014, smartphone developers shipped 1.25 billion units around the world, according to Gartner.

From zero to more than a billion smartphones in less than eight years represents a growth rate approaching infinity.

The Beauty of "Interlocking"

To give you a sense of how much potential still lies ahead for tech investors in 2015, consider how our smartphones are "interlocking" with near-field communication (NFC) technology to create a whole new industry - mobile payments. With mobile payments, which got its big "ignition" spark with Apple Pay late last year, consumers use their NFC- and credit-enabled smartphones to pay for items at checkout counters.

According to Gartner, mobile payments will nearly triple from $235 billion in 2013 to $720 billion in 2017.

And that doesn't take into account the value of smartphone apps, mobile ads, cybersecurity, the chips and sensors that go inside - or the phones themselves for that matter.

Meanwhile, our use of smartphones has pushed rapid adoption of Wi-Fi technology so people can surf the Web at much faster speeds than they can get through cellular connections. And that leads to more cash outlays to build Wi-Fi systems in our office parks, hospitals, downtowns and university campuses.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

And by no means is the smartphone hardly an isolated consumer product. It's part of an ecosystem that includes not only our tablets and laptops, but also our homes, through "smart" thermostats and other appliances.

And then there's our automobile...

Indeed, there was no such thing as a "connected car" back in 1999-2000. But three years from now, every single new car sold in the United States will have embedded technology.

That's because, thanks to a ruling from the U.S. Department of Transportation, all new autos must have backup cameras starting in 2018.

That major change will help usher in the era of true smart cars - ones that also have collision-avoidance systems, Bluetooth integration and self-driving features.

Technology is a big driver in the U.S. auto boom - and vice versa.

Automakers in 2014 sold 16.5 million cars, up 5.9% from 2013 - the strongest U.S. sales since 2006. And according to a PwC report, the hardware and software sales from connected cars will grow at a compound annual rate of 29% - and will reach $152 billion in 2020.

Everywhere you look you see all these technology "ignition points" interlocking and then driving the U.S. economy - and the tech stocks that make up the Nasdaq - forward.

Soon, I'll have a huge profit opportunity - and I'm going to show you how it meets each and every rule of our Your Tech Wealth Blueprint.

I'm not worrying about the Nasdaq, and neither should you.

So, let's start making money with the greatest wealth-creation machine ever - high tech.

A big battle in "smart clothing" is about to break out. According to The Gartner Group, smart clothing is expected to go from practically no sales in 2014 to more than 10 million units in 2015, and 26 million in 2016. That's quite a growth curve. And we've got the goods on the big three companies with the best tech-supportive apparel...

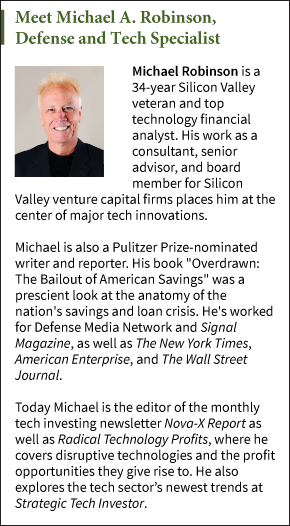

About the Author

Michael A. Robinson is a 36-year Silicon Valley veteran and one of the top tech and biotech financial analysts working today. That's because, as a consultant, senior adviser, and board member for Silicon Valley venture capital firms, Michael enjoys privileged access to pioneering CEOs, scientists, and high-profile players. And he brings this entire world of Silicon Valley "insiders" right to you...

- He was one of five people involved in early meetings for the $160 billion "cloud" computing phenomenon.

- He was there as Lee Iacocca and Roger Smith, the CEOs of Chrysler and GM, led the robotics revolution that saved the U.S. automotive industry.

- As cyber-security was becoming a focus of national security, Michael was with Dave DeWalt, the CEO of McAfee, right before Intel acquired his company for $7.8 billion.

This all means the entire world is constantly seeking Michael's insight.

In addition to being a regular guest and panelist on CNBC and Fox Business, he is also a Pulitzer Prize-nominated writer and reporter. His first book Overdrawn: The Bailout of American Savings warned people about the coming financial collapse - years before the word "bailout" became a household word.

Silicon Valley defense publications vie for his analysis. He's worked for Defense Media Network and Signal Magazine, as well as The New York Times, American Enterprise, and The Wall Street Journal.

And even with decades of experience, Michael believes there has never been a moment in time quite like this.

Right now, medical breakthroughs that once took years to develop are moving at a record speed. And that means we are going to see highly lucrative biotech investment opportunities come in fast and furious.

To help you navigate the historic opportunity in biotech, Michael launched the Bio-Tech Profit Alliance.

His other publications include: Strategic Tech Investor, The Nova-X Report, Bio-Technology Profit Alliance and Nexus-9 Network.