Even though we're in the middle of March Madness right now, I'm not going to talk about this year's "Cinderella" teams, which come out of nowhere and make it to the Final Four in college basketball.

No... the real Cinderella story is happening at U.S. box offices. A simple Disney remake of the classic film managed to gross over $70 million in one weekend earlier this month. There's clearly investment potential in this success.

Let's take a look at Disney's Cinderella story and let its magic bolster our investment profits.

Leveraging Old Films to Generate New Profits

Who besides Walt Disney Co. (NYSE: DIS) could take a remake and turn it into last weekend's second-highest grossing movie?

The special effects, and what Disney's Pixar Animation Studios did to revamp the movie, are what made it great (I know, I watched and enjoyed it). The film could well win some awards for its digital effects and it was no surprise to me to see it doing so strongly.

Is there a similar Cinderella story when it comes to DIS stock?

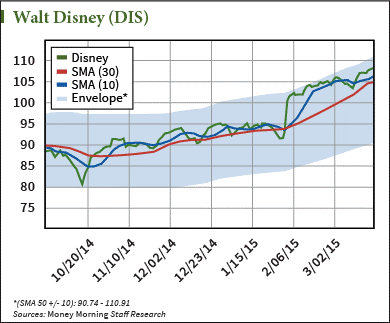

As the following chart shows, Disney stock has been in a marked uptrend now for several months. Simply drawing a line connecting the two most recent lows together on the bottom of the chart and doing the same thing for the two most recent highs reveals the direction that Disney stock wants to move.

The higher DIS stock price climbs, the more these two moving averages will separate, which is a tremendous bullish sign. The technical term "enveloping" is another way to take a moving average and create a range from it. The chart above also has a 50-day moving average, indicated by the blue shading, with a + and - 10% range. Shown here, it represents enveloping. Right now DIS is on the upper side of this envelope channel, meaning that it could see some pullback soon. It's possible that 90 (the bottom of the envelope at present) could be price support and the stock continues to have upside momentum.

The higher DIS stock price climbs, the more these two moving averages will separate, which is a tremendous bullish sign. The technical term "enveloping" is another way to take a moving average and create a range from it. The chart above also has a 50-day moving average, indicated by the blue shading, with a + and - 10% range. Shown here, it represents enveloping. Right now DIS is on the upper side of this envelope channel, meaning that it could see some pullback soon. It's possible that 90 (the bottom of the envelope at present) could be price support and the stock continues to have upside momentum.

Speaking of momentum, recently Disney broke above the $107 resistance, trading as high as $108.94, perhaps behind momentum from the film's pre-screenings.

Moving averages, (MA) while not creating momentum, are one way to gauge it. A moving average is created by using past data and then averaging that data over time within a window of time that "moves" along with the calendar.

So rising stock prices create rising averages, and vice versa. Of all the moving averages tossed around out there, most medium-term traders favor the 10-day and 30-day MA. Think of the 10-day as short-term trend and 30-day longer-term trend. We want to see the 10-day above the 30-day, but this can also be used to spot changes in trend. In recent weeks the 10-day MA has remained above the 30-day.

It's all leading up to some great profit opportunities...

Disney's Profit Target Is Box Office Gold

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]In my estimation, Disney has the potential to hit $150 by year's end, a nearly 30% gain from its price as I write this.

Some of that will be dependent on outside circumstances such as interest rates, as well as other economic indicators gauging consumers' discretionary spending.

However, if we even approach my estimate then it's possible that continued box office smashes like "Cinderella" and the sleeper of the year "McFarland, USA" as well as its formidable resort, amusements and merchandising revenues, could drive record profits for Disney.

The question is, how can we take advantage of the potential for a continued 20% move in Disney stock, but make perhaps 100% + returns with 90% less cost and risk?

Here's where options come in.

Buying longer-term call options that are close to the money can offer both lower cost and lower risk, as well as higher upside return on investment. A call option grants the buyer the right to purchase a stock at an agreed upon price, for an agreed amount of time.

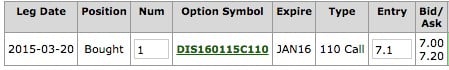

Recently, call options on DIS for January 2016 that are near the current stock price were trading around $7.00 per contract. Since one contract controls 100 shares of stock, the total cost is around $700 per option.

Recently, call options on DIS for January 2016 that are near the current stock price were trading around $7.00 per contract. Since one contract controls 100 shares of stock, the total cost is around $700 per option.

This means the options cost roughly 6% of what it would cost to own the stock outright. All with the opportunity to obtain a 100% return.

That, my friends, is why I trade options: They're a cheaper way to enter a position coupled with maximized profit potential.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.