Oil prices are on the rise to end March. On March 26 WTI oil hit a high of $52.46. That's a 19% climb from the lows it hit just two weeks ago.

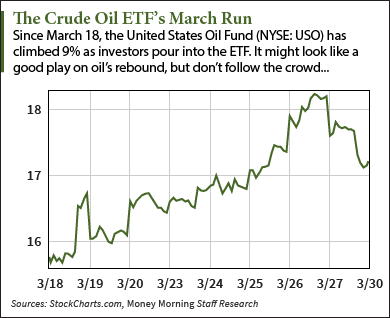

And as the price of oil rises, shares of the United States Oil Fund LP (NYSE: USO) are climbing too. The crude oil ETF is up 9% since March 18.

You see, investors are flooding into this oil ETF as a way to play rebounding oil prices.

You see, investors are flooding into this oil ETF as a way to play rebounding oil prices.

The United States Oil Fund is designed to track the movements of WTI oil by investing in oil futures contracts. It's the most popular U.S. oil fund on the market. It owns contracts on more than 64 million barrels of oil.

The Financial Times reported that investors poured more than $2 billion into the fund in the last year. Total assets now exceed $3.1 billion.

At first glance, it looks like the perfect way to play oil's rebound. After all, it's designed to track WTI's price.

But for long-term investors, buying shares of this crude oil ETF right now is not the best strategy for playing oil's rebound. There's something holding back the returns on this crude oil ETF investment...

What Investors Are Missing About This Crude Oil ETF

The nature of trading futures contracts puts investors at a disadvantage when prices rise.

ETFs like the United States Oil Fund are only concerned with tracking the price of oil, so they will continually roll expiring contracts into the next month's futures contract.

But there is a problem known as "contango" that can seriously limit investors' returns...

Contango refers to the situation where the futures contract trades at a higher price than the spot price of oil.

If there is a price gap between the price of the expiring contract, and the new futures contract, the fund just skips the gap and buys contracts at the higher price. But the investor misses out on those gains. Again, the ETF is only concerned with tracking the price of oil instead of bringing investors the highest possible returns.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

"Contango is deadly. If you're going to own one of these things that's susceptible to contango you've got to be a trader," Efficient Market Advisors' Herb Morgan told the FT.

So when oil prices see a major surge, USO investors only see a portion of those gains.

From 2009 through 2011, WTI oil prices climbed more than 115% in just two years. But USO investors only saw a gain of 34% during the same time.

And losses in oil prices can be brutal for USO investors. Since June, oil prices have dropped more than 51% through March 27. During the same time frame, USO stock has dropped 56.4%.

That also doesn't account for the taxes and fees investors are paying. ETFs that trade in futures contracts face higher taxes than other ETFs. Investors in the fund are taxed as if they themselves are buying the contracts.

While this crude oil ETF will rise with the price of oil, it's not the most cost-effective way to profit from the rebound. Instead, here's what Money Morning's Global Energy Strategist Dr. Kent Moors is recommending now...

The Best Way to Play Oil's Rebound in 2015

Money Morning's Global Energy Strategist Dr. Kent Moors sees oil prices rising significantly by late August:

"Assuming there are no new geopolitical 'wild cards' that cause prices to spike higher, I believe oil prices will rise to about $58 a barrel in New York and $65 a barrel in London," Moors said.

Since the full turnaround in oil prices may take a few months, Moors recommends "solid" oil companies that pay secure dividends. That way you'll be getting paid while you wait for oil's inevitable rally.

"BP Plc. (NYSE: BP), Royal Dutch Shell (NYSE ADR: RDS-A), and Chevron Corp. (NYSE: CVX) are three that regularly pay dividends and could all bridge the gap while their discounted stock prices rebound."

Dr. Moors went across the pond to address the Annual Energy Consultation of the Windsor Energy Group (WEG) on the current state of the energy market. First on his list of items to note: the $5 trillion global problem in the energy sector. Here's everything you need to know about and how it will affect you...

Related Articles:

- Financial Times: ETFs Pour into Top US Oil Contract