The Apple profit margin on its new Watch will outshine even that of the iPhone.

Just how big the gap will be depends on how far Apple Inc. (Nasdaq: AAPL) can penetrate the Swiss luxury watch market with its 18-karat gold "Edition" Watch.

A fat Apple profit margin is the magic that keeps the Cupertino, Calif. company wallowing in money despite not having dominant market share.

A fat Apple profit margin is the magic that keeps the Cupertino, Calif. company wallowing in money despite not having dominant market share.

In its fiscal first quarter, Apple reported gross profit margins of 39.9%, an increase from margins of 37.9% in the same period a year earlier.

Apple makes money from pretty much everything it does, but amongst its hardware, the iPhone has had the biggest margins.

Morgan Stanley (NYSE: MS) analyst Katy Huberty estimates the profit margin on the current mix of iPhones is a robust 46.7%. Most smartphone makers, by contrast, squeak by with margins of only 2% to 4%.

Why the Apple Profit Margin on the Watch Will Be Huge

Now here comes the Apple Watch. The high-end watch sector is an ideal business for Apple. Typical margins in this sector range from 50% to 75%.

What's unclear at this point is what the AAPL profit margin will be on the entry-level Watch, which starts at $349, and the mid-level Watch, which starts at $549. Estimates range from 40% to 50%, about what you'd expect for a luxury watch.

But the gold Apple Edition Watch could skew the average much higher. This model starts at $10,000 and tops out at $17,000. Even when you factor in the cost of one ounce of gold (about $1,150 right now), the Edition should clock in with a profit margin of 80% and up.

And that's right where they should be. Fine gold jewelry generally has a profit margin of more than 90%.

So Apple stands to make a lot of money on every Watch it sells, and an obscene amount of money on the gold ones.

But will it be enough to move Apple stock? Given that the company already rakes in about $40 billion in profit annually, can the Watch have an impact?

You'd better believe it...

Don't Underestimate the Apple Watch

Figuring out the impact of the Watch on AAPL stock involves some number crunching. We know enough now to make some good educated guesses.

We already discussed the Apple profit margins on the Watch. So that leaves sales. With that and the margins, we can predict revenue and profits.

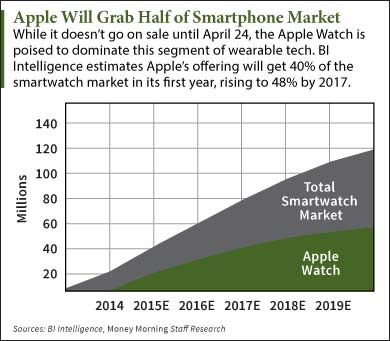

Analyst estimates for the first year range from 8 million a year to 41 million, but cluster in the 20 million area. It's probably conservative, but that's what we'll use.

Analyst estimates for the first year range from 8 million a year to 41 million, but cluster in the 20 million area. It's probably conservative, but that's what we'll use.

Most expect the entry-level Sport model to make up half or more of total Watch sales. We'll lean conservative again and go with 65%, which would be 13 million Watches. Assuming a roughly even split in sales among the Sport models, you get an average selling price of $375. That gets you $4.875 billion in revenue and, with 40% gross margins, $1.95 billion in profits.

We're figuring 30.5% of sales will be of the mid-tier Watch, about 6.1 million Watches. Again, we're splitting sales of the two sizes to get an average selling price of $575. Here we get $3.5 billion in revenue, and, assuming 55% margins, $1.925 billion in profits.

So those two models will raise Apple profits by about 10% - not bad.

But the gold Edition, with its crazy high margins, will pull in eye-popping profits even with modest sales.

A Wall Street Journal article last month said Apple planned to produce 1 million gold Watches per month, but that seems absurd. That implies sales of 12 million gold Apple Watches a year, which would be more than half of all Watch sales and take a 40% bite out of the luxury Swiss watch market.

Such sales would generate a preposterous $162 billion in revenue and $130 billion in profits. Er, no.

However, it's not far-fetched to see the gold Apple Watch taking a slice of the 30 million per year Swiss luxury watch market, where Apple's prices almost look cheap...

The Apple Watch's Profit Margin Power

An Omega Speedmaster '57 Co-Axial Chronograph costs $20,000 while a Rolex Sky-Dweller Oyster goes for $35,000.

Even at just 1%, we're talking 300,000 gold Apple Watches a year. Averaging the price points gives you an ASP of $13,500, although it's likely this will be higher. If you can afford to drop $10,000 on a watch, why not $17,000?

Such modest sales would generate about $4 billion in revenue and $3.24 billion in profits.

But the gold Watch has a good chance of getting 3% of this market. Now we're up to $12 billion in revenue and $9.72 billion in profits. And it's very achievable.

The folks who buy luxury watches typically own more than one. They like to wear different watches in different settings. For this group, adding a gold Apple Watch will be practically de rigueur.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

And then there's the China market. The rapid economic growth there over the past decade has made many wealthy. China now has more than 1 million millionaires. And the new money likes to show off its status by wearing bling like a gold Apple Watch. And it comes at a good time for the company, with Apple revenue from China up 70% in the December quarter.

Finally, the existence of gold Apple watches on the wrists of the rich and famous worldwide will encourage sales of the more affordable models.

So we're left with a first-year scenario in which all versions of the Apple Watch pull in more than $20 billion in revenue and $13.6 billion in profits. That's a tidy 34% boost in earnings per share - more than enough to move the needle.

To see what that does for Apple's stock price, add the extra $2.33 a share in EPS to the trailing 12-month EPS of $7.41 and you get $9.82. Multiply that by a price-to-earnings ratio of 17 (it's 17.23 now) and -- voila! We have AAPL at $166.84, putting it within grasp of a $1 trillion market cap. (AAPL needs to hit $171.82 to get to that milestone.)

Apple stock closed at $127.04 Tuesday.

Apple Dividend Going Up: While the company has made no official announcement, Apple is a shoo-in to raise its dividend at least 10% next month. How can we be so sure Apple plans such a generous raise? These numbers don't lie...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.